FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

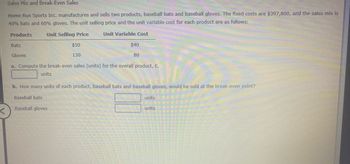

Transcribed Image Text:Sales Mix and Break-Even Sales

Home Run Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $397,800, and the sales mix is

40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows:

Unit Selling Price

Unit Variable Cost

Products

Bats

$50

130

$40

80

Gloves

a. Compute the break-even sales (units) for the overall product, E.

units

b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point?

Baseball bats

Baseball gloves

units

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Salvador Manufacturing builds and sells snowboards, skis and poles. The sales price and variable cost for each follows: Product Selling Priceper Unit Variable Costper Unit Snowboards $340 $150 Skis $380 $200 Poles $60 $30 Their sales mix is reflected in the ratio 7:3:2. If annual fixed costs shared by the three products are $250,900. Determine the break-even point in sales dollars. Break-even point $fill in the blank 1arrow_forwardSteven Company has fixed costs of $443,940. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Priceper unit Variable Cost per unit Contribution Marginper unit X $1,216 $456 $760 Y 710 380 330 The sales mix for products X and Y is 60% and 40% respectively. Determine the break-even point in units of X and Y combined. Round answer to nearest whole number.fill in the blank 1unitsarrow_forwardPierson Pet Products produces two models of dog beds: Basic and Custom. Price, cost and expected sales volume data for the two models are as follows: Selling price per bed Variable cost per bed Expected sales (beds) The total fixed costs for the company are $403,200. Basic $24.00 $ 17.00 66,000 Required: a. What is the anticipated level of profits for the expected sales volumes? b. Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. c. If the product sales mix were to change to three Basic beds for each Custom bed, what would be the new break-even volume? Required A Required B Complete this question by entering your answers in the tabs below. Custom $ 59.00 $38.00 44,000 Basic beds Custom beds Required C Assuming that the expected product mix applies regardless of total sales, compute the break-even volume. Note: In your computations, round up the total units to break-even to the nearest whole number and round other intermediate…arrow_forward

- Steven Company has fixed costs of $267,472. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Y Variable Cost per Unit $468 334 Product Selling Price per Unit X $1,248 624 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number. units of X units of Y Contribution Margin per Unit $780 290arrow_forwardMorris Industries manufactures and sells three products (AA, BB, and CC). The sales price and unit variable cost for the three products are as follows: Sales Price Variable Cost Product per Unit per Unit $30 AA $50 BB 35 10 CC 25 15 Their sales mix is reflected as a ratio of 5:3:2. Annual fixed costs shared by the three products are $253,500 per year. A. What are total variable costs for Morris with their current product mix? Total variable costs $ B. Calculate the number of units of each product that will need to be sold in order for Morris to break even. Number of Units per Product AA BB C. What is their break-even point in sales dollars? Break-even point in sales $ D. Using an income statement format, prove that this is the break-even point. If an amount is zero, enter "0". Income Statement Sales Product AA Product BB Product CC Total Sales Variable Costs Product AA Product BB Product CC Total Variable Costs $ Contribution Margin Fixed Costs Net Incomearrow_forward3. JJ Manufacturing builds and sells switch harnesses for glove boxes. The sales price and variable cost for each follows: Product Selling price per unit Variable cost per unit Trunk switch $60.00 $28.00 Gas door switch $75.00 $33.00 Glove box light $40.00 $22.00 Their sales mix is reflected in the ratio 4:4:1. What is the overall Composite Unit Contribution Margin for JJ Manufacturing with their current product mix? If annual fixed costs shared by the three products are $18,840, how many units of each product are to be sold in order for JJ Manufacturing to break even? Trunk Switch? Gas Door Switch? Glove Box Light? Determine their break-even point in sales dollars. Trunk Switch? Gas Door Switch? Glove Box Light?arrow_forward

- Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $251,600, and the sales mix is 40% bats and 60% gloves The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $50 $40 Gloves 130 80 a. Compute the break-even sales (units) for the overall enterprise product, E. units b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point? Baseball bats units Baseball gloves unitsarrow_forwardManatoah Manufacturing produces 3 models of window air conditioners: model 101, model 201, and model 301. The sales price and variable costs for these three models are as follows: Sales Price Variable Cost per Unit Product per Unit $275 350 395 Model 101 Model 201 Model 301 The current product mix is 4:3:2. The three models share total fixed costs of $657,000. $180 215 240 A. Calculate the sales price per composite unit. Sales price $ B. What is the contribution margin per composite unit? Contribution margin $ per composite unit Break-even point in dollars $ Break-even point in units per composite unit. C. Calculate Manatoah's break-even point in both dollars and units. unitsarrow_forwardSheridan Optics manufactures two products: microscopes and telescopes. Information for each product is as follows. Microscopes Telescopes Sales price $ 34 53 Sales volume 406,565 178,500 Variable cost per unit 15 20 Annual traceable fixed expenses $ 3,003,300 $ 3,505,100 Annual allocated common fixed expenses $ 2,009,500 $ 2,006,700 Prepare a segment margin income statement for Sheridan Optics that provides detail on both the product lines and the company as a whole. (If the amount is negative then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125).) Microscopes Telescopes Total LA $ LA $ LA LAarrow_forward

- Steven Company has fixed costs of $230,400. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products are provided below. Product Selling Price per Unit Variable Cost per Unit Contribution Margin per Unit X $1,376 $516 $860 Y 667 357 310 The sales mix for Products X and Y is 60% and 40%, respectively. Determine the break-even point in units of X and Y. Round answers to the nearest whole number.fill in the blank 1 units of Xfill in the blank 2 units of Yarrow_forwardIsland Novelties, Incorporated, of Palau makes two products-Hawaiian Fantasy and Tahitian Joy. Each product's selling price, variable expense per unit and annual sales volume are as follows: Selling price per unit Variable expense per unit Number of units sold annually Fixed expenses total $652,800 per year. Hawaiian Fantasy $ 30 $21 30,000 Tahitian Joy $ 100 $ 25 6,000 Required: 1. Assuming the sales mix given above, do the following: a. Prepare a contribution format income statement showing both dollar and percent columns for each product and for the company as a whole. b. Compute the company's break-even point in dollar sales. Also, compute its margin of safety in dollars and its margin of safety percentage. 2. The company has developed a new product called Samoan Delight that sells for $30 each and that has variable expenses of $18 per unit. If the company can sell 12,500 units of Samoan Delight without incurring any additional fixed expenses: a. Prepare a revised contribution…arrow_forwardIsland Novelties, Incorporated, of Palau makes two products-Hawaiian Fantasy and Tahitian Joy. Each product's selling price, variable expense per unit and annual sales volume are as follows: Hawaiian Fantasy Tahitian Joy Selling price per unit $ 12 $ 120 Variable expense per unit $9 $ 48 Number of units sold annually 36,000 5,400 Fixed expenses total $ 437,000 per year. Required: 1. Assuming the sales mix given above, do the following: a. Prepare a contribution format income statement showing both dollar and percent columns for each product and for the company as a whole. b. Compute the company's break - even point in dollar sales. Also, compute its margin of safety in dollars and its margin of safety percentage. 2. The company has developed a new product called Samoan Delight that sells for $45 each and that has variable expenses of $27 per unit. If the company can sell 12,000 units of Samoan Delight without incurring any additional fixed expenses: a. Prepare a revised contribution…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education