Effects of Changes in Profits and Assets on

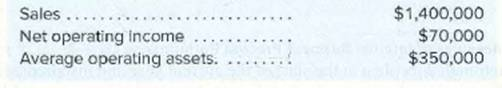

Fitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company’s Springfield Club reported the following results for the past year:

Required:

The following questions are to be considered independently. Carry out all computations to two decimal places.

1. Compute the Springfield club’s return on investment (ROI).

2. Assume that the manager of the club is able to increase sales by $70,000 and that, as a result, net operating income increases by $18,200. Further assume that this is possible without any increase in average operating assets. What would be the club’s return on investment (ROI)?

3. Assume that the manager of the club is able to reduce expenses by $14,000 without any change in sales or average operating assets. What would be the club’s return on investment (ROI)?

4. Assume that the manager of the club is able to reduce average operating assets by $70,000 without any change in sales or net operating income. What would be the club’s return on investment (ROI)?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

- answer in text form please (without image)arrow_forwardThe following information is related to the current operation of Kenanga Branch. Operating income 5,000,000 Sales revenue 62, 500,000 Average operating asset 25,000,000 Average balance in current liabilities 13,400,000 The management of the company has decided that the minimum return required is 11 percent. Residual income is another approach that can be used to measure performance of an investment centre. Define residual income and determine the residual income for Kenanga Branch.arrow_forwardFitness Fanatics is a regional chain of health clubs. The managers of the clubs, who have authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's Springfield Club reported the following results for the past year: Sales $ 780,000 Net operating income $ 17,940 Average operating assets $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $78,000 and that, as a result, net operating income increases by $6,084. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forward

- Alpesharrow_forwardA family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Round your percentage answers to nearest whole percent and other amounts to whole dollars.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ A 500,000 164,000 21 % 13 % $ $ $ Company B 760,000 35,000 19 % 53,000 % C $ 510,000 $ $ 151,000 % 9 % 6,000arrow_forwardThe managers of the XYZ clubs, who have the authority to make investments as needed, are evaluated based largely on return on investment (ROI). The company's X Club reported the following results for the past year: Sales Net operating income Average operating assets $ 730,000 $ 13, 140 $ 100,000 The following questions are to be considered independently. 2. Assume that the manager of the club is able to increase sales by $73,000 and that, as a result, net operating income increases by $5,329. Further assume that this is possible without any increase in average operating assets. What would be the club's return on investment (ROI)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardanswer in text form please (without image)arrow_forwardThe Emergency Medical Services Company has two divisions that operate independently of one another. The financial data for the year 20x5 reported the following results North South $4,440,000 $3,940,000 1,110,000 910,000 920,000 645,000 6,000,000 5,000,000 Sales Operating income Taxable income Investment The company's desired rate of return is 10%. Income is defined as operating income. a. What are the respective return-on-investment ratios for the North and South divisions? Round ROI to the nearest whole percentage. ROI North South b. What are the respective residual incomes of the North and South divisions? Residual income North S South S c. Which division has the better return on investment and which division has the better residual income figure? Return on investment i # Residual incomearrow_forward

- es The Campus Division of All-States Bank has assets of $1,300 million. During the past year, the division had profits of $285 million. All- States Bank has a cost of capital of 6 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Campus Division. (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) Mc Graw Hill Divisional ROI b. Compute the divisional RI for the Campus Division. (Enter your answer in dollars, not in millions.) Divisional RI % Question 11 - Hom....arrow_forwardInstructions: You are an investment analyst for Mango Financial Management, anindependent financial consulting firm. Your latest assignment is to provide anindependent assessment of Big Rock Building Inc. Big Rock is a Caribbean basedcompany that manufactures building products and provides services for the constructionand engineering sectors. The company has several divisions which operate as separateentities.The case study analysis consists of four core sections, and you will have to eitherconduct research or perform calculations. The assessment must be completed within fivedays, because a meeting has been scheduled with the client to discuss your findings. The company’s pension plan is managed by Castle Fund Managers, a leading provider ofpension services. It is a defined contribution plan, where the employees’ contributions arematched by the employer. Each employee had to choose one of the following investmentoptions for their individual plans:a. Preferred Accumulator (PA):…arrow_forwardCan you help me with this question? Thank you for your help and time :)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education