Purchasing and Supply Chain Management

6th Edition

ISBN: 9781285869681

Author: Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need all three parts. ...attempt If you will solve all three parts. ....thanks

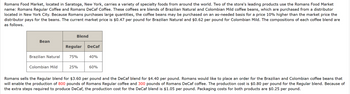

Transcribed Image Text:Romans Food Market, located in Saratoga, New York, carries a variety of specialty foods from around the world. Two of the store's leading products use the Romans Food Market

name: Romans Regular Coffee and Romans DeCaf Coffee. These coffees are blends of Brazilian Natural and Colombian Mild coffee beans, which are purchased from a distributor

located in New York City. Because Romans purchases large quantities, the coffee beans may be purchased on an as-needed basis for a price 10% higher than the market price the

distributor pays for the beans. The current market price is $0.47 per pound for Brazilian Natural and $0.62 per pound for Colombian Mild. The compositions of each coffee blend are

as follows.

Bean

Brazilian Natural

Colombian Mild

Blend

Regular DeCaf

75%

25%

40%

60%

Romans sells the Regular blend for $3.60 per pound and the DeCaf blend for $4.40 per pound. Romans would like to place an order for the Brazilian and Colombian coffee beans that

will enable the production of 800 pounds of Romans Regular coffee and 300 pounds of Romans DeCaf coffee. The production cost is $0.80 per pound for the Regular blend. Because of

the extra steps required to produce DeCaf, the production cost for the DeCaf blend is $1.05 per pound. Packaging costs for both products are $0.25 per pound.

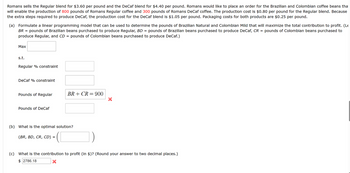

Transcribed Image Text:Romans sells the Regular blend for $3.60 per pound and the DeCaf blend for $4.40 per pound. Romans would like to place an order for the Brazilian and Colombian coffee beans tha

will enable the production of 800 pounds of Romans Regular coffee and 300 pounds of Romans DeCaf coffee. The production cost is $0.80 per pound for the Regular blend. Because

the extra steps required to produce DeCaf, the production cost for the DeCaf blend is $1.05 per pound. Packaging costs for both products are $0.25 per pound.

(a) Formulate a linear programming model that can be used to determine the pounds of Brazilian Natural and Colombian Mild that will maximize the total contribution to profit. (Le

BR =

pounds of Brazilian beans purchased to produce Regular, BD = pounds of Brazilian beans purchased to produce DeCaf, CR = pounds of Colombian beans purchased to

produce Regular, and CD pounds of Colombian beans purchased to produce DeCaf.)

Max

s.t.

Regular % constraint

DeCaf % constraint

Pounds of Regular

Pounds of DeCaf

=

BR+CR= 900

(b) What is the optimal solution?

(BR, BD, CR, CD) :

=

(c) What is the contribution to profit (in $)? (Round your answer to two decimal places.)

$2786.18

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- Retailers Warehouse (RW) is an independent supplier of household items todepartment stores. RW attempts to stock enough items for a 98 percent serviceprobability.A stainless steel knife set is one item it stocks. Demand (2,400 sets peryear) is relatively stable over the entire year. Whenever new stock isordered, a buyer must assure that numbers are correct for stock on handand then phone in a new order. The total cost involved to place an order isabout $5. RW figures that holding inventory in stock and paying forinterest on borrowed capital, insurance, and so on adds up to about $4holding cost per unit per year.Analysis of the past data shows that the standard deviation of demandfrom retailers is about four units per day for a 365-day year. Lead time toget the order is seven days.a. What is the economic order quantity?b. What is the reorder point?arrow_forwardThe relationship between price and quantity supplied is typically O direct O inversearrow_forwardCharlie’s Pizza orders all of it pepperoni, olives, anchovies, and mozzarella cheese to be shipped directly from Italy. An American distributor stops by every seven weeks to take orders. Because the orders are shipped directly from Ital, they take six weeks to arrive. Charlies Pizza uses an average of 250 pounds of pepperoni each week, with a standard deviation of 18 pounds. Charlie prides itself on offering only the best –quality ingredients and a high level of service, so it wants to ensure a 95 percent probability of not stocking out on pepperoni. Assume that the sales representative just walked in the door and there are currently 470 pounds of pepperoni in the walk-in cooler. How many pounds of pepperoni would you order? (Use the excels NORMSINV( ) function to find the critical value for the given a-level, (Round you z-value to 2 decimal places and final answer tarrow_forward

