FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please answer S8-10

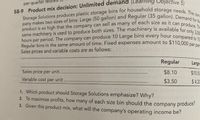

Transcribed Image Text:**Product mix decision: Unlimited demand**

Storage Solutions produces plastic storage bins for household storage needs. The company makes two sizes of bins: Large (50 gallon) and Regular (35 gallon). Demand for the product is so high that the company can sell as many of each size as it can produce. The same machinery is used to produce both sizes. The machinery is available for only 3,000 hours per period. The company can produce 10 Large bins every hour compared to 15 Regular bins in the same amount of time. Fixed expenses amount to $110,000 per period. Sales prices and variable costs are as follows:

| | Regular | Large |

|--------------|---------|-------|

| Sales price per unit | $8.10 | $10.50|

| Variable cost per unit | $3.50 | $4.20 |

1. Which product should Storage Solutions emphasize? Why?

2. To maximize profits, how many of each size bin should the company produce?

3. Given this product mix, what will the company’s operating income be?

**Explanation:**

- The table provides the sales price per unit and variable cost per unit for both Regular and Large bins.

- The task involves determining which product to focus on to maximize profits, how many of each product to produce within the constraints, and calculating the operating income.

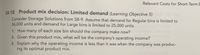

Transcribed Image Text:### Product Mix Decision: Limited Demand

#### Relevant Costs for Short-Term Decisions

**Learning Objective 5**

Consider Storage Solutions from S8-9. Assume that demand for Regular bins is limited to 36,000 units and demand for Large bins is limited to 25,000 units.

1. **How many of each size bin should the company make now?**

2. **Given this product mix, what will be the company’s operating income?**

3. **Explain why the operating income is less than it was when the company was producing its optimal product mix.**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A7 please help[.....arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardHow to solve:S= 1/1.06[1-1/(1.06)^20]/1-1/1.06arrow_forward

- E10.15arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardBookmarks Profiles Tab Window Help C (4726) IFRS v x Accounting10 x Accounting10 × M Question 3-1 WiConn le Chrome File Edit View History Inbox (228) X ACC101 Princ X C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 7 Homework Saved 3 Part 2 of 2 15.96 points eBook Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). March 1 March 2 March 3 (a) March 3 (b) March 6 March 9 March 10 March 12 Purchased $31,000 of merchandise from Van Industries, terms 2/15, n/30. Sold merchandise on credit to Min Cho, Invoice Number 854, for $12,400 (cost is $6,200). Purchased $930 of office supplies on credit from Gabel Company, terms n/30. Sold merchandise on credit to Linda Witt, Invoice Number 855, for $6,200 (cost is $3,100). Borrowed $72,000 cash from Federal Bank by signing a long-term note payable. Purchased $15,500 of office equipment on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education