FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

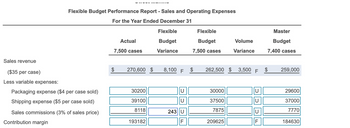

Transcribed Image Text:Sales revenue

Flexible Budget Performance Report - Sales and Operating Expenses

For the Year Ended December 31

($35 per case)

Less variable expenses:

Packaging expense ($4 per case sold)

Shipping expense ($5 per case sold)

Sales commissions (3% of sales price)

Contribution margin

Actual

7,500 cases

270,600 $

30200

39100

8118

193182

Flexible

Budget

Variance

8,100 F

U

243 | U

F

Flexible

Budget

7,500 cases

262,500 $ 3,500 F

30000

37500

7875

Volume

Variance

209625

U

D

Master

Budget

7,400 cases

259,000

29600

37000

7770

184630

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe following information was drawn from the accounting records of Smith Company Static Budget Flexible Budget Actual Results Sales $ 13,500 $ 19,000 $ 21,100 Cost of Goods Sold (6,700 ) (8,600 ) (7,250 ) Gross Margin 6,800 10,400 13,850 Variable Cost (2,700 ) (3,450 ) (4,350 ) Fixed Cost (1,700 ) (1,700 ) (2,000 ) Net Income $ 2,400 $ 5,250 $ 7,500 Based on this information the Multiple Choice variable operating cost volume variance is a $1,100 favorable variance. variable operating cost flexible budget variance is a $900 unfavorable variance. variable operating cost volume variance is a $900 favorable variance. variable operating cost flexible budget variance is a $1,100 favorable variance.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Help Save & Exit AA company provided the following information from its flexible budget performance report: Actual Results 52 Flexible Budget Master Budget Trips (q) 2. Expenses: Maintenance expense ($4,000 + $88.00g) $8,440 $8,400 What is the spending variance for maintenance expense? Multiple Choice $136 F $136 U $176 U Nex 11 of 23 < Prevarrow_forwardMirabel Manufacturing Budgeted Income Statement For the Year Ending December 31 Sales Cost of goods sold: Gross Margin Selling & Administrative Net Operating Income Normal Annual Sales Volume Unit Selling Price Variable expense per unit Variable Fixed Commissions Fixed Marketing Expenses Fixed Administrative Model 101 16,000 $ 650 $250 (Note: Each of the following questions is independent of the others) 1. What is Mirabel's over-all break-even point in sales dollars? $ 13,300,000 $ 9,300,000 $ 4,410,000 $ 1,350,000 $ 6,000,000 $ 2,390,000 Model 201 19,000 $750 $ 200 $ 36,750,000 $ 14,150,000 Model 301 11,000 $ 1,100 $ 500arrow_forwardBudgeted Revenues = $300,000, COGS = $180,000, SG&A=90,000. Actual Revenues = $285,000, COGS = $178,000, SG&A= $87,000. What is the COGS variance from adjusted budget (in dollars)? O $7,000 O $2,000 O-$2,000 O $1,900arrow_forward

- Please do not give solution in image format thankuarrow_forwardStatic and Flexible Budgets Graham Corporation used the following data to evaluate its current operating system. The company sells items for $10 each and used a budgeted selling price of $10 per unit. Units sold Variable costs Fixed costs a. Prepare the actual income statement, flexible budget, and static budget. Do not use negative signs with any of your answers below. Actual Budgeted 1,180,000 1,200,000 2,200,000 2,400,000 1,875,000 1,837,000 Units sold Revenues Variable costs Contribution margin Fixed costs Operating income $ $0 $0 Actual Results Flexible Budget Static Budget $ 0 $ For questions b., c., and d., do not use negative signs with your answers. Select either U for Unfavorable or F for Favorable using the drop down box next to each of your variance answers. b. What is the static-budget variance of revenues? C. What is the flexible budget variance for variable costs? <¶► 0 0 $ 0 0 0 0 $ ◆ 0 0 $ 0 0 0 0 $ d. What is the flexible budget variance for fixed costs? 0 0 0 0 0 0arrow_forwardDarrow_forward

- Budgets Question 1. A manager had the following operating budget and achieved the actual results shown. Calculate the variance and variance percentage for each line item. Then answer the questions that follow. Sales Budget Actual Variance Food $500,000 $550,000 Beverage |50,000 165,000 $650,000 Total Sales Total Controllable Expense Total Fixed Expense 450,000 495,000 135,000 135,000 Profit (Loss) $65,000 What is your assessment of this operation's expense control performance during this budget period? 2. Why are managers who are skilled at controlling expenses in such high demand in the hospitality industry? W APRarrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education