FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Do requirement no. 3 only.

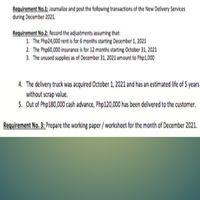

Transcribed Image Text:Requirement No.1; Journalize and post the following transactions of the New Delivery Services

during December 2021.

Requirement No.2: Record the adjustments assuming that:

1. The Php24,000 rent is for 6 months starting December 1, 2021

2. The Php60,000 insurance is for 12 months starting October 31, 2021

3. The unused supplies as of December 31, 2021 amount to Php1,000

4. The delivery truck was acquired October 1, 2021 and has an estimated life of 5 years

without scrap value.

5. Out of Php180,000 cash advance, Php120,00 has been delivered to the customer.

Requirement No. 3: Prepare the working paper/worksheet for the month of December 2021.

Transcribed Image Text:Financial Accounting Project:

1. The owner, Josef Miguel, invested Php250,000 cash in the business. He registered the

business with the following expenditures:

a. Mayor's permit, Php5,000

b. DTI registration, Php600

c. BIR/TIN Registration, Php500

d. Transportation during the processing of registration, Php300

2. After the business permit was taken, he started the business with the following cash

expenditures:

a. Paid in cash rent of office space, Php24,000

b. Paid insurance, Php60,000

c. Purchased supplies, Php3,000

d. Purchased of second-hand delivery truck, Php150,000

3. Total delivery income for the month, Php300,000 of which 40% are on account.

4. Received cash advance amounting to Php180,000 for delivery services to be rendered in

18 months.

5. Billed customers for services rendered, Php45,000.

6. Expenses paid / incurred during the month were as follows:

a. Salaries, Php40,000

b. Utilities, Php2,000

c. Transportation, Php3,000

d. Telephone, Php6,000

7. Collected 50% of transaction no. 3

8. Withdrew cash Php20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sky-blue Pty Ltd is a large private company that manufactures special reinforced concrete and other products used in the construction of airport runways and heavy use motor vehicle freeways. During the course of the audit for the year ended 30 June 20X7, the government announced that it intends to scrap its proposed third runway project. You know that Skyblue Pty Ltd’s projections include a major share of the work expected to flow from this project. The company has been experiencing some cash flow difficulties, although this is not unusual in the industry. Management has recently fully extended their overdraft facility in order to pay day-to-day expenses such as wages and salaries. The audit partner is concerned that the company may be facing going concern problems, but the managing director maintains that future capital expenditure can be cut back to alleviate the going concern issue. In addition, surplus assets can be sold to the growing Asian market and long-term debt can be…arrow_forwardIdentify special issues related to LIFO.arrow_forwardDefine license.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education