FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

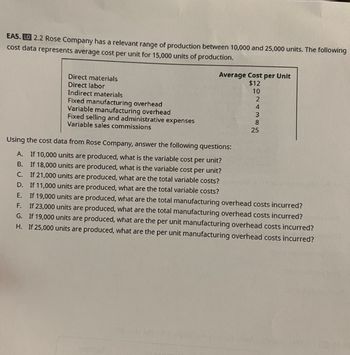

Transcribed Image Text:EA5. LO 2.2 Rose Company has a relevant range of production between 10,000 and 25,000 units. The following

cost data represents average cost per unit for 15,000 units of production.

Direct materials

Direct labor

Indirect materials

Fixed manufacturing overhead

Variable manufacturing overhead

Fixed selling and administrative expenses

Variable sales commissions

Average Cost per Unit

$12

10

2

4

05169 ans

3

8

25

Using the cost data from Rose Company, answer the following questions:

A. If 10,000 units are produced, what is the variable cost per unit?

B.

If 18,000 units are produced, what is the variable cost per unit?

C. If 21,000 units are produced, what are the total variable costs?

If 11,000 units are produced, what are the total variable costs?

D.

E.

If 19,000 units are produced, what are the total manufacturing overhead costs incurred?

F.

If 23,000 units are produced, what are the total manufacturing overhead costs incurred?

G. If 19,000 units are produced, what are the per unit manufacturing overhead costs incurred?

H. If 25,000 units are produced, what are the per unit manufacturing overhead costs incurred?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the prime cost & conversion cost of the masks manufactured.arrow_forwardDOCUMENT FLOWCHART Prepare a flowchart that illustrates the sequence in which the following source documents are prepared.bill of materialswork ordersales forecastmaterials requisition move ticketproduction schedule route sheetarrow_forwardDescribe a merchandising company's operational cycle.arrow_forward

- State five qualitative aspects that the company must evaluate before making a decisionarrow_forwardClassify the type of quality cost: 1.Expediting 2.Line Inspection 3.Recallsarrow_forwardWhat steps or activities are involved in developing standards for the materials that are used in making a product?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education