1. What is the total Conversion Cost per Equivalent Unit?

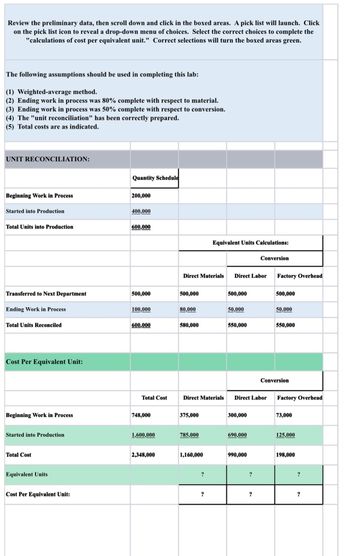

2. Equivalent Units or Material is calculated by 500,000 units Transferred Next Department plus......Units of Ending Work in Process times 80% complete with respect to the material.

3. Equivalent Units for Direct Labor is calculated by 500,000 units Transferred to Next Department plus ...... Units of Ending work in Process multiply by 50% complete with respect to the direct labor.

4.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Regarding your ansWhat would be the answers for:

2. Equivalent Units or Material is calculated by 500,000 units Transferred Next Department plus......Units of Ending Work in Process times 80% complete with respect to the material.

3. Equivalent Units for Direct Labor is calculated by 500,000 units Transferred to Next Department plus ...... Units of Ending work in Process multiply by 50% complete with respect to the direct labor.

Regarding your ansWhat would be the answers for:

2. Equivalent Units or Material is calculated by 500,000 units Transferred Next Department plus......Units of Ending Work in Process times 80% complete with respect to the material.

3. Equivalent Units for Direct Labor is calculated by 500,000 units Transferred to Next Department plus ...... Units of Ending work in Process multiply by 50% complete with respect to the direct labor.

- A company's prime costs total $3,100,000 and its conversion costs total $7,100,000. If direct materials are $1,050,000 and factory overhead is $5,050,000, then direct labor is: Multiple Choice • $4,000,000. . • $2,050,000. $14,200,000. • $1,000,000. $3,100,000. . .arrow_forwardam. 24.arrow_forwardLamont Company produced 80,000 machine parts for diesel engines. There were no beginning or ending work-in-process inventories in any department. Lamont incurred the following costs for May: Direct materials Direct labor Applied overhead Molding Department $12,000 10,000 17,000 Grinding Department $5,300 8,800 14,000 Finishing Department $8,000 12,000 12,000arrow_forward

- Elliott Company... (see pictures).arrow_forwardUnder absorption costing, a company had the following unit costs when 9,000 units were produced. Direct labor $7.25 per unit Direct material $8.00 per unit Variable overhead $5.50 per unit Fixed overhead ($67,500/9,000 units) $7.50 per unit Total production cost $28.25 per unit Compute the total production cost per unit under variable costing if 30,000 units had been produced. $31.75 $28.25 $23.45 $15.25 $20.75arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education