FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Question 6

Requirement 3. Prepare

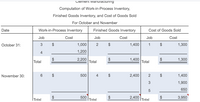

Transcribed Image Text:Ciement Manuiaciuring

Computation of Work-in-Process Inventory,

Finished Goods Inventory, and Cost of Goods Sold

For October and November

Date

Work-in-Process Inventory

Finished Goods Inventory

Cost of Goods Sold

Job

Cost

Job

Cost

Job

Cost

October 31:

3

$

1,000

2$

1,400

1

1,300

4

1,200

2,200

1,400

1,300

Total

Total

Total

November 30:

6

500

2,400

1,400

1,900

650

500

2,400

3,950

Total

Total

Total

%24

LO

%24

Transcribed Image Text:ns costin ng reco

yield the lollowiny inioma uon.

E (Click the icon to view the costing records.)

Read the reguirements.

Data Table

November 30:

$

500

4

$

2,400

2

$

1,400

1,900

5

650

Date

Total

Total

500

Total

2,400

Total

3,950

Manufacturing

Total Cost of Job Costs Added in

Requirement 3. Prepare journal entries to record the transfer of completed jobs from Work-in-Process Inventory to Finishe

entries.)

Job No. Started Finished

Sold

at October 31

November

ions fr

Job No. 1

10/03

10/12

10/13 $

1,300

Record October's entry first.

Job No. 2

10/03

10/30

11/01

1,400

Date

Accounts

Debit

Credit

Job No. 3

10/17

11/24

11/27

1,000 $

900

Oct. 31

Job No. 4

10/29

11/29

12/03

1,200

1,200

Job No. 5

11/08

11/12

11/14

650

Job No. 6

11/23

12/06

12/09

500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Layout Formulas Data Review View Calibri 11 2Wrap Text Paste BIU EEBE E Merge & C Clipboard Font Alignment A54 F. H. 1. Practice Quiz Job Order Costing The information below is for ABC Co.'s first month of operations. The following jobs were begun during the month 9. Number of Direct Job & Products Materials Labor Labor Hours 8. 100 140 $ 1,200 $ 1,100 100 10 11. 101 144 $1,500 $1,500 120 12 13 102 80 $ 1,100 900 80 14 15 103 150 800 $ 1,000 100 16 Indirect 500 700 18 Additional Information: 20 1. Jobs #100, #101 and #102 were completed during the month; Job #103 remained unfinished at the EOM. 2. Other factory overhead incurred during the month amounted to $60, 3. Factory overhead is applied to jobs on the basis of a predetermined rate of $5 per direct labor hour. 24 Required. 1 Prepare the journal entries to record: a. the requisition of materials during the month b. labor incurred during the month c application of factory overhead to jobs d. cost transferred to finished goods…arrow_forwardHow do i compute for the work in process ending inventory of the job 203 and job 206? like what amounts and accounts do i need to include for the computation of wip ending inventory of job 203 and job 206?arrow_forwardaccarrow_forward

- ACCT 102 - Please Do Both Partsarrow_forwardData for the two departments of Kimble & Pierce Company for June of the current fiscal year are as follows: Winding Department Drawing Department 5,900 units, 20% completed 1,600 units, 70% completed Work in process, June 1 Completed and transferred to next processing department during June Work in process, June 30 4,500 units, 85% completed Production begins in the Drawing Department and finishes in the Winding Department. 80,800 units Inventory in process, June 1 Started and completed in June Transferred to Winding Department in June Inventory in process, June 30 Total a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for June for the Drawing Department. If an amount is zero, enter in "0". 80,200 units 2,200 units, 25% completed Drawing Department Direct Materials and Conversion Equivalent Units of Production For June Whole Units Direct Materials Conversion Equivalent Units…arrow_forwardMultiple choicearrow_forward

- need work in process inventory tooarrow_forwardJournal Entries 1a 1b 1c 1d 1e 1f 1g Computation of the cost of jobs finished: Customers were billed: Cost of Jobs Sold: 2. Work in Progress Inventory Finished Goods Inventory 3. Schedule of Unfinished Jobs 4. Schedule of Completed Jobsarrow_forwardS Raw materials Work in process Finished goods Beginning Inventory $ 28,100 22,200 79,400 Raw materials purchases Indirect materials used Direct labor Additional information for the month of March follows: Manufacturing overhead applied Selling, general, and administrative expenses Sales revenue Required 1 Required 2 Inventory Required: 1. Based on the above information, prepare a cost of goods manufactured report. 2. Based on the above information, prepare an income statement for the month of March. Complete this question by entering your answers in the tabs below. $ 25,300 45,600 68,900 Sales Revenue Less: Cost of Goods Sold Beginning Finished Goods Inventory Less: Ending Finished Goods Inventory Cost of Goods Sold Gross Profit Based on the above information, prepare an income statement for the month of March. Stor Smart Company Income Statement For the Month of March Net Income (Loss) from Operations $ 41,300 1,800 63,900 36,000 24,900 237,600arrow_forward

- Multiple choicearrow_forwardFactory Overhead Rates, Entries, and Account Balance Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 Factory 2 Estimated factory overhead cost for fiscal year beginning August 1 $717,960 $1,050,800 Estimated direct labor hours for year 14,200 Estimated machine hours for year 23,160 Actual factory overhead costs for August $57,510 $90,930 Actual direct labor hours for August 1,280 Actual machine hours for August 1,810 a. Determine the factory overhead rate for Factory 1. per machine hour b. Determine the factory overhead rate for Factory 2. per direct labor hour c. Journalize the entries to apply factory overhead to production in each factory for August. If an amount box does not require an entry, leave it blank. Factory 1 Factory 2arrow_forward[The following information applies to the questions displayed below.] The following information pertains to Trenton Glass Works for the year just ended. Budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour Actual direct-labor cost: 80,000 hours at $17.50 per hour Budgeted manufacturing overhead: $997,500 Actual selling and administrative expenses: 435,000 Actual manufacturing overhead: Depreciation Property taxes Indirect labor $234,000 21,000 82,000 201,000 58, 000 33,000 301,000 78,000 Supervisory salaries Utilities Insurance Rental of space Indirect material (see data below) Indirect material: Beginning inventory, January 1 Purchases during the year Ending inventory, December 31 47,000 94,000 63,000 3. Prepare a journal entry to close out the Manufacturing Overhead account into Cost of Goods Sold. (Round intermediate calculations to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education