Personal Finance

13th Edition

ISBN: 9781337669214

Author: GARMAN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

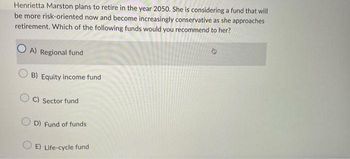

Transcribed Image Text:Henrietta Marston plans to retire in the year 2050. She is considering a fund that will

be more risk-oriented now and become increasingly conservative as she approaches

retirement. Which of the following funds would you recommend to her?

A) Regional fund

B) Equity income fund

OC) Sector fund

OD) Fund of funds

E) Life-cycle fund

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pls help ASAParrow_forwardFor investment advisors, a major consideration in planning for a client in retirement is the determination of a withdrawal amount that will provide the client with the funds necessary to maintain his or her desired standard of living throughout the client's remaining lifetime. If a client withdraws too much or if investment returns fall below expectations, there is a danger of either running out of funds or reducing the desired standard of living. A sustainable retirement withdrawal is the inflation-adjusted monetary amount a client can withdraw periodically from his or her retirement funds for an assumed planning horizon. This amount cannot be determined with complete certainty because of the random nature of investment returns. Usually, the sustainable retirement withdrawal is determined by limiting the probability of running out of funds to 2 some specified level, such as 5%. The sustainable retirement withdrawal amount is typically expressed as a percentage of the initial value of…arrow_forwardA pensioner is expecting a lump sum of GHC 200,000 when she goes on pension next year and is thinking of the best way to allocate the funds to be received. An investment analyst has introduced her to a four funds as follows: Gamma Fund: This specializes in money market instruments and bonds of large corporations Delta Fund: This specializes in equities of exchange listed financial institutions Beta Fund: This specializes in bonds and equities of all good performing companies Index Fund: This is a portfolio that mimics the Ghana Stock Exchange All Share Index The investment analyst gathered information about the performance of the four funds and this is presented below: Funds Mean Return Standard Deviation Beta Co-efficient Gamma 15% 8% 0.25 Delta 20% 14% 1.20 Beta 18% 14% 0.85 Index 17% 12% 1.00 The rate on Government of Ghana five-year bond which is used as the standard risk-free rate is 8% per annum. The…arrow_forward

- Bhavika Investments, a group of financial advi-sors and retirement planners, has been requested to provide advice on how to invest $200,000 forone of its clients. The client has stipulated thatthe money must be put into either a stock fund ora money market fund and the annual return shouldbe at least $14,000. Other conditions related to riskhave also been specified, and the following linear program was developed to help with this invest-ment decision: Minimize risk = 12S + 5Msubject toS + M = 200,000 total investment is$200,000 0.10S + 0.05M Ú 14,000 return must be at least $14,000 M Ú 40,000 at least 40,000 must bein money market fund S, M Ú 0whereS = dollars invested in stock fundM = dollars invested in money market fundThe QM for Windows output is shown below.(a) How much money should be invested in themoney market fund and the stock fund? What isthe total risk?(b) What is the total return? What rate of return isthis?(c) Would the solution change if the risk measurefor each dollar…arrow_forwardAnita is looking forward to her retirement which is only five years away. Her retirement account did not accumulate as much as she had hoped. She decided to make some changes in her financial planning. Based on this information, which of the following statements is correct? a. At this stage, Anita should rebalance her funds in a way that maximizes her investment in growth stocks to accelerate her fund balance. b. At this stage, Anita should focus on preserving what she has accumulated and minimize all debt obligations. c. At this stage, Anita should plan on extending her career, going on a diet, moving in with her children, and eliminating all recreational activities. d. At this stage, Anita should borrow as much as possible and plan on making the payments with her social security earnings.arrow_forwardAs chief investment officer of a small endowment fund, you are considering expanding the fund's strategic asset allocation from just common stock (CS) and fixed-income (FI) to include private real estate partnerships (PR) as well: Current Allocation: 60 percent of Asset CS, 40 percent of Asset FI Proposed Allocation: 50 percent of Asset CS, 30 percent of Asset FI, 20 percent of Asset PR You also consider the following historical data for the three risky asset classes (CS, FI, and PR) and the risk-free rate (RFR) over a recent investment period: rij: Asset Class E(R) CS σ CS FI PR 8.2% 17.0% 1.0 FI 5.6 7.6 0.3 1.0 PR RFR 6.9 3.5 12.5 0.6 0.2 1.0 - You have already determined that the expected return and standard deviation for the Current Allocation are: E(Rcurrent) = 7.16 percent and current = 11.484 percent. a. Calculate the expected return for the Proposed Allocation. Round your answer to two decimal places. % b. Calculate the standard deviation for the Proposed Allocation. Do not…arrow_forward

