FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

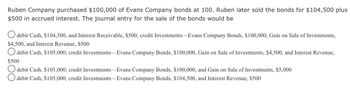

Transcribed Image Text:Ruben Company purchased $100,000 of Evans Company bonds at 100. Ruben later sold the bonds for $104,500 plus

$500 in accrued interest. The journal entry for the sale of the bonds would be

debit Cash, $104,500, and Interest Receivable, $500; credit Investments-Evans Company Bonds, $100,000, Gain on Sale of Investments,

$4,500, and Interest Revenue, $500

Odebit Cash, $105,000; credit Investments Evans Company Bonds, $100,000, Gain on Sale of Investments, $4,500, and Interest Revenue,

$500

debit Cash, $105,000; credit Investments-Evans Company Bonds, $100,000, and Gain on Sale of Investments, $5,000

debit Cash, $105,000; credit Investments-Evans Company Bonds, $104,500, and Interest Revenue, $500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Doyle Company issued $390,000 of 10-year, 8 percent bonds on January 1, Year 2. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $52,500 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 2. b. Prepare the income statement, balance sheet, and statement of cash flows for Year 2 and Year 3. Complete this question by entering your answers in the tabs below. Req B Income Req B Balance Statement Sheet Req B Statement of Cash Flows Prepare the statement of cash flows for Year 2 and Year 3. Note: Amounts to be deducted and cash outflows should be indicated with minus sign. DOYLE COMPANY Statement of Cash Flows For the Year Ended December 31 Cash flows from operating activities ces Net cash flow from operating activities Cash flows from investing activities Net cash flows from investing activities Cash…arrow_forwardStarmount Inc. sold bonds with a $50,000 face value, 12% interest, and 10-year term at $48,000. What is the total amount of interest expense over the life of the bonds?arrow_forwardPlease help me. Thankyou.arrow_forward

- Starks products uses the cost method to account for investments in bonds. They purchased cash $150,000 of ice line inc, 6% bonds at 100 plus accrued interest of $1500. They then received a semiannual interest payment. I already have the answers for the above transactions. Journalize the following entry: sold $90,000 of the bonds at 102 plus accrued interest of $900arrow_forwardAccount balances and information relating to bonds payable during the year: B/P Premium on B/P Beginning of year $80,000 12,000 End of year $60,000 9,000 Bonds with a par value of $20,000 were issued at 110 for land. Bonds with a par value of $40,000 were retired. The amount paid was $50,000, and a loss of $6,000 was sustained. Required: Prepare all the journal entries related to the B/P transactions. That is, prepare JEs for the issue for land, interest expense (if any), and retirement.arrow_forwardIrving Inc. sold bonds with a $50,000, 10% interest, and 10-year term at $52,000. What is the total amount of interest expense over the life of the bonds?arrow_forward

- Ruben Company purchased $100,000 of Evans Company bonds at 100 plus $1,500 in accrued interest. The bond interest rate is 8% and interest is paid semiannually. The journal entry for the purchase would be. Oa. debit Investments-Evans Company Bonds, $100,000; credit Interest Revenue, $1,500, and Cash, $98,500 Ob. debit Investments-Evans Company Bonds, $100,000, and Interest Receivable $1,500; credit Cash, $101,500 Oc. debit Investments-Evans Company Bonds, $101,500; credit Cash, $101,500 Od. debit Investments-Evans Company Bonds, $100,000; credit Cash, $100,000arrow_forwardIf $1,051,000 of 12% bonds are issued at 102 1/2, The amount of cash received from the sale is:arrow_forwardEddie Industries issues $926,000 of 8% bonds at 102. The amount of cash received from the sale is a.$926,000 b.$1,000,080 c.$898,220 d.$944,520arrow_forward

- Eli Inc. issued $100,000 of 10% annual, 5-year bonds for $103,200. What is the total amount of interest expense over the life of the bonds?arrow_forwardThompson Distributors sold $50,000 worth of bonds to raise money for a new warehouse. The bonds pay interest annually at 4% for 10 years. The market rate of interest for a similar instrument was 3%; therefore, the bonds sold for a premium at $54,265. a. Record the sale of the bonds. b. Record the first interest payment and the amortization of the bond premium. Round the interest to the nearest dollar. c. Determine the carrying value (book value) of the bonds after the first year. General Journal Date Account Debit Credit a. b.arrow_forwardIf $1,000,000 of 8% bonds are issued at 102 3/4, the amount of cash received from the sale isarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education