FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

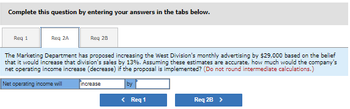

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

The Marketing Department has proposed increasing the West Division's monthly advertising by $29,000 based on the belief

that it would increase that division's sales by 13%. Assuming these estimates are accurate, how much would the company's

net operating income increase (decrease) if the proposal is implemented? (Do not round intermediate calculations.)

Net operating income will

increase

by

< Req 1

Req 2B >

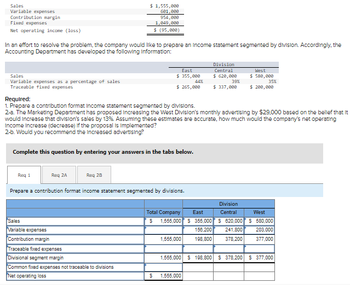

Transcribed Image Text:Sales

$ 1,555,000

Variable expenses

Contribution margin

Fixed expenses

601,000

954,000

1,049,000

Net operating income (loss)

$ (95,000)

In an effort to resolve the problem, the company would like to prepare an Income statement segmented by division. Accordingly, the

Accounting Department has developed the following information:

East

Division

Central

$ 620,000

39%

Sales

$ 355,000

44%

West

$ 580,000

35%

Variable expenses as a percentage of sales

Traceable fixed expenses

$ 265,000

$ 337,000

$ 200,000

Required:

1. Prepare a contribution format Income statement segmented by divisions.

2-a. The Marketing Department has proposed Increasing the West Division's monthly advertising by $29,000 based on the belief that it

would increase that division's sales by 13%. Assuming these estimates are accurate, how much would the company's net operating

Income Increase (decrease) If the proposal is Implemented?

2-b. Would you recommend the Increased advertising?

Complete this question by entering your answers in the tabs below.

Req 1

Reg 2A

Req 2B

Prepare a contribution format income statement segmented by divisions.

Division

Total Company East

Central

West

Sales

Variable expenses

$ 1,555,000 $ 355,000 S 620,000 $ 580,000

156,200 241,800 203,000

198,800 378,200 377,000

Contribution margin

1,555,000

Traceable fixed expenses

Divisional segment margin

1,555,000 $ 198,800 $378,200 $ 377,000

Common fixed expenses not traceable to divisions

Net operating loss

$ 1,555,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume a retailing company has two departments-Department A and Department B. The company's most recent contribution format income statement follows: Total Department A Department B $ 800,000 350,000 450,000 $ 350,000 250,000 Sales $ 450,000 Variable expenses Contribution margin 100,000 100,000 350,000 Fixed expenses 400,000 140,000 260,000 Net operating income (loss) $ 50,000 $ (40,000) $ 90,000 The company says that $60,000 of the fixed expenses being charged to Department A are sunk costs or allocated costs that will continue if the segment is discontinued. However, if Department A is discontinued the sales in Department B will drop by 18%. What is the financial advantage (disadvantage) of discontinuing Department A? Multiple Choice $(103,000) $(83,000) $(92,000) $(101,000)arrow_forwardhsd.1arrow_forwardA1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education