Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Find out the margin ratio

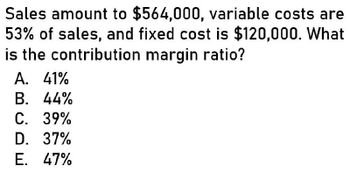

Transcribed Image Text:Sales amount to $564,000, variable costs are

53% of sales, and fixed cost is $120,000. What

is the contribution margin ratio?

A. 41%

B. 44%

C. 39%

D. 37%

E. 47%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Contribution margin Waite Company sells 250,000 units at 120 per unit. Variable costs are 78 per unit, and fixed costs are 8,175,000. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income.arrow_forwardwhat is the contribution margin ratio? accounting.arrow_forwardWhat is the contribution margin ratio of this accounting question?arrow_forward

- If sales are $30,000, fixed costs are $10,000, and variable costs are $7,000 what is the contribution margin ratio? O 0.594 O 0.767 O 0.612 0.659arrow_forward10. If sales are $500,000, variable costs are 200,000, and fixed costs are 260,000, what is the contribution margin percentage? a. 52% b. 48% c. 40% d. 60%arrow_forward5) Sales are $500,000 and variable costs are $350,000. What is the contribution margin ratio? а. 43% b. 30% c. 70% d. Cannot be determined because amounts are not expressed per unit.arrow_forward

- If sales are $828,000, variable costs are 68% of sales, and operating income is $278,000, what is the contribution margin ratio? A. 64% B. 36% C. 68% D. 32% Which of the graphs in Figure 5-1 illustrates the nature of a mixed cost? A. Graph 2 B. Graph 4 C. Graph 1 D. Graph 3arrow_forwardwhat is the contribution margin ratio?arrow_forwardContribution margin ratioarrow_forward

- Answer the following questions based on the given information: Sales Units 500,000 Total Sales $50,000,000 Total Variable Cost $35,000,000 Total Fixed Cost $10,000,000 What is Total Contribution Margin? What is Contribution Margin Per Unit? What is the Contribution Margin Ratio?arrow_forward5. The unit variable cost is $6.43, unit selling price is $10, total fixed costs are $638.03, and the projected sales are 430 units. Calculate: a. Net income b. Contribution Marginarrow_forwardWesley's income statement is as follows: Sales (10,000 units) Less variable costs Contribution margin Less fixed costs Net income $150,000 - 48,000 $102,000 - 24,000 $ 78,000 What is the unit contribution margin? A. $12.00 B. $ 7.20 C. $ 4.80 D. $10.20arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub