Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How much Ron's taxable income?

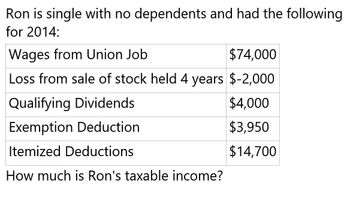

Transcribed Image Text:Ron is single with no dependents and had the following

for 2014:

Wages from Union Job

$74,000

Loss from sale of stock held 4 years $-2,000

Qualifying Dividends

Exemption Deduction

$4,000

$3,950

Itemized Deductions

$14,700

How much is Ron's taxable income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sheila, a single taxpayer, is a retired computer executive with a taxable income of 100,000 in the current year. She receives 30,000 per year in tax-exempt municipal bond interest. Adam and Tanya are married and have no children. Adam and Tanyas 100,000 taxable income is comprised solely of wages they earn from their jobs. Calculate and compare the amount of tax Sheila pays with Adam and Tanyas tax. How well does the ability-to-pay concept work in this situation?arrow_forwardDana and Larry are married and live in Texas. Dana earns a salary of $45,000 and Larry has $25,000 of rental income from his separate property. If Dana and Larry file separate tax returns, what amount of income must Larry report? $0 $22,500 $25,000 $47,500 None of the abovearrow_forwardLeroy and Amanda are married and have three dependent children. During the current year, they have the following income and expenses: Salaries 120,000 Interest income 45,000 Royalty income 27,000 Deductions for AGI 3,000 Deductions from AGI 9,000 a. What is Leroy and Amandas current year taxable income and income tax liability? b. Leroy and Amanda would like to lower their income tax. How much income tax will they save if they validly transfer 5,000 of the interest income to each of their children? Assume that the children have no other income and that they are entitled to a 1,050 standard deduction.arrow_forward

- Chelsea, who is single, purchases land for investment purposes in 2014 at a cost of 22,000. In 2019, she sells the land for 38,000. Chelseas taxable income without considering the land sale is 100,000. What is the effect of the sale of the land on her taxable income, and what is her tax liability?arrow_forwardDarrell is an employee of Whitneys. During the current year, Darrells salary is 136,000. Whitneys net self-employment income is also 136,000. Calculate the Social Security and self-employment taxes paid by Darrell and Whitney. Write a letter to Whitney in which you state how much she will have to pay in Social Security and self-employment taxes and why she owes those amounts.arrow_forwardHow much is Ron's taxable income?arrow_forward

- How much is taxable income?arrow_forwardGive Answerarrow_forwardKenneth owns Sheffield Company and has the following revenue and expenses. Calculate the after-tax net profit (ignoring self-employment tax) for Kenneth who is single in 2023. Taxable revenue received $117,000 Tax-exempt revenue received $15,000 Deductible expenses paid $23,000 Non- deductible expenses paid $5,000arrow_forward

- Nonearrow_forwardIn 2022, Miranda records net earnings from self-employment of $102,000. She has no other income. Determine the amount of Miranda's self-employment tax. $15,825.10 $15,606.00 $14,412.14 $11,680.43 $12,325.54 $15,300arrow_forwardJanice, an unmarried individual, lives in a home with her 9-year-old son, Oscar who qualifies as her dependent. 2021tax information Net Income from self-employment $195,000. Dividend income taxed @ 15% $2800 Deduction for self employed tax $6712 Itemized deduction $14,200 (A)compute AGI, taxable income and tax liability (B)assume that in addition to the original information given above Janice paid $7000 for child care. Compute her taxable income and tax liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you