FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

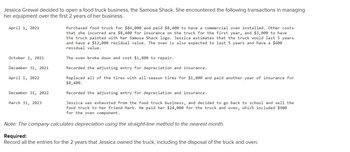

Transcribed Image Text:Jessica Grewal decided to open a food truck business, the Samosa Shack. She encountered the following transactions in managing

her equipment over the first 2 years of her business.

April 1, 2021

October 1, 2021

December 31, 2021

April 1, 2022

December 31, 2022

March 31, 2023

Purchased food truck for $84,000 and paid $8,400 to have a commercial oven installed. Other costs

that she incurred are $8,400 for insurance on the truck for the first year, and $3,000 to have

the truck painted with her Samosa Shack logo. Jessica estimates that the truck would last 5 years

and have a $12,000 residual value. The oven is also expected to last 5 years and have a $600

residual value.

The oven broke down and cost $1,800 to repair.

Recorded the adjusting entry for depreciation and insurance.

Replaced all of the tires with all-season tires for $1,800 and paid another year of insurance for

$8,400.

Recorded the adjusting entry for depreciation and insurance.

Jessica was exhausted from the food truck business, and decided to go back to school and sell the

food truck to her friend Mark. He paid her $24,000 for the truck and oven, which included $900

for the oven component.

Note: The company calculates depreciation using the straight-line method to the nearest month.

Required:

Record all the entries for the 2 years that Jessica owned the truck, including the disposal of the truck and oven.

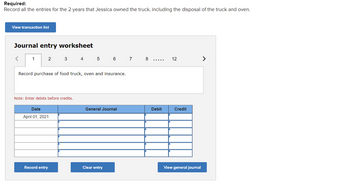

Transcribed Image Text:Required:

Record all the entries for the 2 years that Jessica owned the truck, including the disposal of the truck and oven.

View transaction list

Journal entry worksheet

<

1

2

3

Note: Enter debits before credits.

Date

April 01, 2021

Record entry

4

Record purchase of food truck, oven and insurance.

5

6

General Journal

Clear entry

7

8

Debit

12

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- in the new building? 40. In January, Prahbu purchased for $90,000 a new machine for use in an existing production line of his manufacturing business. Assume that the machine is a unit of property and is not a material or supply. Prahbu pays $2,500 to install the machine, and after the machine is installed, he pays $1,300 to perform a critical test on the machine to ensure that it will operate in accordance with quality standards. On November 1, the critical test is complete, and Prahbu places the machine in service on the production line. On December 3, Prahbu pays another $3,300 to perform periodic quality control testing after the machine is placed in service. How much will Prahbu be required to capitalize as the cost of the machine? Donn 11 LO 2-1 researarrow_forwardDonald was killed in an accident while he was on the job. Darlene, Donald's wife, received several payments as a result of Donald's death. Review the payments below and then enter the amount to be included in Darlene's gross income in the table provided. a. Donald's employer paid Darlene an amount equal to Donald's three months' salary ($15,000), which is what the employer does for all widows and widowers of deceased employees. b. Donald had $6,800 in accrued salary that was paid to Darlene. c. Donald's employer had provided Donald with group term life insurance of $255,000, which was payable to his widow in a lump sum. Premiums on this policy totaling $13,200 had been included in Donald's gross income under § 79. d. Donald had purchased a life insurance policy (premiums totaled $162,000) that paid $427,000 in the event of accidental death. The proceeds were payable to Darlene, who elected to receive installment payments as an annuity of $31,000 each year for a 22-year period. She…arrow_forwardRequired information [The following information applies to the questions displayed below.] Carl purchased an apartment complex for $3.3 million on March 17 of year 1. of the purchase price, $1,400,000 was attributable to the land the complex sits on. He also installed new furniture into half of the units at a cost of $82,000. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Enter your answers in dollars and not in millions of dollars.) a. What is Carl's allowable depreciation deduction for his real property for years 1 and 2? (Round your final answers to the nearest whole dollar amount.) Depreciation Deduction Year 1arrow_forward