- PART A Speedy Bicycle Company (SBC) is a wholesale distributor of a wide variety of bicycles and bicycle parts. The most popular model is the Dragonfly, which sells for $170. All manufacturing is done at a plant in China, and shipment takes a month (30 days) from the time an order is placed. The estimated order cost is $75, including customs clearance. SBC's cost per bicycle is 65% of retail price, and inventory carrying cost is 11% per year of SBC's cost. If the company cannot fulfill a retail order, the retailer will get the shipment from another distributor and SBC loses that business. SBC is planning inventory for 2023 based on forecasted demand and wants to maintain a 93% service level to minimize lost orders. The company has 300 working days per year. 2021 Forecasted Demand for the Dragonfly Bicycle Model: F A J 15 58 J 8 M 31 M 96 J 59 38 A 23 S 16 0 14 N 26 D 41arrow_forwardPART A Speedy Bicycle Company (SBC) is a wholesale distributor of a wide variety of bicycles and bicycle parts. The most popular model is the Dragonfly, which sells for $170. All manufacturing is done at a plant in China, and shipment takes a month (30 days) from the time an order is placed. The estimated order cost is $75, including customs clearance. SBC's cost per bicycle is 65% of retail price, and inventory carrying cost is 11% per year of SBC's cost. If the company cannot fulfill a retail order, the retailer will get the shipment from another distributor and SBC loses that business. SBC is planning inventory for 2023 based on forecasted demand and wants to maintain a 93% service level to minimize lost orders. The company has 300 working days per year. 2021 Forecasted Demand for the Dragonfly Bicycle Model: F A M J 15 58 96 J 8 M 31 J per order 1 Inventory Activity 59 38 (round to nearest cent) 2 bicycles 6 A 23 Develop an inventory plan for the Dragonfly model. Canvas responses…arrow_forwardThe following table shows financial data (year 2009) for two US retailers: Save-A-Lot Retailers and Wally’s Mart. Assume that both companies have an average annual holding cost rate of 20% (i.e. it costs both retailers $2 to hold an item for one entire year that they procured for $10). *Refer to attached image* How much lower, on average, is the inventory cost for Save-A-Lot compared to Wally’s Mart of a household cleaner valued at $50 COGS? Give your answer in terms of dollars. Assume that the unit cost of the household cleaner is the same for both companies and that the price and the inventory turns of an item are independent.arrow_forward

- Sam is at the post office to mail a package. After he pays for mailing the package, the clerk asks if he would like to buy some stamps. Sam pauses to think before he answers. He doesnt have a credit card with him. After paying for the package, he has about $30 in his pocket. Analyze this from an inventory standpoint. Identify the relevant considerations.arrow_forwardDemand for a product is relatively constant at 5 units per day. Lead time for this product is normally distributed with a mean of 20 days and a standard deviation of 4 days. (a) What reorder point provides an 80 percent service level? (b) What reorder point provides a 90 percent service level? (c) If the lead time standard deviation can be reduced from 4 days to 1, what reorder point now provides 90 percent service? How much is safety stock reduced by this change?arrow_forwardSam is at the post office to mail a package. After he pays for mailing the package, the clerk asksif he would like to buy some stamps. Sam pauses to think before he answers. He doesn’t have acredit card with him. After paying for the package, he has about $30 in his pocket. Analyze thisfrom an inventory standpoint. Identify the relevant considerations.arrow_forward

- Conduct a detailed comparative analysis between the Wilson approach and the ABC analysis method for inventory management.arrow_forwardAcme Inc. has decided to outsource and offshore a small electric motor that it currently manufactures itself. It has found an offshore supplier that charges $925,000 for a minimum order quantity of 5,000 motors. Shipping costs for this quantity are $15,000. The buyer expects to place four orders per year to meet its annual need for 20,000 motors. Annual carrying cost is 25% of unit price, and import tariffs are 12% of unit price. The company expects to spend $12,500 per year on contracting and relationship maintenance.What is the total cost of outsourcing and offshoring this motor?arrow_forwardDefine the various elements of a good inventory management.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning