FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

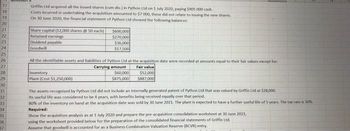

Griffin Ltd acquired all the issued shares (cum div.) in Python Ltd on 1 July 2020, paying 5905 000 cash.

Costs incurred in undertaking the acquisition amounted to $7 000, these did not relate to issuing the new shares.

On 30 June 2020, the financial statement of Python Ltd showed the following balances:

Share capital (12,000 shares @50 each)

Retained earnings

Dividend payable

Goodwill

$600,000

$270,000

$36,000

$17.500

All the identifiable assets and liabilities of Python Ltd at the acquisition date were recorded at amounts equal to their fair values except for:

Fair value

Inventory

Plant (Cost $1,250,000)

Carrying amount

$60,000

$875,000

$52,000

$887,000

The assets recognised by Python Ltd did not include an internally generated patent of Python Ltd that was valued by Griffin Ltd at $28,000.

its useful life was considered to be 4 years, with benefits being received equally over that period.

80% of the inventory on hand at the acquisition date was sold by 30 June 2021. The plant is expected to have a further useful life of 5 years. The tax rate is 30%

Required:

Show the acquisition analysis as at 1 July 2020 and prepare the pre-acquisition consolidation worksheet at 30 June 2021,

using the worksheet provided below for the preparation of the consolidated financial statements of Griffin Ltd.

Assume that goodwill is accounted for as a Business Combination Valuation Reserve (BCVR) entry.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2023, Sandhill Corp's general ledger includes the following account balances: Copyrights $52500 Deposits with advertising agency (will be used to promote goodwill) 43000 Discount on bonds payable 74000 Excess of cost over fair value of identifiable net assets of acquired subsidiary 589500 Trademarks 106000 In the preparation of Sandhill's balance sheet as of December 31, 2023, what should be reported as total intangible assets? O $158500 O $748000 $791000 O $822000arrow_forward16.Explain the process of accounting for mergers and acquisitions. How are the assets and liabilities of the acquired company recorded on the balance sheet of the acquiring company? Discuss the treatment of goodwill and any adjustments that might be necessary post-acquisition. Provide an example of a hypothetical merger and the journal entries that would be recorded.arrow_forwardWhich of the following is/are true regarding goodwill achieved through acquisition as part of business combination? Where the acquirer was able to purchase the business at a discount, the excess of the market capitalization over the consideration transferred will be recognized in profit or loss. The acquirer shall recognize goodwill as of the acquisition date measured as the excess of the aggregate of the consideration transferred over the net of the fair values of all the assets acquired and the liabilities assumed Group of answer choices Both statements are true. None of these statements are true. 2 only. 1 only.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education