FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

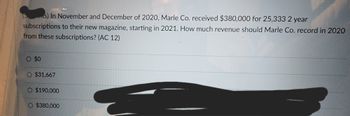

Transcribed Image Text:(s) In November and December of 2020, Marle Co. received $380,000 for 25,333 2 year

subscriptions to their new magazine, starting in 2021. How much revenue should Marle Co. record in 2020

from these subscriptions? (AC 12)

O $0

O $31,667

O $190,000

O $380,000

Expert Solution

arrow_forward

Step 1

The revenue recognition principle state that, the organization can recognize revenue if the services are provided or the revenue has been earned. Irrespective of cash receipt or not.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please all parts Find the following accumulated values on December 31, 2020 a) $6000 invested on May 1, 2020 at 3.6% interest. b) $20,000 invested on January 1, 2018 if &t = 0.025 + 0.02t. (c) $15,000 invested at ireal=3.25% on January 1, 2020 if inflation in 2020 is 1.75% d) Payments of $5,000 made every December 31 from 2014 to 2020 at 5% interest.arrow_forwardSmith Electic (SE) owed Estimated Warranty Payable of $1,100 at the end of 2023. During 2024, SE made sales of $100,000 and expects product warranties to cost the company 5% of the sales. During 2024, SE paid $2,600 for warranties. What is SE's Estimated Warranty Payable at the end of 2024? OA. $2,600 OB. $5,000 O C. $6,100 OD. $3,500arrow_forward6arrow_forward

- Am. 355.arrow_forwardSales made in 2021 for $3,000,000 includes a 2-year warranty coverage, included in the price. The estimated cost for warranty is expected to be 2% for the first year and 5% for the second year. How much warranty expense should be recorded in 2021? Question 4 options: $60,000 $150,000 $100,500 $210,000arrow_forwardnkj.2arrow_forward

- At Dec. 31, 2019. H&M Co. had gift certificates outstanding, which had been sold to customers during 2019 for P 100 each H& M operates on a gross margin of 60% of its sales. What amount of revenue pertaining to the 10,000 outstanding gift certificates should be deferred at Dec. 31, 2019. * A.N one B.400,000 C.600,000 D.1,000,000arrow_forwardWhat is the liability for the outstanding premiums at year-end?* a. 2,000,000 b. 562,500 c. 2,250,000 d. 500,000arrow_forward71. Sbject :- Accountingarrow_forward

- On September 30, 2020, Zee Company paid P240,000 for equipment that will be used for the next four years. What is the equipment's carrying value on December 31, 2023? O P240,000 O P225,000 O P165,000 O P105,000arrow_forward27 On June 1, 2022, Iconic Properties obtained a loan in the amount of $120,000 with an interest rate of 12%. All interest and principal are due May 31, 2023. How much interest expense will be reported on the 2022 and 2023 income statement? What is the total liability, if any, on the balance sheet as of December 31, 2022?arrow_forwardProblem 9. At December 31, 2021, Cactus Co. had 10,000 gift certificates outstanding which had been sold to customers during 2021 for P100 each. Cactus operates on a gross margin of 60% of its sales. What amount of revenue pertaining to the 10,000 outstanding gift certificates should be deferred at December 31, 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education