FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Sh 8

Please help me.

Thankyou.

Transcribed Image Text:Sanders Storage owns a large warehouse that can be subdivided to accommodate storage spaces of various sizes using movable

walls. Sanders contracts with companies to provide them storage space. Christina Containers Corporation (CCC) contracted with

Sanders to provide storage for CCC's excess containers. The contract specifies that CCC's containers will be kept in an identified

space in the warehouse, providing 2,500 square feet for a four-year period. The contract also specifies that CCC's containers must be

stored at a specific temperature. Sanders has only one location in its warehouse with an HVAC system capable of maintaining the

required temperatures. CCC can modify the space with shelving and equipment needed to add, move, and remove containers.

Sanders cannot switch locations of the containers or modify the space without CCC's consent. CCC paid $14,200 on April 1, 2024, for

the first year's accommodations. The market rate of interest is 4%.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Prepare the appropriate entry(s) for Christina Containers Corporation on April 1, the commencement of the agreement.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your

answers to the nearest whole dollar amounts.

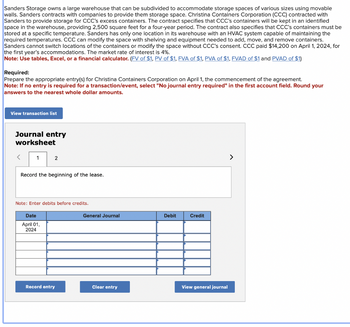

View transaction list

Journal entry

worksheet

<

1

2

Record the beginning of the lease.

Note: Enter debits before credits.

Date

April 01,

2024

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- myedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forwardGoodwill messages craft special messages that foster goodwill and convey kindness. One page answerarrow_forward18 pts Multiple Functions 88 MULTIPLE CHOICE Question 2 ◄ Listen When f(x)=-3x-6 and g(x) = x²-x-6, what is ? A B C f 54 g = 3 fg = -3 x-3x=3 f 51 g = -2x+2; x=1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education