eBook

Chapter 4

Critical Thinking Case 2

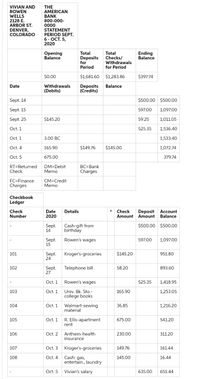

Reconciling the Wells' Checking Account

Vivian and Rowen Wells are college students who opened their first joint checking account at the American Bank on September 14, 2020. They've just received their first bank statement for the period ending October 5, 2020. The statement and checkbook ledger are shown in the table below.

From this information, prepare a bank reconciliation for the Wells family as of October 5, 2020,

Given your answer to Question 1, determine what, if any, adjustment will the Wells family need to make in their checkbook ledger. Enter the answers as positive value. Round the answer to the nearest cent.

$

If the Wells family earned interest on their idle balances because the account is a

The effect of the interest earnings would have been a(n) -Select-decreaseincreaseItem 19 in both bank and checkbook balances.

Explain.

The input in the box below will not be graded, but may be reviewed and considered by your instructor.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The U.S. Chamber of Commerce provides a free monthly bank reconciliation template at business.uschamber.com/tools/bankre_m.asp. Paula Hein just received her bank statement notice online. She wants to reconcile her checking account with her bank statement and has chosen to reconcile her accounts manually. Her checkbook shows a balance of $698. Her bank statement reflects a balance of $1,348. Checks outstanding are No. 2146, $25; No. 2148, $58; No. 2152, $198; and No. 2153, $464. Deposits in transit are $100 and $50. There is a $15 service charge and $5 ATM charge in addition to notes collected of $50 and $25. Reconcile Annie's balances. BANK RECONCILIATION Annie's checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Subtotal Reconciled balance Reconciled balance aw 4 of 15arrow_forwardTable 2: Deposit Slip CHECKING DEPOSIT Name: Jamal Houston Date: May 17, 2021 Account Number: 1234 5678 9012 16. How much in checks are being deposited in the deposit slip above? C H E S CURRENCY COINS 2-36 8-97 10-87 SUBTOTAL LESS CASH TOTAL DEPOSIT DOLLARS CENTS 345 00 0 58 55 20 125 61 92 18 75 00 17. What is the total deposit amount in the deposit slip above?arrow_forwardeBook Using the following information, prepare the journal entries to reconcile the bank statement. Bank balance: $6,788 Book balance: $8,393 Deposits in transit: $1,735 Outstanding checks: $579 and $1,523 Bank service charges: $25 Bank incorrectly charged the account $25. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $137 but posted in the accounting records as $317. This check was expensed to Utilities Expense.arrow_forward

- CHAPTER : BANK RECONCILIATIONarrow_forwardi need the answer quicklyarrow_forwardAttached is some information about DGA Groceries. Use this information to prepare a bank reconciliation for April 30, 2020. Bank of Edmonton Downtown Edmonton, Alberta, Canada Bank Statement Period: Apr 1 - 30, 2020 Client Name DCA Groceries Account Number 7800-7802364 Description Deposit Withdrawal Date Balance Balance Forward 1-Apr-20 15,032.00 Cheque#7801010 200.00 1-Apr-20 14,832.00 EFT 2,900.00 1-Apr-20 17,732.00 Cheque Deposit 1,800.00 2-Apr-20 19,532.00 Cheque Deposit 800.00 3-Apr-20 20,332.00 Cheque#7801012 1,500.00 3-Apr-20 18,832.00 Cheque#7801013 1,912.00 3-Apr-20 16,920.00 Checque Deposit 13,200.00 3-Apr-20 30,120.00 Cheque#7801014 110.00 6-Apr-20 30,010.00 Cash Withdrawal 100.00 7-Apr-20 29,910.00 Cash Deposit 1,275.00…arrow_forward

- The problem below with Corrected Bank reconciliationarrow_forwardInstructions: Prepare a bank reconciliation for Kali Loli from the following checkbook records and bank statement CHECKBOOK Check number 801 802 803 804 805 Date Description fo transaction 44835 H&H Jewelers 44840 Deposit 44842 L.L. Bean 44844 Cashe 44847 Deposit 44847 Four Seasons Hotel 44849 American Express 44854 ATM Withdrawal 44858 Deposit 44861 Deposit 44862 Home-Depot - Debit Card BANK STATEMENT Statement Date: Checking Account Summary: Account Number: Checking Account Transactions Date Amount 44837 44840 44844 44847 44849 44851 44856 44858 44862 44864 BANK RECONCILIATION Check book balance. Amount of payment or withdrawal Amount of deposit or interest Balance Forward 879.36 November 3, 2021 October 1- 31, 2021 449-56-7792 Previous Balance Deposits Number Total Credits ✓ Check Number Total Debits Current Balance → 879.36 3 1954.59 7 1347.83 1486.12 Description 236.77 Check # 801 450.75 Deposit 324.7 Returned item 880.34 EFT payroll deposit 75.89 Check #803 507.82 Check #805…arrow_forwardPlease help me solvearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education