- ! Required information [The following information applies to the questions displayed below.] At the beginning of the year, Almond Factory bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Cost of the asset Installation costs Renovation costs prior to use Repairs after production began $10,400 940 1,020 790 Prepare the journal entry to record year 2 straight-line depreciation expense for Machine A, assuming an estimated life of 4 years and $1,000 residual value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardS Required information [The following information applies to the questions displayed below.] Carl purchased an apartment complex for $3.5 million on March 17 of year 1. of the purchase price, $1,500,000 was attributable to the land the complex sits on. He also installed new furniture into half of the units at a cost of $84,000. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) Note: Enter your answers in dollars and not in millions of dollars. a. What is Carl's allowable depreciation deduction for his real property for years 1 and 2? Note: Round your final answers to the nearest whole dollar amount. Year 1 Year 2 Depreciation Deductionarrow_forward! Required information [The following information applies to the questions displayed below.] At the beginning of the year, Almond Factory bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Cost of the asset Installation costs Renovation costs prior to use Repairs after production began $10,400 940 1,020 790 7. Prepare the journal entry to record year 2 double-declining balance depreciation expense for Machine C, which has a cost of $26,800, an estimated life of 10 years, and $1,400 residual value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) A. Record the year 2 depreciation expense for Machine C.arrow_forward

- Rebecca is a doctor with an AGI of $128,000 before consideration of income or loss from her dog breeding business. Her home is on 15 acres, 10 of which she uses to house the animals and provide them with ample space to play and exercise. Her records show the following related income and expenses for the current year: Income from fees and sales $ 2,650 Expenses: Dog food $ 4,150 Veterinary bills 3,650 Supplies 1,260 Publications and dues 380 Required: How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby? (Leave no cells blank. Enter "0" wherever required.) How would your answer differ if the operation were held to be a business? (Leave no cells blank. Enter "0" wherever required. Enter all losses with a minus sign.)arrow_forwardSaved Help Required Information [The following information applies to the questions displayed below.] Steve Pratt, who is single, purchased a home in Spokane, Washington, for $415,000. He moved into the home on February 1 of year 1. He lived in the home as his primary residence until June 30 of year 5, when he sold the home for $767,500. (Leave no answer blank. Enter zero if applicable.) b. Assume the original facts, except that the home is Steve's vacation home and he vacations there four months each year. Steve does not ever rent the home to others. What gain must Steve recognize on the home sale? Recognized gain on salearrow_forwardDonald was killed in an accident while he was on the job. Darlene, Donald's wife, received several payments as a result of Donald's death. Review the payments below and then enter the amount to be included in Darlene's gross income in the table provided. a. Donald's employer paid Darlene an amount equal to Donald's three months' salary ($45,600), which is what the employer does for all widows and widowers of deceased employees. b. Donald had $21,200 in accrued salary that was paid to Darlene. c. Donald's employer had provided Donald with group term life insurance of $135,000, which was payable to his widow in a lump sum. Premiums on this policy totaling $23,600 had been included in Donald's gross income under § 79. d. Donald had purchased a life insurance policy (premiums totaled $172,000) that paid $415,000 in the event of accidental death. The proceeds were payable to Darlene, who elected to receive installment payments as an annuity of $37,000 each year for a 29-year period. She…arrow_forward

- Domesticarrow_forwardRequired information [The following information applies to the questions displayed below.) At the beginning of the year, Cruz & Turner Corporation bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Cost of the asset Installation costs Renovation costs prior to use Repairs after production began $10,700 970 1,110 850 Required: 1. Compute the amount to be capitalized for Machine A Total cost Uarrow_forwardIman purchased an electric lawn mower, an edger, and an extension cord from her neighborhood yard and garden store. Immediately thereafter, the store emailed her a bill for these items. The bill stated that payment was due within 30 days. The bill is called a(n): Multiple Choice ledger statement. warranty. indenture. receipt. invoice.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education