FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

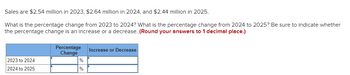

Transcribed Image Text:Sales are $2.54 million in 2023, $2.64 million in 2024, and $2.44 million in 2025.

What is the percentage change from 2023 to 2024? What is the percentage change from 2024 to 2025? Be sure to indicate whether

the percentage change is an increase or a decrease. (Round your answers to 1 decimal place.)

2023 to 2024

2024 to 2025

Percentage

Change

%

%

Increase or Decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You have $76,000 in your account that you want to grow to triple that amount in 25 years. What annual rate of return is necessary to reach your goal? (Note: Enter your answer is a decimal, not a percentage. For example, enter .0452 instead of 4.52%) Your Answer: Answerarrow_forwardYou want to retire in 40 years as a millionaire (i.e., to have $1,000,000). If 6% is the average rate of return on the investment during this time period, then how much should you invest per month starting at the end of this month? a. $502 b. $702 c. $802 d. $602arrow_forwardYou are thinking of investing in Nikki T's, Incorporated. You have only the following information on the firm at year-end: Net income is $250,000, total debt is $2.5 million, and debt ratio is 55 percent. What is Nikki T's ROE for next year? Note: Do not round intermediate calculations and round your final answer to 2 decimal places. ROE %arrow_forward

- ¥¥¥¥answerarrow_forwardAssume you invest $15,000 today. How much will you have in six years at an interest rate of 9%? Future Value of $1: 8% 123456 1.080 1.166 1.260 1.360 1.469 1.587 OA. $23.805 OB. $25,155 OC. $26.580 OD. $23,085 9% 1.090 1.188 1.295 1.412 1.539 1.677 10% 1.100 1.210 1.331 1.464 1.611 1.772 MAKED ہےarrow_forwardQw.02. Compute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable Sales Cost of goods sold Accounts receivable Numerator: 2024: 2023: Numerator: 2024 $ 463,414 234,107 22,522 2024: 2023: 2022: 2021: 2020: Is the trend percent for Net Sales favourable or unfavourable? Numerator: I 1 1 1 Trend Percent for Net Sales: 2023 $ 306,897 155,099 17,861 1 1 1 I 1 2022 2021 $ 249,510 $ 175,095 128,255 89,348 10,226 17,042 Trend Percent for Cost of Goods Sold: Denominator: 2024: 2023: 2022: 2021: 2020: Is the trend percent for Cost of Goods Sold favourable or unfavourable? 7 Denominator: 7 1 Trend Percent for Accounts Receivable: Denominator: 2022: 2021: 2020: Is the trend percent for Accounts Receivable favourable or unfavourable? = E # = S U = E = = 2020 $ 129,700 64,850 8,871 Trend percent Trend percent Trend percent 1% %6 % % % % 196 196 56…arrow_forward

- Given the cash flow diagram, what is the uniform annual equivalent value at the end of each year for six years?arrow_forwardSuppose you invest $350 in a CD with an APR of 2.9% compounded daily. Match each expression with what it represents in this context. 0.029 . 100 365 0.029 1+ 365 365(11) 365 0.029 1+ 365 0.029 365 (11) 1+ 365 365 0.029 1+ 100 365 a. The 11-year growth factor b. The number of times interest is compounded in 11 years c. The daily growth factor d. The daily percent change e. None of these. f. The annual growth factorarrow_forwardWhat amount of cash would result at the end of one year, if $15,000 is invested today and the rate of return is 8%? A) $16,200 B) $13,889 C) $15,000 D) $1,200arrow_forward

- How much must be invested now at 6% interest in order to have $75,000 in ten years? TVM Tables link (will open in a new window) Select one: O a. $70,755 O b. $134,854 c. $43,268 O d. $39,509 e. $41,879arrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forwardSandhill Company earns 11% on an investment that will return $459,000 8 years from now. Click here to view the factor table. What is the amount Sandhill should invest now to earn this rate of return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, eg. 25.25.) Sandhill Company should invest $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education