FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

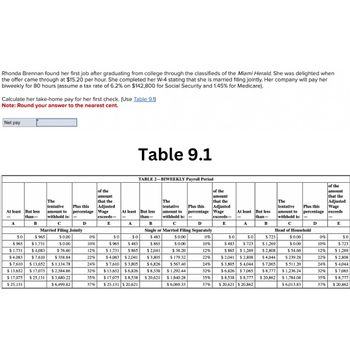

Transcribed Image Text:Rhonda Brennan found her first job after graduating from college through the classifieds of the Miami Herald. She was delighted when

the offer came through at $15.20 per hour. She completed her W-4 stating that she is married filing jointly. Her company will pay her

biweekly for 80 hours (assume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare).

Calculate her take-home pay for her first check. (Use Table 9.1)

Note: Round your answer to the nearest cent.

Net pay

The

tentative

amount to

withhold is:

с

Married Filing Jointly

$ 0.00

$ 0.00

$76.60

$358.84

$1,134.78

$ 2,584.86

$3,680.22

$ 6,499.82

At least But less

than-

B

A

$0

$ 965

$ 965 $ 1,731

$1,731 $4,083

$4,083 $7,610

$7,610 $ 13,652

$ 13,652 $ 17,075

$17,075 $ 25,131

$ 25,131

Plus this

percentage

D

0%

10%

12%

22%

24%

32%

35%

37%

of the

amount

that the

Adjusted

Wage

exceeds-

E

-

Table 9.1

A

At least But less

than-

TABLE 2-BIWEEKLY Payroll Period

$0

$0

$483

$ 965

$ 1,731 $ 865

$4,083 $2,041

$7,610 $3,805

$ 13,652 $6,826

$17,075 $8,538

$25,131 $ 20,621

The

tentative Plus this

amount to percentage

withhold is:

B

C

D

Single or Married Filing Separately

$ 483

$ 0.00

$ 865

$ 2,041

$3,805

$ 6,826

$8,538

$ 20,621

$ 0.00

$38.20

$179.32

$ 567.40

$ 1,292.44

$1,840.28

$6,069.33

of the

amount

that the

Adjusted

Wage

exceeds-

E

At least But less

than-

B

-

A

The

tentative Plus this

amount to percentage

withhold is: -

с

Head of Household

$0.00

$ 0.00

$ 54.60

$239.28

$511.20

$ 1,236.24

$ 1,784.08

$6,013.83

0%

$0 $0 $723

10%

$483 $723 $1,269

12%

$ 865 $1,269 $ 2,808

22% $2,041 $2,808 $4,044

24% $ 3,805 $4,044 $7,065

32% $6,826 $7,065 $8,777

35% $8,538 $8,777 $ 20,862

37% $ 20,621 $ 20,862

Ꭰ

0%

10%

12%

22%

24%

32%

35%

37%

of the

amount

that the

Adjusted

Wage

exceeds

-

E

$0

$723

$ 1,269

$ 2,808

$4,044

$7,065

$8,777

$ 20,862

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following information is available for the employees of Webber Packing Company for the first week of January Year 1 1. Kayla earns $26 per hour and 1½ times her regular rate for hours over 40 per week. Kayla worked 50 hours the first week in January. Kayla’s federal income tax withholding is equal to 11 percent of her gross pay. Webber pays medical insurance of $100 per week for kayla and contributes $57 per week to a retirement plan for her. 2. Paula earns a weekly salary of $1,150. Paula’s federal income tax withholding is 17 percent of her gross pay. Webber pays medical insurance of $145 per week for Paula and contributes $135 per week to a retirement plan for her. 3. Vacation pay is accrued at the rate of 2 hours per week (based on the regular pay rate) for Kayla and $75 per week for Paula. Assume the Social Security tax rate is 6 percent on the first $110,000 of salaries and the Medicare tax rate is 1.5 percent of total salaries. The state unemployment tax rate is 5.4…arrow_forwardA senior citizen gets a part-time job at a fast-food restaurant. She earns $9 per hour for each hour she works, and she works exactly 30 hours per week. Thus, her total pretax weekly income is $270. Her total income tax assessment each week is $50, but she has determined that she is assessed $3 in taxes for the final hour she works each week. This person's average tax rate each week is percent. (Round your answer to one decimal place)arrow_forwardBritta has been accepted into a 2-year medical assistant program at a career school. . Suppose that Britta decided to take out a private loan for 12,00012,000 USD for which loan payments start as soon as the loan amount is deposited in her account and continue for 10 years. The interest rate is 6.1%6.1%.We have to calculate her monthly payment.arrow_forward

