FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

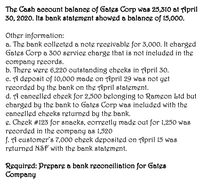

Transcribed Image Text:The Cash account balanee of Gates Corp was 25,310 at April

30, 2020. Its bank statement showed a balance of 15,000.

Other information:

a. The bank collected a note receivable for 3,000. It charged

Gates Corp a 300 service charge that is not ineluded in the

company records.

b. There were 6,220 outstanding checks in April 30.

c. A deposit of 10,000 made on April 29 was not yet

recorded by the bank on the April statement.

d. A cancelled check for 2,500 belonging to Rameon Ltd but

charged by the bank to Gates Corp was ineluded with the

cancelled checks returned by the bank.

e. Check #123 for snacks, correctly made out for 1,250 was

recorded in the company as 1,520

f. A customer's 7,000 check deposited on April 15 was

returned NSF with the bank statement.

Required: Prepare a bank reconciliation for Gates

Company

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please answer.arrow_forwardSelect the banking terms from drop down to match with the correct definition. Definitions Banking Terms a. A check that has been paid by the bank on behalf of the depositor. select a banking term Automated teller machine (ATM)Electronic funds transfer (EFT)MakerDepositorDebit memorandumPayeeBank statementPayerCredit memorandumDeposit slipCheckCanceled checkSignature cardEndorsement b. A disbursement system that uses wire, telephone, or computers to transfer cash balances from one location to another. select a banking term EndorsementBank statementDeposit slipDebit memorandumCheckDepositorElectronic funds transfer (EFT)PayeeSignature cardPayerCanceled checkCredit memorandumAutomated teller machine (ATM)Maker c. A document provided by the bank that requires the signature of all authorized signers of checks. select a banking term…arrow_forwardWould a bank service charge be added to or subtracted from the company's books or the bank statement during the construction of a bank reconciliation?arrow_forward

- On the Excel worksheet are the T- accounts for cash and other accounts need to record the bank reconciliation. Also, the format for the bank reconciliation is provided. Complete the bank reconciliation, using formulas when possible.arrow_forwardWhich field typically appears in the Bank Register but not usually in reports?arrow_forwardCertainly! Here's a detailed information on bank reconciliation presented in table format: Bank Reconciliation Information: Key Components Definition Purpose Frequency Steps in Bank Reconciliation Common Adjustments Importance of Bank Reconciliation Explanation. Bank reconciliation is a process that compares the cash balance in a company's accounting records with the balance in its bank statement. - Identify discrepancies between the company's records and the bank statement. - Ensure accuracy and completeness of financial records. Detect errors, fraud, or unauthorized transactions. Typically performed monthly, but can be more frequent for larger transactions or to catch discrepancies early. 1. Start with the ending balance of the bank statement. 2. Add deposits in transit (deposits made but not yet recorded by the bank). 3. Deduct outstanding checks (checks written but not yet cleared by the bank). 4. Add or deduct bank errors (errors made by the bank in recording transactions). 5.…arrow_forward

- What is a key prerequisite for using electronic bank account management (eBAM) to reduce paperwork? Bank-provided treasury management system Upgrade from BAI2 to BTRS TWIST standards Initial relationship developmentarrow_forwardThe following reconciling items are applicable to the bank reconciliation for Forde Co.Indicate how each item should be shown on a bank reconciliation. (a) Outstanding checks. Select how the item should be shown on a bank reconciliation Added to cash balance per booksDeducted from cash balance per bankDeducted from cash balance per booksAdded to cash balance per bank (b) Bank debit memorandum for service charge. Select how the item should be shown on a bank reconciliation Added to cash balance per bankDeducted from cash balance per booksDeducted from cash balance per bankAdded to cash balance per books (c) Bank credit memorandum for collecting from customer an electronic funds transfer. Select how the item should be shown on a bank reconciliation Deducted from cash balance per bankDeducted from…arrow_forwardIdentify the basic concepts of bank reconciliation.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education