FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

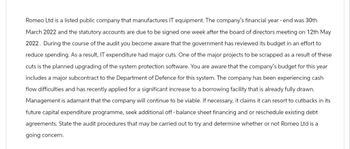

Transcribed Image Text:Romeo Ltd is a listed public company that manufactures IT equipment. The company's financial year-end was 30th

March 2022 and the statutory accounts are due to be signed one week after the board of directors meeting on 12th May

2022. During the course of the audit you become aware that the government has reviewed its budget in an effort to

reduce spending. As a result, IT expenditure had major cuts. One of the major projects to be scrapped as a result of these

cuts is the planned upgrading of the system protection software. You are aware that the company's budget for this year

includes a major subcontract to the Department of Defence for this system. The company has been experiencing cash

flow difficulties and has recently applied for a significant increase to a borrowing facility that is already fully drawn.

Management is adamant that the company will continue to be viable. If necessary, it claims it can resort to cutbacks in its

future capital expenditure programme, seek additional off-balance sheet financing and or reschedule existing debt

agreements. State the audit procedures that may be carried out to try and determine whether or not Romeo Ltd is a

going concern.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Carinal Ltd. specializes in the development of electronic components within quite acompetitive environment causing concerns for marketing and pricing. Its non-current assetsprimarily include IT software, property, and investments, and there have been additions tothese during the year.As audit manager, you are conducting a preliminary analytical review and associated riskanalysis for this client for the year ended June 30 2022. You have been presented with thefollowing draft financial information about Carinal with incomplete ratios and percentagescalculation. INCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue…arrow_forwardYou are an audit manager at Foyer & Associates and have been assigned to the audit of Modern Electrical Limited (MEL) for the year ending 30 June 2021. During the planning stage of the audit, you become aware of the following matters: a.MEL has significant loans from its bank. The bank has Indicated that it is concerned about MEL'S ability to meet specific loan covenants, particularly the return on total assets (net b. The aped trade accounts receivable listing indicates that the percentage of accounts receivable exceeding 90 days has jumped from 15 per cent to 37.5 per cent during the last 12 months. The credit manager hasindicated that the is because some of MEL'S Customers are currently'experiencing financial difficulty. This question.includos Part A and B part- a for each of the following scenerio describe briefly how this matter is a fraud audit risk factor in relation to mel's financial report.arrow_forwardMarilyn Terrill is the senior auditor for the audit of Uden Supply Company for the year ended December 31, 20X4. In planning the audit, Marilyn is attempting to develop expectations for planning analytical procedures based on the financial information for prior years and her knowledge of the business and the industry, including these: 1. Based on economic conditions, she believes that the increase in sales for the current year should approximate the historical trend in terms of actual dollar increases. 2. Based on her knowledge of industry trends, she believes that the gross profit percentage for 20X4 should be about 2 percent less than the percentage for 20X3. 3. Based on her knowledge of regulations, she is aware that the effective tax rate for the company for 20X4 has been reduced by 5 percent from that in 20X3. 4. Based on her knowledge of economic conditions, she is aware that the effective interest rate on the company's line of credit for 20X4 was approximately 12 percent. The…arrow_forward

- You are the audit partner at Parkville & Associates, a mid-tier audit firm. You are responsible for theaudits of the following four independent entities for the year ended 30 June 2018:(a) Human Help Ltd is a non-profit entity. You have discovered that it has not kept substantiatingvouchers or receipts for more than 55 percent of its expenses, excluding salaries and allowances(b) JJ King Ltd is a building contractor with a varying workload. In order to compensate for theirregularity of its contracted building projects, JJ King also purchases large vacant blocks of landthat it later subdivides for the construction of houses and units. JJ King then sells these on its ownaccount. Your analysis strongly suggests that the apportionment of costs to houses and units soldhas been kept low to boost profits. In your opinion, this has resulted in the overvaluation of theunsold properties. The directors of the company do not agree and hold to their view that the stockof properties is correctly…arrow_forwardChelsea Bank provided overdraft facilities to Liverpool Ltd and Manchester & Co. were Liverpool’s auditors. The relevant overdraft facility letters between Chelsea Bank and Liverpool Ltd contained a clause requiring Manchester & Co. to send Chelsea Bank, each year, a copy of the annual audited financial statements.In 2018 Liverpool Ltd was put into receivership with approximately $23.5M owing to Chelsea Bank. Chelsea Bank claimed that, due to massive fraud, Liverpool’s financial statements for the previous years had misstated the financial position of Liverpool and Manchester & Co. had been negligent in not detecting the fraud. Chelsea Bank contended that it had continued to provide the overdraft facilities in reliance on Manchester’s unqualified opinions.Manchester & Co. applied to the court for an order striking out the claim on the grounds that, even if all the facts alleged by Chelsea Bank were true, the claim could not succeed in law because Manchester & Co.…arrow_forwardCarinal Ltd. specializes in the development of electronic components within quite acompetitive environment causing concerns for marketing and pricing. Its non-current assetsprimarily include IT software, property, and investments, and there have been additions tothese during the year.As audit manager, you are conducting a preliminary analytical review and associated riskanalysis for this client for the year ended June 30 2022. You have been presented with thefollowing draft financial information about Carinal with incomplete ratios and percentagescalculation. INCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses 5555 512Profit from operations 2899 4854Net interest receivable 1245 495Profit before tax 4144 5349Income tax expense 2145 2345Net profit 1999 3004Retained profits 1325 2105Dividends paid $1250 $1049Accounting ratios and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education