Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

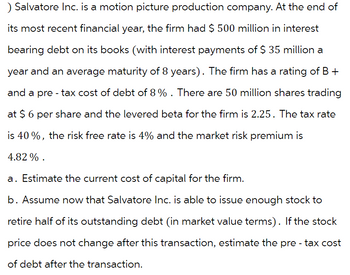

Transcribed Image Text:) Salvatore Inc. is a motion picture production company. At the end of

its most recent financial year, the firm had $ 500 million in interest

bearing debt on its books (with interest payments of $ 35 million a

year and an average maturity of 8 years). The firm has a rating of B +

and a pre-tax cost of debt of 8%. There are 50 million shares trading

at $ 6 per share and the levered beta for the firm is 2.25. The tax rate

is 40%, the risk free rate is 4% and the market risk premium is

4.82%.

a. Estimate the current cost of capital for the firm.

b. Assume now that Salvatore Inc. is able to issue enough stock to

retire half of its outstanding debt (in market value terms). If the stock

price does not change after this transaction, estimate the pre-tax cost

of debt after the transaction.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Saeed Construction’s CFO has the following information to estimate the company’s weighted average cost of capital:The company currently has 20-year, 8.5% semi-annual coupon bonds that currently sells for Rs.945.The company’s stock has a beta of 0.80.The market risk premium, RPm , equals 3%.The risk-free rate is 2.4% and market rate is 5.4%. The company’s growth (g) = 0%, stock price (P0) = Rs.50, current dividend (D0) = Rs.2 and additional/new equity flotation cost = 15%.The company has outstanding preferred stock that pays a Rs.2.00 annual dividend. The preferred stock sells for Rs.25 a share.The company’s tax rate is 40%. The company’s capital structure consists of 40% long-term debt, 40% common stock, and 20% preferred stock. Requirement: Calculate Component cost of debt, cost of equity, cost of preferred stock and weighted average cost of capital.arrow_forwardTime Warner shares have a market capitalization of $55 billion. The company just paid a dividend of $0.35 per share and each share trades for $35. The growth rate in dividends is expected to be 6.5% per year. Also, Time Warner has $20 billion of debt that trades with a yield to maturity of 7%. If the firm's tax rate is 30%, compute the WACC?arrow_forwardBlooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 109%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%. Company tax rate is 30%. Required: Complete the following tasks: 3) Calculate the current price of the corporate bond? b) Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%: - c) Calculate the current value of the preferred share if the average return of the shares in the same industry is 12% d) Calculate the current market…arrow_forward

- Osborne Construction currently has the following capital structure: Debt: $20,500,000 paying 9.5% coupon bonds outstanding with 15 years to maturity, an annual before-tax yield to maturity of 8% on a new issue. The bonds currently sell for $1,125 per $1,000 face value. Ordinary Shares: 100,000 shares outstanding currently selling for $45 per share. The company just paid a $3.50 dividend per share and is experiencing a 5% growth rate in dividends, which it expects to continue indefinitely. (Note: The firm's marginal tax rate is 30%.) Required: a) Calculate the current total market value of the company. b) Calculate the capital structure of the company. c) Calculate the weighted average cost of capital (WACC) for the firm. d) Discuss the significance of calculating WACC for this company.arrow_forwardBlooming Ltd. currently has the following capital structure: Debt: $2,500,000 par value of outstanding bond that pays annually 12% coupon rate with an annual before-tax yield to maturity of 10%. The bond issue has face value of $1,000 and will mature in 25 years. Ordinary shares: 65,000 outstanding ordinary shares. The firm plans to pay a $7.50 dividend per share in the next financial year. The firm is maintaining 3% annual growth rate in dividend, which is expected to continue indefinitely. Preferred shares: 40 000 outstanding preferred shares with face value of $100, paying fixed dividend rate of 14%. Company tax rate is 30%. Required: Complete the following tasks: Calculate the current price of the corporate bond? Calculate the current price of the ordinary share if the average return of the shares in the same industry is 9%? Calculate the current value of the preferred share if the average return of the shares in the same industry is 12% Calculate the current market…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education