FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

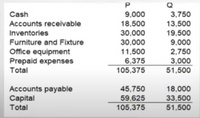

On March 1, 2020, P and Q decided to combine their business and form a

They agreed to have the following items recorded in their books:

1. Provide 2% allowance for doubtful accounts.

2. P’s furniture and fixtures should be P31,000, while Q’s office equipment is underdepreciated by P250.

3. Rent expense incurred previously by P was not yet recorded amounting to P1000, while

salary expenses incurred by Q amounting to P800 was also not recorded.

4. The fair value of P’s anf Q’s inventory amounted to P29,500 and P21,000 each

respectively

Requirements:

Compute the total liabilities after formation

Transcribed Image Text:P

Cash

9,000

18,500

30,000

30.000

11,500

3,750

13,500

19,500

9,000

2,750

Accounts receivable

Inventories

Furniture and Fixture

Office equipment

Prepaid expenses

Total

6,375

105,375

3,000

51,500

Accounts payable

Capital

Total

45,750

18,000

59,625

105,375

33,500

51,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mrs. Shine was registered in Jamaica as a sole trader in 2015. To grow her practice Mrs. Shine decided to enter into a partnership agreement with Mr. Rain, thus the status of the business was changed in 2021. In 2022, the partnership income statement for Shine & Rain was as follows: Income Statement for the year ended 31 December 2022 $ $ Revenue 11,600,000 Expenses Salaries & Wages 7,600,000 Employer NIS Contribution 1,400,000 Rent and Rates 2.400,000 Interest 500,000 Maintenance 120,000 Depreciation 550,000 Loss on Disposal of Vehicle 80,000 Telephone 235,000 Electricity 255,000 General Expenses 700,000 Donations 85,000 Provision for Bad Debts 80,000 Fines and Penalties 115,000 Drawings Net Loss 2,625,000 105,000 14,225,000 Notes to the Income Statement $55,000 of the drawings…arrow_forwardRoberto and Sangeeta have been in partnership for many years sharing profits and losses in the ratio 3:2. They decide to dissolve the partnership on 31 August 2021. Their summarized statement of financial position at that date was as follows: The following information is also available: Furniture and equipment were sold for $690,000. Roberto took over one of the vehicles at an agreed value of $90,000; the other was sold for $120,000. The firm paid $148,000 in full settlement of accounts payable Inventory realized $210,000. Accounts receivable were settled after allowing a 10% discount Dissolution expenses amounted to $4,000 Required: Prepare the following accounts: a. Realization b. Bank c. Capital accounts d. State two reasons why a partnership might be disolvedarrow_forwardthe early part of 2021, the partners of HughJacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2020 but had never used an accountant's services Hugh and Jacobs began the partnership by contributing $150,000 and $100,000 in cash, respectivelyHugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period A compensation allowance of $5,000 was to go to Hugh with a $25,000 amount assigned to Jacobs Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively 2020, revenues totaled $175,000, and expenses were $146,000 (not including the partnerscompensation allowance)Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $7,500 for repairs made to Hugh's home and…arrow_forward

- I can’t seem to arrive to the correct answer can you help me make a solution to this? Thanks!arrow_forwardOn March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $20,960 in cash and merchandise inventory valued at $56,060. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $59,510. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow: Wallace’s Ledger Agreed-Upon Balance Valuation Accounts Receivable $18,460 $17,560 Allowance for Doubtful Accounts 1,570 1,810 Equipment 83,160 54,420 Accumulated Depreciation 29,820 – Accounts Payable 15,330 15,330 Notes Payable (current) 36,100 36,100 1. Journalize the entries on March 1 to record the investments of Keene and Wallacein the partnership accounts. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education