Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

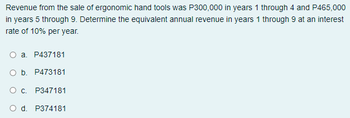

Transcribed Image Text:Revenue from the sale of ergonomic hand tools was P300,000 in years 1 through 4 and P465,000

in years 5 through 9. Determine the equivalent annual revenue in years 1 through 9 at an interest

rate of 10% per year.

a. P437181

O b. P473181

Oc. P347181

O d. P374181

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Far East Imports Inc. owes $64 000.00 to be repaid by monthly payments of $2475.00. Interest is 6.12% compounded monthly. What is the outstanding principal amount at the end of year 2? Group of answer choices 50300.5449080.1059691.8455312.87arrow_forwardWhat is the FV of $1,000 in 15 years if it earns an annual rate of 9.5% monthly compounded? O $4,375.19 O $4.177.17 $4,134.59 O $4,089.17arrow_forwardWhat amount will be received after 18 months if P15 000 is invested at 4% compounded semi annually? (А) Р30598.31 в) Р30742.95 (c) P15924.38 P15918.12arrow_forward

- Given Principal $21, 000, Interest Rate 11%, Time 240 days (use ordinary interest) On 100th day, $8,000 On 180th day, $4,500 Partial payments: a. Use the U.S. Rule to solve for total interest cost. (Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Total interest cost %24 b. Use the U.S. Rule to solve for balances. (Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) On 100th day On 180th day Balance after the payment 2$ 24 c. Use the U.S. Rule to solve for final payment. (Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Final payment %24 5 of 14 Next > < Prevarrow_forwardMaintenance costs on a piece of equipment begin at $1000 in period 1 and increase by $250 each year over its 5-year life. If the interest rate is 8%, how much money should be put aside now to pay these maintenance costs?arrow_forwardFor equipment upgrades, a business borrowed $500,000 at 8% compounded semiannually for 6 years. What are the semiannual payments (in dollars)?arrow_forward

- Givens, Hong, and Partners obtained a $8,100 term loan at 9.6% compounded annually for new boardroom furniture. Prepare a complete amortization schedule in which the loan is repaid by equal semiannual payments over three years. (Round your answers to the nearest cent. Do not round the intermediate calculations.) Payment Interest number Payment $ portion $ 0 DLN3 456 1 2 1624.80 1624.80 1624.80 1624.80 1624.80 1624.80 Principal portion $ Principal balance $ 8,100.00arrow_forward5- An equipment requires maintenance every year, at the end of each year, for 8 years. The 1st year maintenance cost is $1000.00, and every year it increases by $100.00. If the interest rate is 8%, what is the present worth of all the maintenance costs? a) $5747.00 b) $7527.60 c) $1780.60 d) $9600.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education