FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:WORK

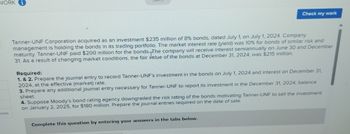

Check my work

Tanner-UNF Corporation acquired as an investment $235 million of 8% bonds, dated July 1, on July 1, 2024. Company

management is holding the bonds in its treding portfolio. The market interest rate (yield) was 10% for bonds of similar risk and

maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December

31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $215 million.

Required:

1. & 2. Prepare the journal entry to record Tanner-UNF's Investment in the bonds on July 1, 2024 and interest on December 31,

2024, at the effective (merket) rate.

3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2024, balance

sheet

4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment

on January 2, 2025, for $180 milion. Prepare the journal entries required on the date of sale

Complete this question by entering your answers in the tabs below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Turtle Inc., purchased as a long-term investment $80 million of 8% bonds, dated January 1, on January 1, 2017. Management intends to have the investment available for sale when circumstances warrant. For bonds of similar risk and maturity the market yield was 10%. The price paid for the bonds was $66 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2017, was $70 million. a. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). b. At what amount will Turtle Inc. report its investment in the December 31, 2017, balance sheet? c. Prepare the entry necessary to achieve this reporting objective. SHOW IN EXCEL PLEASEarrow_forwardTanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2018. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. Company management has classified the bonds as available-for-sale investments. As a result of changing market conditions, the fair value of the bonds at December 31, 2018, was $210 million. 1. Prepare any journal entry necessary for Tanner-UNF to report its investment in the December 31, 2018, balance sheet. 2. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2019, for $190 million. Prepare the journal entries necessary to record the sale, including updating the fair-value adjustment, recording any reclassification adjustment, and recording the sale PLEASE SHOW WORKarrow_forwardMills Corporation acquired as a long-term investment $235 million of 8% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $270 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $260 million. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $280 million. Record any reclassification adjustment.arrow_forward

- Mills Corporation acquired as a long-term investment $235 million of 8% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $270 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $260 million. Required: 1. & 2. Prepare the journal entry to record Mills’ investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2024, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $280 million. Prepare the journal entries required on the date of sale.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $200 million of 6% bonds, dated July 1, on July 1, 2021. Companymanagement has the positive intent and ability to hold the bonds until maturity, but when the bonds were acquired Tanner-UNFdecided to elect the fair value option for accounting for its investment. The market interest rate (yield) was 8% for bonds of similar riskand maturity. Tanner-UNF paid $170 million for the bonds. The company will receive interestsemiannually on June 30 and December31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $180 million. Required:1. How would this investment be classified on Tanner-UNF's balance sheet?2. to 4. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2021, interest on December 31, 2021, atthe effective (market) and fair value changes as of December 31, 2021.5. At what amount will Tanner-UNF report its investment in the December 31, 2021, balance…arrow_forwardMills Corporation acquired as a long-term investment $270 million of 8% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $310 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $290 million. Required: 1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2024, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2025, for $320 million. Prepare the journal entries required on the date of sale. Answer is not complete.…arrow_forward

- E4arrow_forwardTanner-UNF Corporation acquired as a long-term investment $260 million of 6% bonds, dated July 1, on July 1, 2024. Company management has classified the bonds as an available-for-sale investment. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $220 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $230 million. Required: 1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the effective (market) rate. 3. Prepare any additional journal entry necessary for Tanner-UNF to report its investment in the December 31, 2024, balance sheet. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $200 million. Prepare the journal entries…arrow_forwardFuzzy Monkey Technologies Inc purchased as a long-term investmetn $60 million of 6% bonds, dated Jan 1, on Jan 1 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $46 million. Interest is received semianually on June 30 and Dec 31. Due to changing market conditions the fair value of the bonds at Dec 31 2021 was $50 million. 1 to 3. Prepare the relevant journal entries on the respective dates. 4. At what amount will Fuzzy Monkey report its investment in Dec 31, 2021 balance sheet? 5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment?arrow_forward

- Tanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. Suppose Moody’s bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale.arrow_forwardTanner-UNF Corporation acquired as a long-term investment $200 million of 6% bonds, dated July 1, 2024. Assume Tanner-UNF management is holding the bonds in a trading portfolio. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million. Required: 1. to 3. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024, interest on December 31, 2024, at the effective (market) rate and the fair value adjustment at December 31. 4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motiving Tanner-UNF to sell the investment on January 2, 2025, for $190 million. Prepare the journal entry to record the sale. Comple this question by entering your wers in the tabs below. Req 1 to 3 Suppose Moody's bond rating agency downgraded the risk rating of the bonds motiving Tanner-UNF to…arrow_forwardMills Corporation acquired as a long-term investment $250 million of 8% bonds, dated July 1, on July 1, 2021. Company management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 6% for bonds of similar risk and maturity. Mills paid $290.0 million for the bonds. The company will receive interest semiannually on June 30 and December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2021, was $270.0 million. Required: 1. & 2. Prepare the journal entry to record Mills' investment in the bonds on July 1, 2021 and interest on December 31, 2021, at the effective (market) rate. 3. At what amount will Mills report its investment in the December 31, 2021, balance sheet? 4. Suppose Moody's bond rating agency upgraded the risk rating of the bonds, and Mills decided to sell the investment on January 2, 2022, for $300 million. Prepare the journal entry to record the sale.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education