FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

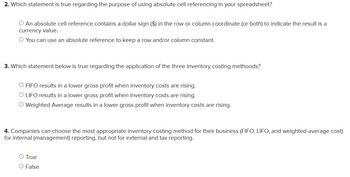

Transcribed Image Text:2. Which statement is true regarding the purpose of using absolute cell referencing in your spreadsheet?

○ An absolute cell reference contains a dollar sign ($) in the row or column coordinate (or both) to indicate the result is a

currency value.

O You can use an absolute reference to keep a row and/or column constant.

3. Which statement below is true regarding the application of the three inventory costing methoods?

O FIFO results in a lower gross profit when inventory costs are rising.

O LIFO results in a lower gross profit when inventory costs are rising.

○ Weighted Average results in a lower gross profit when inventory costs are rising.

4. Companies can choose the most appropriate inventory costing method for their business (FIFO, LIFO, and weighted-average cost)

for internal (management) reporting, but not for external and tax reporting.

○ True

O False

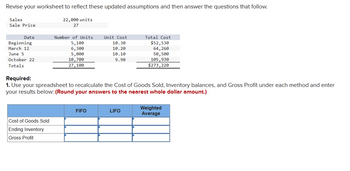

Transcribed Image Text:Revise your worksheet to reflect these updated assumptions and then answer the questions that follow.

Sales

Sale Price

22,000 units

27

Date

Number of Units

Unit Cost

Total Cost

Beginning

5,100

10.30

$52,530

March 12

6,300

10.20

64,260

June 5

5,000

10.10

50,500

October 22

Totals

10,700

9.90

105,930

27,100

$273,220

Required:

1. Use your spreadsheet to recalculate the Cost of Goods Sold, Inventory balances, and Gross Profit under each method and enter

your results below: (Round your answers to the nearest whole dollar amount.)

FIFO

LIFO

Weighted

Average

Cost of Goods Sold

Ending Inventory

Gross Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- The answer is d, ex In a period of rising prices, the inventory method which tends to report the lowest inventory is a. FIFO. b. LISH. c. Specific identification. d. Average - cost.arrow_forwardPlease do not give solution in image format ? And Fast Answering Please ? And please explain proper steps by Step.arrow_forwardWard Hardware does not expect costs to change dramatically and wants to use an inventory costing method that averages cost changes. Requirements 1. Which inventory costing method would best meet Ward's goal? 2. Assume Ward wanted to expense out the newer purchases of goods instead. Which inventory costing method would best meet that need? Requirement 1. The inventory costing method that averages cost changes is the: O A. Last-in, first-out (LIFO) cost method O B. Weighted-average method OC. First-in, first-out (FIFO) cost method O D. Specific identification method Requirement 2. The inventory costing method that expenses out the newer purchases of goods is the: O A. Last-in, first-out (LIFO) cost method B. Weighted-average method Oc. Specific identification method O D. First-in, first-out (FIFO) cost methodarrow_forward

- 3.What is the purpose of the current ratio? Assume that Island Solutions want to compute its current ratio, which inventory method (FIFO or Average Cost) would give a more meaningful current ratio. Explain. 4.Island Solutions has discovered that all of its competitors are using another inventory method and is worried. Can the company change its inventory accounting method, on what grounds? Discuss two (2) trade-offs for the company.arrow_forwardPlease do not give solution in image format thankuarrow_forwardDiscuss the two (2) components of every Sales dollar, and defend the choice of a business to utilize the LIFO inventory costing system, in a period of rising prices.arrow_forward

- Which method would produce the same unit cost for Inventory and Cost of Good Sold in periods of rising prices? Select one: a. Weighted Average b. FIFO c. LIFOarrow_forwardH7. For the same transactions, why does the weighted-average cost method provide different value for ending inventory and COGS depending on whether the periodic or perpetual inventory system is used? Select one: a. Perpetual inventory calculates and assigns costs as items are sold, while periodic inventory calculates and assigns costs at the end of the period. b. Perpetual inventory calculates and assigns costs at the end of the period, while periodic inventory calculates and assigns costs as items are sold. c. Perpetual inventory counts all the purchases for the month first before calculating the average cost, while periodic calculates the average cost after every transaction. d. Perpetual inventory and periodic inventory will not provide different values using Explain also wrong options and explain with detailsarrow_forwardUnder the weighted average cost, when a unit is sold, the average cost of each unit in inventory is assigned to cost of goods sold. True O Falsearrow_forward

- Solve both questions Do not give answer in imagearrow_forwardWhen inventory costs rise and inventory quantities are not decreasing, what does the LIFO produces?arrow_forwardWhich of the following statements Is/are true? Multiple Cholce In a period of rising costs and stable inventory levels, using the FIFO method leads to a higher taxable income and higher net income compared to the LIFO method. All of the other answer choices are true. In a period of falling costs and stable inventory levels, cost of goods sold is the same under LIFO and FIFO. In a period of rising costs and stable inventory levels, using the LIFO method leads to a lower taxable income and higher net income compared to the FIFO method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education