Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

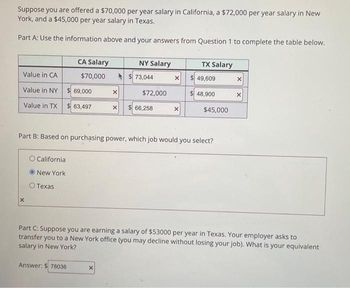

Transcribed Image Text:Suppose you are offered a $70,000 per year salary in California, a $72,000 per year salary in New

York, and a $45,000 per year salary in Texas.

Part A: Use the information above and your answers from Question 1 to complete the table below.

Value in CA

Value in NY

$ 69,000

Value in TX $ 63,497

X

O California

New York

CA Salary

$70,000

O Texas

Answer: $78036

X

NY Salary

X

$73,044

$72,000

X $ 66,258

X

Part B: Based on purchasing power, which job would you select?

X

TX Salary

$49,609

$ 48,900

$45,000

X

Part C: Suppose you are earning a salary of $53000 per year in Texas. Your employer asks to

transfer you to a New York office (you may decline without losing your job). What is your equivalent

salary in New York?

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- es ! Required information [The following information applies to the questions displayed below.] Greer Utsey earned $48,400 in 2022 for a company in Kentucky. Greer is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Required: Compute the following employee share of the taxes for the third weekly payroll of the year. Note: Do not round intermediate calculation. Round your final answers to 2 decimal places. Federal income tax withholding Social Security tax Medicare tax State income tax withholding $ 13.49arrow_forwardPURELY COMPENSATION INCOME EARNER Instructions: 1. Download BIR Forms 1700 AND 2316 Version 2018 at www.bir.gov.ph. Compute the income tax payable, if any. Relevant information: YOU, single and a Filipino citizen, and a resident of Brgy. Talipapa, Quezon City is employed by PA-MINE Corp. located in N. Reyes St., Sampaloc, Manila for the calendar period 2021. During your employment, PA-MINE Corp. was able to apply for your TIN where BIR RDO No. 032 – Manila assigned you Taxpayer Identification No. 123-456-789-0000. PA-MINE Corp.’s TIN No. is 987-654-321-0000. Additional information: Your basic salary is Php 30,000 per month In addition to your basic pay, you received the following: Holiday pay – Php 10,000 Hazard pay – Php 20,000 Overtime pay – Php 20,000 Fixed transportation allowance – Php 10,000 Cost of Living Allowance – Php 20,000 13th month pay – Php 30,000 Other benefits – Php 20,000 De minimis benefit of Php – 20,000 PA-MINE Corp. has deducted the following…arrow_forwardDATE OF PAY PERIOD ENDING 20- 20 PAYMENT NET СК. EARNINGS DEDUCTIONS EMPLOYEE MAR. TOTAL NAME ALLOW RATE SOC. SEC. FED. INC. STATE INC. HOSP. INS OTHERS TOTAL PAY NO. NUMBER STATUS HOURS REGULAR OVERTIME TOTAL MED. TAX TAX TAX TAX 10 2 3 6. 9. 10 11 10 12 11 13 14 13 15 14 16 17 15 18 16 17 18 25 12 7.arrow_forward

- Deductible Commission Salesperson Expenses - Example 4 Barton Ho is a commission salesperson. During the current year, in addition to his salary of $92,500, he earns and receives $34,700 in commissions. His costs for advertising were $12,200 and, in addition, he spent $6,400 on client entertainment. Because of the extensive travel required by his work, his travel accommodation costs totaled $16,100. Mr. Ho paid $5,000 for a sports club membership where he regularly entertains clients. He is required to pay his own expenses and does not receive any allowance from his employer. What is Mr. Ho's maximum expense deduction for the current year? Show your calculations.arrow_forwardVishnuarrow_forwardQuestion text The totals from the first payroll of the year are shown below. Total Earnings FICA OASDI FICA HI FIT W/H State Tax Union Dues Net Pay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the entry to deposit the FICA and FIT taxes.arrow_forward

- Question 2 With the following data, compute the NET FUTA Tax. $6,750 Gross FUTA Tax DUE Credit against FUTA (assume $3,100 applicable) O $3,650 O $7,000 O $3,100 $6,750 MacBook Air 80 F3 F2 F4 F5 F6 F7 FB F9 3 4. 5 7 8 9. E T Y D G < 6 F.arrow_forwardPlease help and can show correct answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education