Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

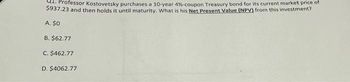

Transcribed Image Text:Professor Kostovetsky purchases a 10-year 4%-coupon Treasury bond for its current market price of

$937.23 and then holds it until maturity. What is his Net Present Value (NPV) from this investment?

A. $0

B. $62.77

C. $462.77

D. $4062.77

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Detailed steps please conceptarrow_forward1.Piotr buys a 10 year, $50,000.00 face value, r(2) = 1.500% coupon bond. The bond yield is j(365) = 7.750%. What is the price of the bond? a. $29,563.60. b. $28,155.81. c. $30,126.72. d. $29,282.04. e. $28,437.37.arrow_forwardD $1,000 Last year Janet purchased a face value corporate bond with a 10%. annual coupon rate and a 10-year maturity. At the time of the purchase, it had an expected yield to maturity of 9,33%. If Janet sold the band fuday for $1,067.87, what rate of return would She have earned for the past year?arrow_forward

- An investor with a bond of par value $1,000 paying 5% coupon semi-annually will receive ________. a. $100 annually b. $25 semi-annually c. $25 annually d. None of the above.arrow_forwardSally purchased a 5.73 percent coupon bond with a clean price of $1,031.83. What is the invoice price of the bond if there is four months to the next semiannual coupon date? A $1,012.73 B $1,022.28 C$1,041.38 D) $1,050.93 (E $1,089.13arrow_forwardvv.3arrow_forward

- Alex purchased a 10-year, zero-coupon bond today with a yield to maturity of 7.5% and face value of $1,000. One year later, if the yield to maturity decreases to 6%, what will the price of the bond be 1 year later? Group of answer choices A. $591.90 D. $1,060.00 E. $943.40 C. $485.19 B. $558.39arrow_forwardVic Zaloom bought a corporate bond from IBEM Corporation for $100,000. The face value of the bond is $100,000 and will mature in twenty years. A $2,500 dividend is expected to be paid every quarter. If Vic plans to keep the bond until maturity, determine the effective rate of return he is getting on this investment. A. 10.38% B. 10.00% C. 12% D. 9.15%arrow_forwardAssume an investor buys a newly issued 8 percent, semiannual 10 year bond at par. He sells it two years later when market interest rates have decreased to 6 percent. How much is the investor’s capital gain or loss? $147.20 gain $70.20 gain $125.61 gain $124.20 lossarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education