FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

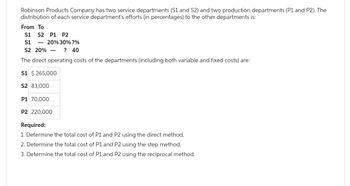

Transcribed Image Text:Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The

distribution of each service department's efforts (in percentages) to the other departments is:

From To

S1 S2 P1 P2

S1 - 20% 30% ?%

S2 20% - ? 40

The direct operating costs of the departments (including both variable and fixed costs) are:

S1 $ 265,000

S2 83,000

P1 70,000

P2 220,000

Required:

1. Determine the total cost of P1 and P2 using the direct method.

2. Determine the total cost of P1 and P2 using the step method.

3. Determine the total cost of P1 and P2 using the reciprocal method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 S2 S1 S2 To P1 10% 20% ? 10% S1 S2 P1 P2 – P2 $225,000 75,000 62,000 180,000 ?% The direct operating costs of the departments (including both variable and fixed costs) are: 30 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forwardCoastal Carolina Company has a product with a unit selling price of $200, the unit variable cost is $110, and the total monthly fixed costs are $300,000. What is Coastal Carolina's contribution margin ratio? OA) 182% B) 55% C) 45% OD) 150%arrow_forwardShirley Incorporated has three divisions, King, West and Gold. All common fixed costs are unavoidable. Following is the segmented income statement for the previous year: Sales revenue Variable costs Contribution margin Direct fixed costs Segment margin Common fixed costs (allocated) Net operating income (loss) King $ 1,040,000 312,000 $ 728,000 104,000 $ 624,000 391,000 $ 233,000 Required: a. What would Shirley's net income (loss) be if the West Division were dropped? b. What would Shirley's net income (loss) be if the Gold Division were dropped? Complete this question by entering your answers in the tabs below. Required A Required B What would Shirley's net income (loss) be if the West Division were dropped? Gold $426,000 251,340 $ 174,660 48.000 $ 126,660 159,375 $ (32,715) Total $ 2,048,000 889,260 $ 1,158,740 192,000 $ 966,740 763,000 $ 203,740arrow_forward

- Donnelly Company has three products, R2, R4, and R2D2. The following information is available: Product R2 Product R4 Product R2D2 Sales $30,000 $45,000 $12,000 Variable Costs 18,000 24,000 7,500 Contribution Margin 12,000 21,000 4,500 Fixed Costs: Avoidable 4,500 9,000 3,000 Unavoidable 3,000 4,500 2,700 Operating Income $4,500 $7,500 $(1,200) Donnelly Company is thinking of dropping Product R2D2 because it is reporting a loss. Assuming Donnelly drops Product R2D2 and does not replace it, what will happen to operating income?arrow_forwarded Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 52 $1 S1 S2 P1 P2 20% $2 20% $ 220,000 74,000 61,000 175,000 To P1 30% ? The direct operating costs of the departments (including both variable and fixed costs) are: Required 1 Required 2 P2 Production department 1 Production department 2 ?% Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method. 40 Complete this question by entering your answers in the tabs below. $ $ Determine the total cost of P1 and P2 using the reciprocal method. (Do not round intermediate calculations. Round your final answers to whole dollars.) Required 3 Total Cost Allocated 183,548 346,458 < Required 2arrow_forwardVikram Bhaiarrow_forward

- Ram Company has three geographic segments: New York, New Jersey, and Connecticut. Its segmented income statement for last year is shown below: Company New York New Jersey Connecticut Sales 800,000 350,000 250,000 200,000 Variable costs 440,000 140,000 120,000 CM Traceable Fixed Costs 90,000 65,000 50,000 Segment margin Common Fixed Costs Net operating income 1. What was the amount of segment margin for New York? a)$60,000 b)$70,000 c)$80,000 d)$50,000 2. If Ram Company’s total fixed costs were $305,000, how much were the company’s common fixed costs? a)$110,000 b)$80,000 c)$100,000 d)$90,000arrow_forwardBryce Co. sales are $897,000, variable costs are $468,500, and operating income is $276,000. The contribution margin ratio is Oa. $2.2% Ob. 57.4% Oc. 47.8% Od. 43.5%arrow_forwardMarket Inc. has two divisions, Telbot and Heather Following is the Income statement for the past month 27 Total Talbot Beather $217, 500 $217,500 $435,000 195,750 65,250 261,000 21,750 152, 250 174,000 78, 300 78,300 156, 600 Sales Variable Costs Contribution Margin Fired Costs (allocated) Profit Margin $(56,550) $ 73,950 $ 17,400 What would Marker's proft margih be if the Talbot division was dropped and all fixed costs are unavoidable? Mutiole Choice $56.550 loss $4.350 loss $73.950 profitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education