FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

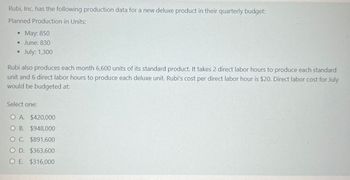

Transcribed Image Text:Rubi, Inc. has the following production data for a new deluxe product in their quarterly budget:

Planned Production in Units:

.

• May: 850

⚫ June: 830

.

July: 1,300

Rubi also produces each month 6,600 units of its standard product. It takes 2 direct labor hours to produce each standard

unit and 6 direct labor hours to produce each deluxe unit. Rubi's cost per direct labor hour is $20. Direct labor cost for July

would be budgeted at:

Select one:

O A. $420,000

O B. $948,000

O C. $891,600

OD. $363,600

O E. $316,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help mearrow_forwardThe production manager of Rordan Corporation prepared the following quarterly production forecast for next year: Units to be produced 1st Quarter 10,200 2nd Quarter 3rd Quarter 4th Quarter 7,500 8,100 10,400 Each unit requires 0.45 direct labor-hour, and direct laborers are paid $14.00 per hour. Required: 1. Prepare a direct labor budget for next year. Note: Round "Direct labor time per unit (hours)" answers to 2 decimal places. Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost Rordan Corporation Direct Labor Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Yeararrow_forwardVaughn Company’s sales budget showed expected sales of 13480 widgets. Beginning finished goods contained 1110widgets. The company determined that 14120 units should be produced. How many widgets will the company have on hand at the end of the year? 1110 1750 640 470arrow_forward

- Jerry Jay is the CEO of Jerry's Jackets (JJ). In June, Jerry expects to produce and sell 3100 jackets, and he expects his June utilities cost to be $8,000 plus $0.60 per jacket. After the month ended, it was reported that 2960 jackets were sold in June and $10,190 was spent on utilities. What is the planning budget for utilities in June? Round your answer to the nearest whole number.arrow_forwardZia & Company sells a single product. Each unit takes 2 pounds of material and costs $3 per pound. Company has prepared a production budget by quarter as follows: First Second Third Fourth Budgeted Production 30,000 60,000 90,000 100,000 The ending inventory at the end of quarter must be equal to 25% of the following quarter’s production needs. 26,000 pounds of material are on hand to start the quarter. Prepare direct materials budget for the ending year. Please dont provide solution in image format thank yuarrow_forwardLydia Company manufactures a single product. It keeps its inventory of finished goodsat twice the coming month’s budgeted sales and inventory of raw materials at 150%of the coming month’s budgeted production. Each unit of product requires five poundsof materials, which cost P3 per pound. The sales budget is, in units: May, 10,000;June, 12,400; July, 12,600; August, 13,200. 2. Compute the budgeted production for Julyarrow_forward

- Fairfield Company management has budgeted the following amounts for its next fiscal year: Selling price per unit Variable expenses per unit Total fixed expenses $40.00 per unit $25.00 per unit $832,500 19. Fairfield Company's goal for the month is to earn a target operating income of $285,000. How many units must be sold to achieve this goal? (A)54,000 units (B) 55,500 units (C) 74,500 units (D) 33,300 units (2 marks) If Fairfield can reduce fixed expenses by $41,625, by how much can variable expenses per unit increase and still allow the company to maintain the original breakeven sales in units? 20. (A) (B) $0.75 $2.78 (C) $0.53 (D) $0.25 (3 marks)arrow_forwardThe production department of Headstrong Company has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th G Quarter Units to be produced 7,000 8,000 6,000 5.000 In addition, the beginning raw materials inventory for the first quarter is budgeted to be 1,400 kilograms and the beginning accounts payable for the first quarter are budgeted to be $2,940. Each unit requires two kilograms of raw material that costs $1.40 per kilogram. Management desires to end each quarter with an inventory of raw materials equal to 10% of the following quarter's production needs. The desired ending inventory for the fourth quarter is 1, 500 kilograms. Management plans to pay for 80% of raw material purchases in the quarter acquired and 20% in the following quarter. Each unit requires 0.60 direct labour - hours, and direct labour - hour workers are paid $14 per hour. Required: 1. Prepare the company's direct materials budget…arrow_forwardZhang Industries budgets production of 350 units in June and 360 units in July. Each finished unit requires 4 pounds of raw material K, which costs $5 per pound. Each month's ending inventory of raw materials should be 40% of the following month's budgeted production. The June 1 raw materials inventory has 560 pounds of raw material K. Compute the budgeted cost of purchases for raw material K for June. Multiple Choice $4,400. $7,000. $7,200. $7,080. $7,100.arrow_forward

- Movers Company manufactures sneakers. Production of their new sneaker for the coming three months is budgeted as follows: August 50,000 September 62,000 October 48,000 Each sneaker requires 1.5 hours of direct labor time. Direct labor wages average $16 per hour. Monthly variable overhead averages $8 per direct labor hour plus fixed overhead of $700,000. What is the total overhead budgeted for the month of September?arrow_forwardEasy Farms Inc. makes tillers for small farms. Their sales budget is shown below: Sep sales, units 10,000 Oct sales, units 56,000 Nov sales, units 40,000 Management want enough tillers on hand to meet 10% of next month's sales. Each tiller requires 8 round blades. Management wants enough blades to meet 13% of next month's production needs. Each blade cost $4.50. What is the material budget for blades for September (in dollars)? Enter as a whole number, no commas and no dollar signs. Your Answer: Answerarrow_forwardFazel Company makes and sells paper products. In the coming year, Fazel expects total sales of $18,000,000. There is a 6% commission on sales. In addition, fixed expenses of the sales and administrative offices include the following: Salaries $ 960,000 Utilities 365,000 Office space 230,000 Advertising 1,200,000 Required: Prepare a selling and administrative expenses budget for Fazel Company for the coming year. Fazel Company Selling and Administrative Expenses Budget For the Coming Year Variable selling expenses Fixed expenses: Salaries Utilities Office space Advertising Total fixed expenses Total selling and administrative expensesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education