Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Hi please calculate additional funds needed

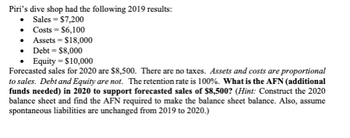

Transcribed Image Text:Piri's dive shop had the following 2019 results:

• Sales = $7,200

• Costs = $6,100

Assets $18,000

•

• Debt = $8,000

Equity = $10,000

Forecasted sales for 2020 are $8,500. There are no taxes. Assets and costs are proportional

to sales. Debt and Equity are not. The retention rate is 100%. What is the AFN (additional

funds needed) in 2020 to support forecasted sales of $8,500? (Hint: Construct the 2020

balance sheet and find the AFN required to make the balance sheet balance. Also, assume

spontaneous liabilities are unchanged from 2019 to 2020.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- State the kinds of note disclosures that need to be made to help users understand the nature of “Transfers in” to the General Fund.arrow_forwardThis problem has two parts, part a and part b. Answer each part separately using the same information. Do not mix answers to a and b; they are answered separately. Problem a: Using the list of transactions below, provide all necessary journal entries for the Fund statements. You also need to identify which funds are involved in the transaction, such as the Capital projects fund, Debt service fund Special revenue fund, or Permanent fund. Problem b: Using the same list of transactions, provide all necessary journal entries for the Governmental Activities section in the Government-wide statements. Write “no entry” if no entry is needed. Dunellen City, covered in this problem, issues a $10,000,000 bond at face value. The cash is to be used for the construction of a fire station. Previously undesignated cash of $100,000 from the General Fund is set aside to begin paying the bonds issued in item (1). A state cash grant of $300,000 is received that must be spent in the future for…arrow_forwardOliver's Place is a nonprofit entity that cares for dogs until they are adopted. It uses fund accounting and uses a UCF, an RCF, and an EF. It charges its expenses to the care of animals program, special programs, and administrative expenses. Following are some of its transactions for its fiscal year. Prepare the journal entries needed to record these transactions, indicating the fund used for each entry and showing net asset classifications, where appropriate. 1. During the year, Oliver's Place received pledges of $80,000 without donor restrictions. It estimated that 95 percent of the pledges would be collected in cash. 2. It received the following gifts from various donors: a. Donor A made a gift of common stock that had a fair value of $16,000. Donor A stated that the gift could be used for any purpose. b. Donor B made a cash gift of $4,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people. c. Donor C made a gift of common stock that…arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education