Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

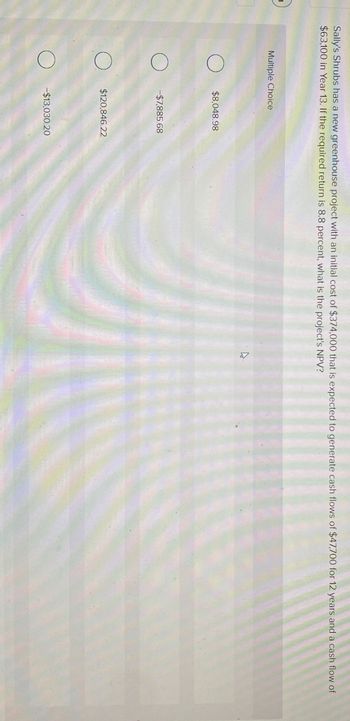

Transcribed Image Text:Sally's Shrubs has a new greenhouse project with an initial cost of $374,000 that is expected to generate cash flows of $47,700 for 12 years and a cash flow of

$63,100 in Year 13. If the required return is 8.8 percent, what is the project's NPV?

Multiple Choice

☐ $8,048.98

-$7,885.68

$120,846.22

-$13,030.20

13

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investment Criteria. What is the NPV of a project that costs $250,000 and provides cash inflows of $50,000 annually for ten years and the discount rate is 10 percent? Should the project be accepted? Please show your workarrow_forwardMendez Company is considering a capital project that costs $35,000. The project will deliver the following cash flows: Ac raw Year 1 $14,000 Year 2 $12,000 Year 3 Year 4 Year 5 $10,000 $12,000 $10,000 Using the incremental approach, the payback period for the investment is: Multiple Choice O 1.38 years. 2.9 years. 5 years. 2 years.arrow_forwardVishuarrow_forward

- Vijayarrow_forwardA firm evaluates all of its projects by using the NPV decision rule. Year Cash Flow 0 -$ 27,000 1 23,000 14,000 8,000 a. At a required return of 25 percent, what is the NPV for this project? 2 WN 3 NPV b. At a required return of 34 percent, what is the NPV for this project? NPVarrow_forwardLiving Colour Company has a project available with the following cash flows: Year Cash Flow 0 - $ 33, 630 1 8, 240 2 9,930 3 14, 190 4 15, 970 5 10,880 If the required return for the project is 8.8 percent, what is the project's NPV? Multiple Choice $11, 883.44 $25,580.00 $ 4,746.96 $12, 873.73 $13, 581.08arrow_forward

- U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows Capital investment Annual net income: (a) Year 1 2 3 4 5 Total ow Transcribed Text Project Bono $160,000 Project Bono 14,000 Project Edge 14,000 Project Clayton 14.000 ow Transcribed Text 14,000 Your answer is incorrect. 14,000 $70,000 Project Edge Project Clayton $175,000 $200,000 18,000 17,000 16,000 12,000 9,000 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15% (Assume that cash $72,000 O Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. years Compute the cash payback period for each project. (Round answers to 2 decimal places, eg years C years 27,000 23,000 9 21.000 13,000 C 12,000 $96,000 1.50.) (b) The parts…arrow_forwardBillabong Tech uses the internal rate of return (IRR) to select projects. Calculate the IRR for each of the following projects and recommend the best project based on this measure. Project T-Shirt requires an initial investment of $ 15,333 and generates cash inflows of $ 7,000 per year for 4 years. Project Board Shorts requires an initial investment of $ 28,500 and produces cash inflows of $ 13,500 per year for 5 years.arrow_forwardSnowflake Resorts is considering investing in a project that has a net investment of $240,000. This project will return positive net cash flows annually for the next 5 years of $80,000 per year. Snowflake Resorts requires a 12% return on all of its investments. The payback period of this investment is ________ years 5 3 4 2 The net present value of this project is $65,355 $48,384 $85,652 $57,635 The profitability index of this project is 2016 5924 7350 3852 When projects have scale differences, only the Net Present Value method will rank the projects correctly True False Fees paid to investment bankers and lawyers for issuing securities are called Component costs Issuance costs Security costs Licensing costs Purposes for considering a capital project may include which of the following Cost reductions Growth projects Government required projects All of the above When the weighted average cost of capital for a project is considered on an after tax…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education