FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

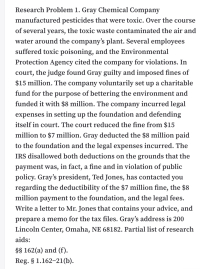

Transcribed Image Text:Research Problem 1. Gray Chemical Company

manufactured pesticides that were toxic. Over the course

of several years, the toxic waste contaminated the air and

water around the company's plant. Several employees

suffered toxic poisoning, and the Environmental

Protection Agency cited the company for violations. In

court, the judge found Gray guilty and imposed fines of

$15 million. The company voluntarily set up a charitable

fund for the purpose of bettering the environment and

funded it with $8 million. The company incurred legal

expenses in setting up the foundation and defending

itself in court. The court reduced the fine from $15

million to $7 million. Gray deducted the $8 million paid

to the foundation and the legal expenses incurred. The

IRS disallowed both deductions on the grounds that the

payment was, in fact, a fine and in violation of public

policy. Gray's president, Ted Jones, has contacted you

regarding the deductibility of the $7 million fine, the $8

million payment to the foundation, and the legal fees.

Write a letter to Mr. Jones that contains your advice, and

prepare a memo for the tax files. Gray's address is 200

Lincoln Center, Omaha, NE 68182. Partial list of research

aids:

§$ 162(a) and (f).

Reg. § 1.162-21(b).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Two firms, A and B, each currently dump 50 tonnes of chemicals into the local river. The government has decided to reduce the pollution and from now on will require a pollution permit for each tonne of pollution dumped into the river. The government will sell 40 pollution permits for $75 each. It costs Firm A $100 for each tonne of pollution that it eliminates before it reaches the river, and it costs Firm B $50 for each tonne of pollution that it eliminates before it reaches the river. Between the cost of permits and the cost of eliminating pollution, the likely outcome is Firm A spends and Firm B spends cross out $4000; $3500 cross out O b. $3000; $2500 cross out O c. $3000; $3500 cross out O d. $4000; $2500 cross out O e. $5000; $2500 cross out O f. $5000; $3500arrow_forwardCandalibra Company incurred the following costs during the year ended December 31, 2018: Laboratory research aimed at discovery of new knowledge $300,000 Costs of testing prototype and design modifications (economic viability not achieved) 55,000 Quality control during commercial production, including routine testing of products 210,000 Construction of research facilities having an estimated useful life of 12 years but no alternative future use 440,000 What is the total amount to be classified and expensed as research and development in 2018 under U.S. GAAP? 79arrow_forwardWhich one of the following costs is most likely to be deductible? Group of answer choices Fines paid for dumping toxic waste into a City of Denver park. Bribes to a city health inspector to ensure an “A” rating to a restaurant. The telephone bill for the headquarters of an illegal stolen car parts organization. Advertising costs for a Colorado marijuana dispensary.arrow_forward

- Chip and Dale run separate logging companies in the same forest. Both pollute the river flowing through the forest with debris from their work. In the table below, the first row shows the current level of debris that makes its way into the river from their work. The following rows show how much it would cost each logger to reduce its pollution by additional increments of 10 pounds. If the government imposes a pollution tax of $7 for each 10 pounds of debris, total pollution will fall by. pounds, at a total cost of Chip Dale Current debris in pounds 60 80 Cost of reducing debris by 10 pounds $5 $2 Cost of reducing debris by a second 10 pounds $10 $4 Cost of reducing debris by a third $15 $6 10 pounds Cost of reducing debris by a fourth 10 pounds $20 $8 Cost of reducing debris by a fifth $25 $10 10 pounds a) 40, $28arrow_forwardAllocated on the basis of program revenues. The head administrator of Jackson County Senior Services, Judith Miyama, considers last year's net operating income of $33,800 to be unsatisfactory; therefore, she is considering the possibility of discontinuing the housekeeping program. The depreciation in housekeeping is for a small van that is used to carry the housekeepers and their equipment from job to job. If the program were discontinued, the van would be donated to a charitable organization. None of the general administrative overhead would be avoided if the housekeeping program were dropped, but the liability insurance and the salary of the program administrator would be avoided. Required: 1-a. What is the financial advantage (disadvantage) of discontinuing the Housekeeping program? 1-b. Based on the financial advantage (disadvantage) of discontinuing the Housekeeping program calculated in requirement Req 1A, should the Housekeeping program be discontinued? 2-a. Prepare a properly…arrow_forwardSwifty Corporation is being sued for illness caused to local residents as a result of negligence on the company's part in permitting the local residents to be exposed to highly toxic chemicals from its plant. Swifty's lawyer states that it is probable that Swifty will lose the suit and be found liable for a judgment costing Swifty anywhere from $ 1830000 to $ 8960000. However, the lawyer states that the most probable cost is $ 5410000. As a result of the above facts, Swifty should accrue a loss contingency of $ 1830000 and disclose an additional contingency of up to $ 7130000. a loss contingency of $ 5410000 and disclose an additional contingency of up to $ 3550000. no loss contingency but disclose a contingency of $ 1830000 to $ 8960000. a loss contingency of $ 5410000 but not disclose any additional contingency.arrow_forward

- Dakota Corporation is an owner/operator of 15 water filtration systems in the Northwestern region of the United States. During February 2022, 4 of the tanks had leaks which contaminated the water and surrounding environment. Dakota is very concerned about their obligation to the community to maintain the environment. Dakota corrected the leaks by installing new water filters and liners which cost $500,000. These corrections will extend the life of the tanks and improve future production. These improvements will also prevent any future environmental contamination. Overall, the $500,000 spent on the new water filters and liners have improved the facility. Dakota is unsure whether the $500,000 spent for this environmental issue should be capitalized or expensed. Accounting Issue: Should Dakota capitalize or expense the $500,000 spent on the new water filters and liners?arrow_forwardCheck In the current year, the building occupied by Sunshine City's Culture and Recreation Department suffered severe structural damage as a result of a hurricane. It had been 48 years since a hurricane had hit the Sunshine City area, although hurricanes in Sunshine City's geographic area are not uncommon. The building had been purchased 10 years earlier at a cost of $3,800,000 and had accumulated depreciation of $950,000 as of the date of the hurricane. Based on a restoration cost analysis, city engineers estimate the impairment loss at $410,000; however, the city expects during the next fiscal year to receive insurance recoveries of $210,000 for the damage. Required a. Should the estimated impairment loss be reported as an extraordinary item? As a special item? A special item An extraordinary item Ordinary expense, disclosed in the notes to the financial statements b. Record the estimated impairment loss in the journal for governmental activities at the government-wide level. (If no…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education