FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

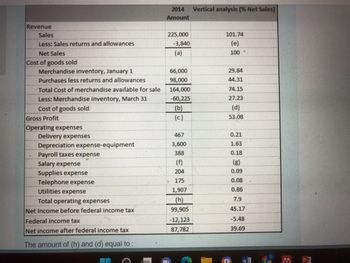

The amount of (h) and (D) equal to

H) =17,800

D) 4.06%

True or false?

Transcribed Image Text:Revenue

Sales

Less: Sales returns and allowances

Net Sales

Cost of goods sold

Merchandise inventory, January 1

Purchases less returns and allowances

Total Cost of merchandise available for sale

Less: Merchandise inventory, March 31

Cost of goods sold

Delivery expenses

Depreciation expense-equipment

Payroll taxes expense

Salary expense

Supplies expense

Telephone expense

Utilities expense

Total operating expenses

Net Income before federal income tax

Federal income tax

Net income after federal income tax

The amount of (h) and (d) equal to :

Gross Profit

Operating expenses

2014

Amount

225,000

-3,840

(a)

66,000

98,000

164,000

-60,225

(b)

(c)

467

3,600

388

204

175

1,907

(h)

99,905

-12,123

87,782

Vertical analysis (% Net Sales)

101.74

(e)

100

29.84

44.31

74.15

27.23

(d)

53.08

0.21

1.63

0.18

(g)

0.09

0.08

0.86

7.9

45.17

-5.48

39.69

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- pf = 200] . PA = [pf = 200 = 100 - = 100] - 20 & PB = Find the expected pay off assets A and B under probability measures P & P . Using Poi -Ē(P;) find the period 0, price of assets A and B rf Rf =1.05 and Beta=0.95238arrow_forwardModify the Box 10.2 example on page 291 as follows: • The payouts in the three states are (Y¹, Y², Y³) = (4,3,2) • All other assumptions remain the same. Hints: Solving the problem involves applying Eq. (10.4). To see how this applies I re-write Eq. (10.4) below. U'(Y₁)q₁ = ¿E₁[U' (Ÿ₁+1)(+1+Ỹ₁+1)] U' (Y₁)q₁ = 8E₁[U' (Ỹ₁+1)(Ÿ₁+1)] +8E₁[U' (Ỹ₁+1)(+1)] where Eq. (1) matches the system of equations shown in Box 10.2. (1) ⚫ You should be able to validate that for U(c) = ln(c) implies E₁[U'(Ỹ₁+1)(Ỹ₁+1)] = 8 ⚫ To understand the Transition Matrix, assume the current state 0₁ = 1.5. The LHS is 19(1.5)=9(1.5), which is the LHS of the first equation in the system. ⚫ Since we assume we are in ₁ the Transition matrix tells us there is .5 probability of state ₁ = 1.5 eventuating in the next period so that (.5)q(1.5) = 39(1.5), which is a RHS term in the system in Box 10.2 ⚫ Apply this set-up to all three states, which generates the system shown.arrow_forwardL(RS, YUS) = 10 YUS RS +1arrow_forward

- Solve for IRR 0 = -100000 + 10000/(1+IRR) + 40000/(1+IRR) ^2 + 40000/(1+IRR) ^3 + 40000/(1+IRR) ^4 + 10000/ ( 1+ IRR) ^5arrow_forward2) the math of interest. please indicate if you are unsure or totally sure about the answerarrow_forward(1 + rnominal) = (1 + rreal) (1 + inflation rate). true or falsearrow_forward

- Solve it using formulas, no tables correct answers: i) i^2 0.059126 > 0.0341 iii) P(wd) £73.34 per £100 nominal iv) using i* > 6% pa --> NPV(6%)= 2.78020 and NPV(6.5%) = 1.59578 therefore i= 6.32% pa and f=2.5% --> i'= 3.72% pa A fixed interest security pays coupons of 5% per annum convertible half-yearly in arrears. The security is redeemable at 110% at the option of the borrower on any anniversary date between 15 and 25 years after the date of issue. An investor, who is liable to tax on income at a rate of 25% and on capital gains at a rate of 30%, intends to buy the product exactly two months after issue for a price that gives a net effective yield of at least 6% per annum. (i) Determine whether the investor would make a capital gain if the bond is held until redemption. (ii) In what way does your answer to part (i) affect the assumptions made for calculating the issue price? Explain in general terms the reasoning behind your chosen pricing approach. (iii) Calculate the maximum…arrow_forwardSuppose A=D+E, E=$350,000 and E/A=0.7. Solve for D.arrow_forwardIts npv vs discount rate graph please help with conceptarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education