FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

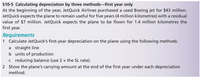

Transcribed Image Text:S10-5 Calculating depreciation by three methodsfirst year only

At the beginning of the year, JetQuick Airlines purchased a used Boeing jet for $43 million.

JetQuick expects the plane to remain useful for five years (4 million kilometres) with a residual

value of $7 million. JetQuick expects the plane to be flown for 1.4 million kilometres the

first year.

Requirements

1 Calculate JetQuick's first-year depreciation on the plane using the following methods:

a straight line

b units of production

c reducing balance (use 2 x the SL rate).

2 Show the plane's carrying amount at the end of the first year under each depreciation

method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $501,400. The equipment was expected to have a useful life of four years, or 10,000 operating hours, and a residual value of $41,400. The equipment was used for 3,800 hours during Year 1, 3,100 hours in Year 2, 1,800 hours in Year 3, and 1,300 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method.Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the four-year life of the equipment?arrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $282,600. The equipment was expected to have a useful life of four years, or 4,800 operating hours, and a residual value of $23,400. The equipment was used for 1,680 hours during Year 1, 1,008 hours in Year 2, 1,344 hours in Year 3, and 768 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in the…arrow_forwardComparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $479,600. The equipment was expected to have a useful life of four years, or 8,000 operating hours, and a residual value of $39,600. The equipment was used for 2,800 hours during Year 1, 1,680 hours in Year 2, 2,240 hours in Year 3, and 1,280 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of- activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Year 1 Year 2 Year 3 Year 4 Total Straight-Line Method Units-of-Activity Method 2. What method yields the highest depreciation expense for Year 1? Double-declining-balance method Double-Declining- Balance Method 3. What method yields the most depreciation over…arrow_forward

- Comparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $248,600. The equipment was expected to have a useful life of four years, or 7,600 operating hours, and a residual value of $20,600. The equipment was used for 2,900 hours during Year 1, 2,400 hours in Year 2, 1,400 hours in Year 3, and 900 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method.Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Output Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill…arrow_forwardAt the beginning of 2016, Foley Airline purchased a used airplane at a cost of $33,500,000. Foley Airline expects the plane to remain useful for eight years (4,000,000 miles) and to have a residual value of $5,500,000. Foley Airline expects the plane to be flown 1,300,000 miles the first year and 1,200,000 miles the second year. Requirements 1. Compute second-year (2017) depreciation expense on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Calculate the balance in Accumulated Depreciation at the end of the second year for all three methods. Requirement 1a. Compute second-year (2017) depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's second-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation expense for the second year. Straight-line depreciationarrow_forwardrmn.3arrow_forward

- Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $272,000. The equipment was expected to have a useful life of four years, or 5,200 operating hours, and a residual value of $22,400. The equipment was used for 1,820 hours during Year 1, 1,092 hours in Year 2, 1,456 hours in Year 3, and 832 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in the…arrow_forwardDeprecation exercise instructions: Assumptions: Purchase at time 0 of a piece of widget processing equipment for an assumed cost of $18,300. The equipment is assumed to have a 7-year economic life. The assumed salvage value for the widget equipment at the end of its economic life is $800. The equipment is expected to produce 35,000 widgets over its economic life. Actual annual production of widgets is 3,450 in year 1, 5,200 in year 2, 5,400 in year 3, 5,350 each in years 4-6 and 4,900 in year 7. Assume for the declining balance method that you will apply a double declining balance approach. Use an Excel spreadsheet to create a table similar to the one shown below. On your Excel spreadsheet, using the assumptions listed above, calculate the annual depreciation expense for the widget processing equipment using each of the four methods and fill in the table in Excel. After you have completed the calculations, determine which method you would choose to use for tax purposes, if you were in…arrow_forwardNonearrow_forward

- Comparing Three Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $725,600. The equipment was expected to have a useful life of four years, or 10,400 operating hours, and a residual value of $60,000. The equipment was used for 3,640 hours during Year 1, 2,184 hours in Year 2, 2,912 hours in Year 3, and 1,664 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the four years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Activity Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Year 2 $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Year 3 $fill in…arrow_forwardComparing Three Depreciation Methods Waylander Coatings Company purchased waterproofing equipment on January 6 for $730,400. The equipment was expected to have a useful life of four years, or 10,000 operating hours, and a residual value of $60,400. The equipment was used for 3,800 hours during Year 1, 3,100 hours in Year 2, 1,800 hours in Year 3, and 1,300 hours in Year 4. Required: 1. Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-output method, and (c) the double-declining-balance method. Also determine the total depreciation expense for the four years by each method.Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. Depreciation Expense Year Straight-Line Method Units-of-Output Method Double-Declining-Balance Method Year 1 $fill in the blank 1 $fill in the blank 2…arrow_forwardHSLarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education