FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

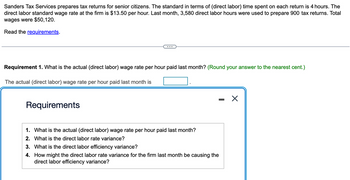

Transcribed Image Text:Sanders Tax Services prepares tax returns for senior citizens. The standard in terms of (direct labor) time spent on each return is 4 hours. The

direct labor standard wage rate at the firm is $13.50 per hour. Last month, 3,580 direct labor hours were used to prepare 900 tax returns. Total

wages were $50,120.

Read the requirements.

Requirement 1. What is the actual (direct labor) wage rate per hour paid last month? (Round your answer to the nearest cent.)

The actual (direct labor) wage rate per hour paid last month is

Requirements

1. What is the actual (direct labor) wage rate per hour paid last month?

2. What is the direct labor rate variance?

3. What is the direct labor efficiency variance?

4.

How might the direct labor rate variance for the firm last month be causing the

direct labor efficiency variance?

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An appliance company has three installers. Larry earns $325 per week, Curly earns $490 per week, and Moe earns $565 per week. The company's SUTA rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. (a) How much SUTA and FUTA tax (in $) does the company owe for the first quarter of the year? total SUTA tax $ total FUTA tax $ (b) How much SUTA and FUTA tax (in $) does the company owe for the second quarter of the year? total SUTA tax $ total FUTA tax $ Submit Answorarrow_forwardTio Tom's Dive Shop has 6 employees who each make $12,500 for the first quarter. Total quarterly federal income tax withheld from wages = $6,900. What should line 6 be on the first quarter Form 941 for Tio Tom's Dive Shop? (All wages are taxable for OASDI, HI and federal income tax).arrow_forwardToren Inc. employs one person to run its solar management company. The employee's gross income for the month of May is $7,208. Payroll for the month of May is as follows: • FICA Social Security tax rate at 6.2% FICA Medicare tax rate at 1.45% Federal income tax of $400 • State income tax of $75 Health-care insurance premium of $298 • Union dues of $50 • The employee is responsible for covering 14% of his or her health insurance premium What is the net pay of the one employee for the month of May? Round to the nearest penny, two decimals. # No new data to save. Last checked at 11:47pm Submit Carrow_forward

- Deep Mouse Designs has 14 employees within Denver City and County. The employees earned $9.80 per hour and worked 160 hours each during the month. The employer must remit $4.00 per month per employee who earns more than $500 per month. Additionally, employees who earn more than $500 per month must have $5.75 withheld from their pay. Required: What is the employee and employer Occupational Privilege Tax for these employees? (Round your answers to 2 decimal places.)arrow_forwardPls help in detailed way and correct plss stepwise.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- During the first week of February, Gabe Hopen earned earned $300. Assume that FICA taxes are 7.65 percent of wages up to $106,800, state unemployment tax is 5.0 percent of wages up to $13,000, and federal unemployment tax is .8 percent of wages up to $13,000. Assume that Gabe has voluntary with holdings of $27.40 (in addition to taxes) and that federal and state income tax with holdings are $18 and $6, respectively. Using the information above, what amount is the check, netof all deductions, that Gabe received for the week's pay? Group of answer choices $259.60 $274.60 $277.00 $225.65arrow_forwardSubject : accounting' Lacy Crawford has a regular hourly rate of $21.60. In a week when she worked 40 hours and had deductions of $110.60 for federal income tax, $53.60 for social security tax, and $12.50 for Medicare tax, her net pay wasarrow_forwardMary’s Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20—, are given. Employees are paid 1½ times the regular rate for working over 40 hours a week. Name No. ofAllowances Marital Status Total Hours Worked Mar. 16–22 Rate Total EarningsJan. 1–Mar. 15 Bacon, Andrea 4 M 44 $12.00 $5,500.00 Cole, Andrew 1 S 40 12.00 5,860.00 Hicks, Melvin 3 M 43 10.50 4,820.00 Leung, Cara 1 S 35 11.00 5,056.50 Melling, Melissa 2 M 40 13.00 4,727.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%. Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Bacon and Leung have $13 withheld and Cole and Hicks have $4 withheld for health insurance. Bacon and Leung have $22 withheld to be invested in the travel agency’s credit union. Cole has $38.00 withheld and Hicks has…arrow_forward

- Sky Company employed Tom Mills in Year 1. Tom earned $5,900 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Tom's federal income tax withholding amount is $870 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employeearrow_forwardPrecision Labs has two employees. The following information was taken from its individual earnings records for the month of September. Determine the missing amounts assuming that the Social Security tax is 6.2 percent, the Medicare tax is 1.45 percent, and the state income tax is 20 percent of the federal income tax. Assume that the employees are married and have one withholding allowance. All earnings are subject to Social Security and Medicare taxes. If required, round your answers to the nearest cent and use the rounded answers in subsequent computations. Enter all amounts as positive values. BROWN RINGNESS TOTAL Regular earnings $3,520.00 $ $ Overtime earnings 124.00 Total earnings $3,675.00 $ $ Federal income tax withheld $320.00 $ $ State income tax withheld 36.80 Social Security tax withheld 227.85 170.00 Medicare tax withheld 53.29 39.76 Charity withheld 34.00 96.00 Total deductions $699.14 $526.56 $ Net pay $ $2,215.44 $arrow_forwardPlease solve very soon completelyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education