Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

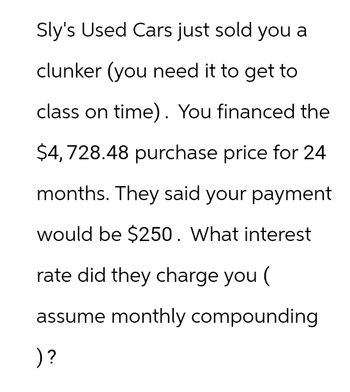

Transcribed Image Text:Sly's Used Cars just sold you a

clunker (you need it to get to

class on time). You financed the

$4,728.48 purchase price for 24

months. They said your payment

would be $250. What interest

rate did they charge you (

assume monthly compounding

)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You pay $9.51 for lunch from Chipotle most days during the work week. 1. How much do you pay for these lunches if you get Chipotle 200 times per year? 2. If you would have invested that money in your 401(k) that has a 5% APR, how much money would you have at the end of one year?arrow_forwardYou are financing a car worth $26194.15 with tax included. Interest rates are 11.9% compounded daily. Payments are monthly and made at the end of the month. You will own the car in 5 years. You have a down payment of $1274, Calculate the finance charge (interest charged on purchase). Round your answer to two decimal places. Do not enter the dollar sign. Sample input: 1564.23 (Hint: Take the down payment off the total worth of the car including tax; this is your PVn. Then, find the monthly payment by hand using the ordinary general annuity formuls or use the TVM salver, You will need an interest conversion if you do this question by hand or Excel because we have daily interest but monthly payments, you will need a monthly periodic interest rate. Then find the total value of ALL your monthly payments (e. g., PMT x Total Number of Monthly Payments) and add this to your down payment; subtract the purchase price including tax of the car from this figure-the difference is the interest you'll…arrow_forwardYou currently work part-time making $1,500 per month. You have $1,000 in your bank account and drive a 2010 Honda Civic worth $5,000. You hope to pay off the loan on the car next year but still owe $1,000. You use your credit card for simple monthly expenses like groceries and gas with the intention of always paying it off before you owe any interest. Currently the card has an outstanding balance of $300. You have few items of any value (you rent your apartment which comes furnished) but you do have a laptop that you use for school. You estimate it is worth $500. You are in your last semester of college. Because you work part-time you are going to graduate with only $5,000 in student loans. Based on this information what is your Net Worth? Question 8 Answer a. $1,700 b. $800 c. $200 d. $1,200arrow_forward

- Would appreciate the help. 4arrow_forwardBowflex’s television ads say you can get a Treadclimber that sells for $12,000 for 5 annual payments of $3,000. What annual rate of interest are you paying on this loan? PLEASE BREAK DOWNarrow_forwardYou just bought a used car for $13,000 with no down payment using dealer financing at 7% APR compounded monthly. If you make monthly payments of $425, how many months will it take you to payoff the loan? Your Answer:arrow_forward

- You are buying a car for $16,995; you are going to put down $6,500; balance to finance: $10,495 in 84 payments at 3.95% APR. Calculate how much you will ultimately pay for the unit?arrow_forwardCongratulations! You just bought a new car. You didn't have enough cash to pay for the whole thing right now, so you decided to finance the purchase and get a car loan. You will be making payments of $436.08 at the end of every month for 4 years. The rate of interest is 5 6% compounded annually. Determine the original purchase price of the cararrow_forwardA friend of yours just bought a new sports car with a $5,000 down payment,and her $30,000 car loan is financed at an interest rate of 0.75% per month for 48 months. After two years, the “Blue Book” value of her vehicle in the used-car marketplace is $15,000. Solve, a. How much does your friend still owe on the car loan immediately after she makes her 24th payment? b. Compare your answer to Part (a) to $15,000. This situation is called being “upside down.” What can she do about it? Discuss your idea(s) with your instructor.arrow_forward

- Sultan’s Used Cars just sold you a clunker (you need it to get to class on time). You financed the $8,000 purchase price for 48 months. They said your payment would be $250. What interest rate did they charge you (assume monthly compounding)?arrow_forwardYou need to buy a new laundry center with a price of $ 22,000 because the one you had no longer works and has no repair, at the moment you do not have the cash available to buy it, so you went to a department store to buy it on credit, The store offers you to pay for the laundry center in 24 months with an annual rate of 17%. What is the amount you will have to pay monthly? Note: Step by step to get to the result, do not skip anything.Note2: If it can be done in excel it is betterarrow_forwardExcited to buy her dream car, Molly rushes into her local Jeep dealership. Molly picks out a car, sits down at the financing desk, and hears the following: "Well, we ran your credit history. You've got a really thin file -- just a year's worth of student loan payments. The deal you saw was for 'well-qualified buyers.' The best deal we can offer you is 6.6% for 60 months. A little more bad news -- the cash allowance is also based on credit history, so you don't qualify for $500. That said, you're excited about a Jeep, and I want to see you driving one, so I can do $400 for you!" 9. Molly still has a $2500 down payment. How much loan does Molly need?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education