ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

K5

Fully Explain

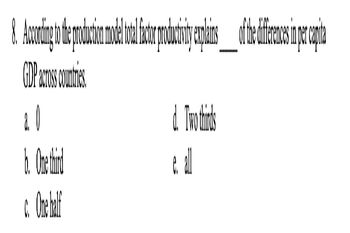

Transcribed Image Text:8. A conting the proteiner

GDP across countries

b. One third

One half

C.

pe plans to the afterno si pre

d. Two thirds

all

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that 20 risk neutral competitors participate in a rent seeking game with a fixed prize of $500. Each player may invest as much money as he wishes in the political contest. The probability of winning is directly proportional to the candidate's share of the total rent-seeking investment. 1. What is the expected net benefit of a player if all other players invest $20 each? Write the net benefit as a function of the player's investment. 2. Solve the maximization problem to arrive at the profit-maximizing investment. Round to the nearest cent.arrow_forwardFind the inverse of the given matrix, if it exists. - 2 - 9 M = 9 40 Select the correct choice below and, if necessary, fill in the answer box to complete your choice. 40 - 9 - 1 А. М 2 -9 B. The matrix M 1 does not exist.arrow_forwardSatiation preference is monotonic. True or False, why?arrow_forward

- QD1 = 12-4P1 + P2, QS1 = 3+2P1-5P2. solve for P equilibrium and Q equilibriumarrow_forwardExercise 1.12. Consider the following game. There is a club with three members: Ann, Bob and Carla. They have to choose which of the three is going to be president next year. Currently Ann is the president. Each member is both a candidate and a voter. Voting is as follows: each member votes for one candidate (voting for oneself is allowed); if two or more people vote for the same candidate then that person is chosen as the next president; if there is complete disagreement, in the sense that there is exactly one vote for each candidate, then the person from whom Ann voted is selected as the next president. (a) Represent this voting procedure as a game frame, indicating inside each cell of each table which candidate is elected. (b) Assume that the players' preferences are as follows: AnnAm Carla Ann Bob, Carla Bob Ann, Bob Carla Ann Caria Carla. Using utility values 0, 1 and 2, convert the game frame into a game. (c) Apply the IDWDS to the game of part (b). Is there a weak iterated…arrow_forwardPlease help solve fill in the blanks.arrow_forward

- Hello, please help me to solve part (d) and (e):Charlie finds two fifty-pence pieces on the floor. His friend Dylan is standing next to him when he finds them. Chris can offer Dylan nothing at all, one of the fifty-pence pieces, or both. Dylan observes the offer made by Charlie, and can either accept the offer (in which case they each receive the split specified by Charlie) or reject the offer.If he rejects the offer, each player gets nothing at all (because Charlie is embarassed and throws the moneyaway).(a) Formulate this interaction as an extensive-form game. To keep things simple, players’ payoff is equal to their monetary gain.(b) List all histories of the game. Split these into terminal and non-terminal histories.(c) What are the strategies available to Charlie? What are the strategies available to Dylan? Draw the strategic-form game.(d) Find the pure-strategy Nash equilibria of this game.(e) What do you think will happen?arrow_forwardEach stock listed on the New York Stock Exchange is allocated to a specialist, who is responsible for maintaining an orderly market. This person has a specific location on the floor of the exchange known asarrow_forwardOwleodoxkxmmaswarrow_forward

- No1 ) Rob works as a loan officer for a major U.S. commercial bank, specializing in international loans. When considering loans to governments and businesses in other nations, Rob Multiple Choice must be aware of federal limits on the total amount of U.S. funds his bank can lend to foreign borrowers. can only make loans if his bank has funds in excess of those sought by American firms. is likely to approve loans to foreign borrowers if the return is high enough to justify the risk. must increase the dollar volume of loans they make to customers. must pay more to borrow from the Fed. have fewer funds available for lending. will find their balance sheets temporarily out of balance. must be careful to get approval from the International Monetary Fund. No. 2) When the Fed increases the reserve requirement, banks Multiple Choice must increase the dollar volume of loans they make to customers. must pay more to borrow from the Fed.…arrow_forwardEconomics Explain in detail how you would extend the Cox- Ross{Rubinstein binomial tree model for pricing options if instead of considering two states of nature in each period you consider three states of nature (e.g. a good state, a middle state and a bad state). Focus on a tree with two periods (periods 0, 1 and 2) and draw the corresponging trinomial tree.arrow_forwardAn individual has a vNM utility function over money of u(x)= x, where x is final wealth. She currently has $8 and can choose among the following three lotteries. Which lottery will she choose? • Lottery 1: Give up her $8 and face the gamble (0.1, 0.5, 0.4) over final wealth levels ($1, $8, $27). • Lottery 2: Keep her $8. • Lottery 3: Give up her $8 and face the gamble (0.2, 0.8,0.0) over final wealth levels ($1, $8, $27) O Lottery 1 O Lottery 2 Lottery 3 O They are indifferent between lotteries 1 and 2 O They are indifferent between lotteries 2 and 3 O They are indifferent between lotteries 1 and 3 O They are indifferent between all three lotterisarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education