- Your answer is partially correct. Karen Peters' regular hourly wage rate is $42, and she receives an hourly rate of $63 for work in excess of 40 hours. During a March pay period, Karen works 47 hours. Karen's federal income tax withholding is $80, and she has no voluntary deductions. The FICA tax rate is 7.65%. A Prepare the journal entry to record Karen's pay for the period. Use March 15 for the end of the pay period. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Mar. 15 here to search Account Titles and Explanation Salaries and Wages Expense FICA Taxes Payable Salaries and Wages Payable Cash Ef 50 Chp Debit 2,121 Credit 162.25 1.878.75 1,878.75 12:1 61°F Clear ^ @4) 934arrow_forwardVicky Le, an employee of Sweet Shoppe Industries, receives a bonus of $3,700 for her stellar work. Her boss wants Vicky to receive $3,700 on the check. She contributes 3 percent of her pay in a pre-tax deduction to her 401(k).Required:Calculate the gross pay amount that would result in $3,700 paid to Vicky. (The tax rate on bonuses is 22 percent. Social Security (6.2%) and Medicare taxes (1.45%) must be added to this rate.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardMelissa recently pod $760 for round trip airfare to San Francisco to attend a business conference for three days. Melissa also paid the following expenses: $370 fee to register for the conference, $365 per night for three nights' lodging, $250 for meals and $300 for cab fare. Suppose that while Melissa was on the coast, she also spent two day's sightseeing the national parks in the area. To do the sightseeing, she paid $1,710 for transportation, $1,285 for lodging, and $475 for meals during this part of her trip, which she considers personal in nature. What amount of these costs can Melissa deduct as business expense?arrow_forward

- Lee Sutherlin is a self-employed electrical consultant. He estimates his annual net earnings at $35,300. How much Social Security and Medicare must he pay (in $) this year? Social Security $ Medicare $arrow_forwardJerrad, age 51, works 15 hours a week at a local fast-food restaurant while he attends a university. He recently learned about the power of compounding, and he opened a traditional IRA this year. If he earned $8,250 in wages this year, what is the most Jerrad could contribute to his traditional IRA? A : $6,500. B : $0. C : $5,500. D : $8,250.arrow_forwardJustin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, married filing jointly), social security taxes, and state income tax (1%). Enter deductions beginning with a minus sign (-). Round interim amounts to two decimal places. Use these values in subsequent computations then round final answer to two decimal places. As we go to press, the federal income tax rates for 2021 are being determined by budget talks in Washington and not available for publication. For this edition, the 2020 federal income tax tables for Manual Systems with Forms W-4 from 2020 or later with Standard Withholding and 2020 FICA rates have been used. Click here to access the…arrow_forward

- Deja owns a photo printing business and wants to purchase a new state-of-the-art photo printer that she found online for $9,275, plus sales tax of 5.5%. The supply company is offering cash terms of 2/15, n/30, with a 1.5% service charge on late payments, or 90 days same as cash financing if Deja is approved for a company line of credit. If she is unable to pay within 90 days under the second option, she would have to pay 22.9% annual simple interest for the first 90 days, plus 2% simple interest per month on the unpaid balance after 90 days. Deja has an excellent credit rating but is unsure of what to do. c) If Deja takes the 90 days same as cash and pays within 90 days, what is her payoff amount? If she can't pay until April 30, how much additional money would she owe? (Assume ordinary interest and exact time and a non-leap year)arrow_forwardSeiko's current salary is $87,500. Her marginal tax rate is 32 percent, and she fancies European sports cars. She purchases a new auto each year. Seiko is currently a manager for Idaho Office Supply. Her friend, knowing of her interest in sports cars, tells her about a manager position at the local BMW and Porsche dealer. The new position pays $73,900 per year, but it allows employees to purchase one new car per year at a discount of $23,400. This discount qualifies as a nontaxable fringe benefit. In an effort to keep Seiko as an employee, Idaho Office Supply offers her a $17,800 raise. Answer the following questions about this analysis. What is the annual after-tax cost to Idaho Office Supply if it provides Seiko with the $17,800 increase in salary? Note: Ignore payroll taxes. b-1. Financially, which offer is better for Seiko on an after-tax basis? b-2. By how much is the offer better for Seiko on an after tax basis? (Assume that Seiko is going to purchase the new car whether she…arrow_forwardSue is a college student. Look at the screenshot below to answer the question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education