FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

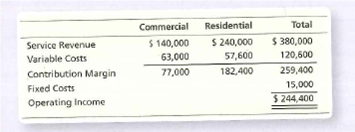

Using variable costing, service company

Sherman Company provides carpet cleaning services to commercial and residential customers. Using the data below, determine the contribution margin ratio for each business segment, rounded to two decimal places:

Transcribed Image Text:Residential

Total

Service Revenue

Variable Costs

Contribution Margin

Commercial

$ 140,000

63,000

77,000

$ 380,000

120,600

259,400

15,000

$ 244,400

S 240,000

57,600

182,400

Fixed Costs

Operating Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: i) Calculate the unit cost for the chocolate cake and butter cake using the variable costing method and absorption costing method. ii) Solve operating income using variable costing. ii) Solve operating income using absorption costing.arrow_forward25: Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and activity bases are as follows: Activity Budgeted Activity Cost Activity Base Casting $570,000 Machine hours Assembly 80,000 Direct labor hours Inspecting Setup Materials handling 42,000 Number of inspections Number of setups 38,000 23,750 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity Base Entry Dining Total Machine hours 6,000 13,000 19,000 Direct labor hours 3,000 2,000 5,000 Number of inspections 600 400 1,000 Number of setups 300 200 500 Number of loads 450 500 950 Units produced 6,000 3,000 9,000arrow_forwardPlease provide answer in text (Without image)arrow_forward

- Classify each cost as being either variable or fixed with respect to the number of units produced and sold. Also classify each cost as either a period or a product cost. Predicting Cost Preparing Behavior Statements Cost Item 1. Hamburger buns in a Wendy's restaurant. 2. Advertising by a dental office. 3. Apples processed and canned by 4. Shipping canned apples from a Del Monte plant to customers. 5. Insurance on a Bausch & Lomb factory producing contact lensesarrow_forwardThe following data are for Elm Leaf Apparel: East Sales volume (units): Product XX Product YY Sales price: Product XX Product YY Variable cost per unit: Product XX Product YY 6,300 3,300 $12 $15 $7 $9 West 5,300 7,100 $13 $14 $7 $9 a. Determine the contribution margin for Product YY. $fill in the blank 1 b. Determine the contribution margin for the West Region. $fill in the blank 2arrow_forwardHelpful Division of X Company makes two products, Small and Large. The company has always used Conventional Costing (for financial reporting purposes), but this period wants to try using Activity-Based Costing to make better decisions. Information related to the current period is as follows: REQUIRED: (#1) Since the company has three activities, what are the three overhead application rates the company would use for activity-based costing? (ROUND EACH RATE TO THE NEAREST CENT and be sure to label the rates appropriately.) (#2) Using activity-based costing, what was the cost to manufacture one Small unit? (#3) Using activity-based costing, what was the cost to manufacture one Large unit? (#4) Based on what you learned about activity-based costing this week, how might Helpful Division managers use the new cost information from its activity-based costing system to better manage its operations? Helpful Resource: https://www.youtube.com/watch?v=PU3U_aMbKwsarrow_forward

- Scoring: Your score will be based on the number of correct matches. There is no penalty for incorrect or missing matches. Match each of the following descriptions with the appropriate costing concept. Clear All Generally provides the most useful report for controlling costs Absorption costing only Generally provides the most useful report for setting long-term prices Both absorption and variable costing May be used in a manufacturing company Variable costing only Includes gross profit on the income statementarrow_forwardneed help please. also, please Calculate the total cost of the1,600 units in ending inventory using absorption costing and variable costingarrow_forwardRequired: Rank the support departments based on the percentage of their services provided to other support departments. Use this ranking to allocate the support departments’ costs to the operating departments based on the step-down method.arrow_forward

- Required: 1) Develop a segmented income statement for Rayya Sdn. Bhd. for the coming year using variable costing.arrow_forwardSuppose the smartphone manufacturer Peony Electronics provides the following information for its costs last month (in millions): (Click the icon to view the costs.) Read the requirements. Requirements 1, 2 and 3. Classify each of these costs according to its place in the value chain. Within the production category, break the costs down further into three subcategories: Direct Materials, Direct Labor, and Manufacturing Overhead. Then calculate the total cost for each value chain category. (Enter amounts in millions. If an input field is not used in the table, leave the input field empty; do not enter a zero.) Cost Delivery expense Salaries of salespeople Chipset Exterior case for phone Assembly-line workers' wages Technical support hotline Depreciation on plant and equipment Rearrange production process 1-800 (toll-free) line for customer orders Scientists' salaries Total costs Cost R and D $ 14 Peony Electronics Value Chain Cost Classification Direct Design Materials LA 60 5 $…arrow_forwardGreat Outdoze Company manufactures sleeping bags, which sell for $66.10 each. The variable costs of production are as follows: Direct material Direct labor Variable manufacturing overhead $19.10 10.30 7.40 k Budgeted fixed overhead in 20x1 was $157,500 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 21,300 were sold. Variable selling and administrative costs were $1.30 per unit sold; fixed selling and administrative costs were $22,000. atarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education