Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Rosa Burnett needs $4,000 in three years to make the down payment on a new car. How much must she invest today if she receives 2.5% interest annually,

compounded annually?

Click the icon to view the present value of $1.00 table.

She must invest $

(Round to the nearest cent as needed.)

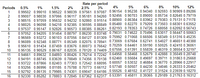

Transcribed Image Text:Rate per period

Periods

4%

5%

6%

8%

10%

12%

0.5%

0.99502 0.99010 0.98522 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.92593 0.90909 0.89286

0.99007 0.98030 0.97066 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.85734 0.82645 0.79719

0.98515 0.97059 0.95632 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.79383 0.75131 0.71178

0.98025 0.96098 0.94218 0.92385 0,90595 0.88849 0.85480 0.82270 0.79209 0.73503 0.68301 0.63552

0.97537 0.95147 0.92826 0.90573 0.88385 0.86261 0.82193 0.78353 0.74726 0.68058 0.62092 0.56743

0.97052 0.94205 0.91454 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.63017 0.56447 0.50663

0.96569 0.93272 0.90103 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.58349 0.51316 0.45235

0.96089 0.92348 0.88771 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.54027 0.46651 0.40388

0.95610 0.91434 0.87459 0.83676 0,80073 0.76642 0.70259 0.64461 0.59190 0.50025 0.42410 0.36061

0.95135 0.90529 0.86167 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.46319 0.38554 0.32197

0.94661 0.89632 0.84893 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.42888 0.35049 0.28748

0.94191 0.88745 0.83639 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.39711 0.31863 0.25668

0.93722 0.87866 0.82403 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.36770 0.28966 0.22917

0.93256 0.86996 0.81185 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.34046 0.26333 0.20462

0.92792 0.86135 0.79985 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.31524 0.23939 0.18270

0.92330 0.85282 0.78803 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.29189 0.21763 0.16312

1%

1.5%

2%

2.5%

3%

1

2

3

4.

6.

7

8

10

11

12

13

14

15

16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Stephen plans to purchase a car 4 years from now. The car will cost $35,175 at that time. Assume that Stephen can earn 7.38 percent (compounded monthly) on his money. How much should he set aside today for the purchase? Round the answer to two decimal places.arrow_forwardPatty purchases a $240,000 house. She pays $40,000 down and takes out a 25 year mortgage with monthly payments, at an interest rate of 12% interest compounded monthly. How much money will Patty have to pay each month?arrow_forwardAlexandria wants to receive $12,000 a year for 8 years. How much must Alexandria invest today in an annuity that pays 5% annually?arrow_forward

- Wilma wants to buy a car that costs $52,000. She has arranged to borrow the total purchase price of the car from her bank at 6 percent interest rate. The loan requires monthly payments for a period of five years. If the first payment is due in one month after purchasing the car, what will be the amount of Wilma’s monthly payment on the loan?arrow_forwardKourtney currently works at Bruin Productions and decide to finally plan for the future, she wants to retire in 10 years, but has not saved for retirement. She wants to have $250,000 when she retires in 10 years. How much should she deposit each month into an account that pays 6.1% annual interest, compunded monthly?arrow_forwardPayton wants $5,000 saved in 2 years to make a down payment on a house. How much money should she invest now at 3.2% compounded monthly in order to meet her goal?arrow_forward

- Mrs. Jones decides to buy a house. She pays $40,000 down and pays $1500 per month for 30 years at 4% monthly. What is the cash price of the house.arrow_forwardMary wants to have $14000 for a trip to Mexico in five years. How much does she need to deposit at the end each month into an account earning 3.6% compounded monthly in order to have the money she needs?arrow_forwardMegan takes out a car loan for $13,000. She intends to make monthly payments for 5 years to pay off her loan. If the bank charges her an annual interest rate of 4.2% computed monthly on the loan balance, how much will her monthly payments be?arrow_forward

- To help buy her new house, Donna is taking out a $271,000 mortgage loan for 30 years at 4.1% annual interest. Her monthly payment for this loan is $1309.47. Fill in all the blanks in the amortization schedule for the loan. Assume that each month is in of a year. Round your answers to the nearest cent.arrow_forwardTo finance a vacation in 2 years, Elsie saves $380 at the beginning of every six months in an account paying interest at 13% compounded semi-annually. (a) What will be the balance in her account when she takes the vacation? (b) How much of the balance will be interest? (c) If she waits an additional year to start her vacation, and continues to save the same amount of money, how much more money does she have to spend?arrow_forwardJenelle bought a home for $370,000, paying 18% as a down payment, and financing the rest at 4.6% interest for 30 years. Round your answers to the nearest cent. How much money did Jenelle pay as a down payment? $ What was the original amount financed? $ What is her monthly payment? $ If Jenelle makes these payments every month for thirty years, determine the total amount of money she will spend on this home. Include the down payment in your answer. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education