- You are considering investing in one of several mutual funds. All the funds under consideration have various combinations of front-end and back-end loads and/or 12b-1 fees. The longer you plan on remaining in the fund you choose, the more likely you will prefer a fund with a rather than (a)__ everything else equal. a) 12b-1 fee; back-end load b) front-end load; 12b-1 fee c) 12b-1 fee; front-end load d) front-end load; back-end load e) 12b-1 fee; no load chargearrow_forward(Computing the standard deviation for an individual investment) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: LOADING... . a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Calculate the standard deviation in the anticipated returns found in part a. c. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. State of Economy Probability Fund Returns Rapid expansion and recovery…arrow_forwardNick is nearing retirement and is looking to purchase a mutual fund that will provide a relatively safe investment as well as regular income payments. Among mutual funds with an income objective, Nick can either buy shares in which invest in CDs, government securities, and short-term obligations issued by corporations, or he can invest in for a slightly higher current income return and the potential for capital appreciation as well. Within the category of bond funds are even more specific options. Nick decides to buy shares in a fund that invests in Treasury issues maturing in more than ten years, known as bonds. He is also collecting income from shares he already owns in a fund, a type of fund that invests in securities issued by agencies such as Fannie Mae and Freddie Mac Growth Objective Karen is a 32-year-old woman with two children who owns her own home and has a substantial retirement account. She recently received an inheritance from her uncle and is looking to invest in a…arrow_forward

- Assume that your uncle gave you $50,000 to invest solely in mutual funds. Based on your point in the life cycle and your investment philosophy, identify your investment goals and explain how you would spread your money among different funds. Include the funds you would invest in, the amounts you would invest and explain why you selected these funds.arrow_forward(Related to Checkpoint 8.1) (Expected rate of return) James Fromholtz is considering whether to invest in a newly formed investment fund. The fund's investment objective is to acquire home mortgage securities at what it hopes will be bargain prices. The fund sponsor has suggested to James that the fund's performance will hinge on how the national economy performs in the coming year. Specifically, he suggested the following possible outcomes: a. Based on these potential outcomes, what is your estimate of the expected rate of return from this investment opportunity? b. Would you be interested in making such an investment? Note that you lose all your money in one year if the economy collapses into the worst state or you double your money if the economy enters into a rapid expansion. a. The expected rate of return from this investment opportunity is %. (Round to two decimal places) Data Table State of Economy Rapid expansion and recovery Modest growth Continued recession Falls into…arrow_forwardAnita is looking forward to her retirement which is only five years away. Her retirement account did not accumulate as much as she had hoped. She decided to make some changes in her financial planning. Based on this information, which of the following statements is correct? At this stage, Anita should rebalance her funds in a way that maximizes her investment in growth stocks to accelerate her fund balance. At this stage, Anita should focus on preserving what she has accumulated and minimize all debt obligations. At this stage, Anita should borrow as much as possible and plan on making the payments with her social security earnings. At this stage, Anita should plan on extending her career, going on a diet, moving in with her children, and eliminating all recreational activities.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...

Finance

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning