FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

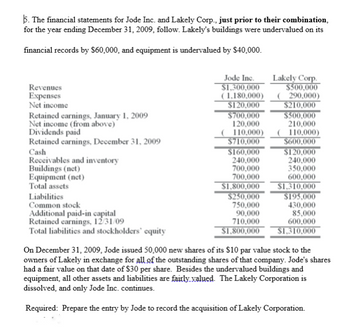

Transcribed Image Text:5. The financial statements for Jode Inc. and Lakely Corp., just prior to their combination,

for the year ending December 31, 2009, follow. Lakely's buildings were undervalued on its

financial records by $60,000, and equipment is undervalued by $40,000.

Revenues

Expenses

Net income

Retained earnings, January 1, 2009

Net income (from above)

Dividends paid

Retained earnings, December 31, 2009

Cash

Receivables and inventory

Buildings (net)

Equipment (net)

Total assets

Liabilities

Common stock

Additional paid-in capital

Retained earnings, 12/31/09

Total liabilities and stockholders' equity

Jode Inc.

$1,300,000

(1,180,000)

$120,000

$700,000

120,000

(110,000)

$710,000

$160,000

240,000

700,000

700,000

$1,800,000

$250,000

750,000

90,000

710,000

$1,800,000

Lakely Corp.

$500,000

( 290,000)

$210,000

$500,000

210,000

(110,000)

$600,000

$120,000

240,000

350,000

600,000

$1,310,000

$195,000

430,000

85,000

600,000

$1,310,000

On December 31, 2009, Jode issued 50,000 new shares of its $10 par value stock to the

owners of Lakely in exchange for all of the outstanding shares of that company. Jode's shares

had a fair value on that date of $30 per share. Besides the undervalued buildings and

equipment, all other assets and liabilities are fairly valued. The Lakely Corporation is

dissolved, and only Jode Inc. continues.

Required: Prepare the entry by Jode to record the acquisition of Lakely Corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide the specific nine-digit FASB Codification citation (XXX-XX-XXX-X) that describes the disclosure requirements that must be made by publicly traded companies for a LIFO liquidation. (Hint: Look in the SEC Materials section.)arrow_forwardFrom page 7-1 of the VLN, acquisition cost would NOT include: A. Purchase price. B. Transportation cost to get the asset ready to be used. C. Sales taxes. D. Cost incurred to operate the asset.arrow_forwardHow are acquisition costs recorded in a merger?arrow_forward

- Acquisition Entries, Acquisition Costs, Bargain Gain Plastic Corporation is contemplating a business combination with Steel Corporation at December 31, 2021. Steel's condensed balance sheet on that date appears below: Assets Cash and receivables Inventory Equity method investments Land Buildings and equipment Patents Total assets Liabilities and Stockholders' Equity Liabilities Common stock Retained earnings Total liabilities and equity Cash and receivables Inventory Equity method investments Land Description Buildings and equipment Patents Goodwill Liabilities Required Prepare the journal entry to record the business combination of Plastic and Steel for each of the following acquisition costs and combination methods. (a) Plastic acquires Steel as a merger for $250,000 cash. Other direct cash acquisition costs are $20,000. General Journal Description Cash and receivables Inventory Equity method investments. Land Liabilities Cash Buildings and equipment Patents ÷ Description (b) Plastic…arrow_forwardSolve all questions Do not give answer in imagearrow_forwardWhat important issues should management consider prior to a merger or acquisition? What are the current GAAP requirements for the type of merger/acquisition?arrow_forward

- HOW DOES A COMPANY REALLY DECIDE WHICH INVESTMENT METHOD TO APPLY? Pilgrim Products, Inc., buys a controlling interest in the common stock of Crestwood Corporation. Shortly after the acquisition, a meeting of Pilgrim's accounting department is convened to discuss the internal reporting procedures required by the ownership of this subsidiary. Each member of the staff has a definite opinion as to whether the equity method, initial value method, or partial equity method should be adopted. To resolve this issue, Pilgrim's chief financial officer outlines several of her concerns about the decision. I already understand how each method works. I know the general advantages and disadvantages of all three. I realize, for example, that the equity method provides more detailed information whereas the initial value method is much easier to apply. What I need to know are the factors specific to our situation that should be considered in deciding which method to adopt. I must make a recommendation…arrow_forwardPlease do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.arrow_forwardIn The Process Of the Acquisition, ABC Incorporation Paid In Cash the Following Expenses US Accounting fees 30,000 Travel expenses 10,000 Accounting fees (SEC) 10,000 SEC filing fees 20,000 Required: Prepare the journal entry to record the acquisition expensesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education