FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

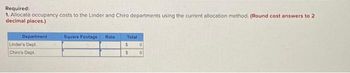

Transcribed Image Text:Required:

1. Allocate occupancy costs to the Linder and Chiro departments using the current allocation method. (Round cost answers to 2

decimal places.)

Department

Linder's Dept.

Chiro's Dept.

Square Footage

Rate.

Total

$

$

0

0

![Required information.

[The following information applies to the questions displayed below.]

National Bank has several departments that occupy both floors of a two-story building. The departmental accounting

system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded

in this account for the current period follow.

Depreciation-Building

Interest-Building mortgage

Taxes-Building and land

Gas (heating) expense

Lighting expense

Maintenance expense

Total occupancy cost

$27,000

40,500

12,000

3,750

4,500

8,250

$96,000

The building has 6,000 square feet on each floor. In prior periods, the accounting manager merely divided the $96,000

occupancy cost by 12,000 square feet to find an average cost of $8 per square foot and then charged each department a

building occupancy cost equal to this rate times the number of square feet that it occupied.

Diane Linder manages a first-floor department that occupies 900 square feet, and Juan Chiro manages a second-floor

department that occupies 1,800 square feet of floor space. In discussing the departmental reports, the second-floor

manager questions whether using the same rate per square foot for all departments makes sense because the first floor

space is more valuable. This manager also references a recent real estate study of average local rental costs for similar

space that shows first floor space worth $40 per square foot and second-floor space worth $10 per square foot (excluding

costs for heating, lighting, and maintenance).

Required:

1. Allocate occupancy costs to the Linder and Chiro departments using the current allocation method. (Round cost anstvers to 2

decimal places.)](https://content.bartleby.com/qna-images/question/e485a7df-6286-4e84-b1d5-277bac7f51c0/6735dec3-110a-4808-92a9-2cd12d14455b/p9a4ne_thumbnail.jpeg)

Transcribed Image Text:Required information.

[The following information applies to the questions displayed below.]

National Bank has several departments that occupy both floors of a two-story building. The departmental accounting

system has a single account, Building Occupancy Cost, in its ledger. The types and amounts of occupancy costs recorded

in this account for the current period follow.

Depreciation-Building

Interest-Building mortgage

Taxes-Building and land

Gas (heating) expense

Lighting expense

Maintenance expense

Total occupancy cost

$27,000

40,500

12,000

3,750

4,500

8,250

$96,000

The building has 6,000 square feet on each floor. In prior periods, the accounting manager merely divided the $96,000

occupancy cost by 12,000 square feet to find an average cost of $8 per square foot and then charged each department a

building occupancy cost equal to this rate times the number of square feet that it occupied.

Diane Linder manages a first-floor department that occupies 900 square feet, and Juan Chiro manages a second-floor

department that occupies 1,800 square feet of floor space. In discussing the departmental reports, the second-floor

manager questions whether using the same rate per square foot for all departments makes sense because the first floor

space is more valuable. This manager also references a recent real estate study of average local rental costs for similar

space that shows first floor space worth $40 per square foot and second-floor space worth $10 per square foot (excluding

costs for heating, lighting, and maintenance).

Required:

1. Allocate occupancy costs to the Linder and Chiro departments using the current allocation method. (Round cost anstvers to 2

decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- answer in text with all workarrow_forwardDuring the month of July, the Town of Lynton recorded the following information related to purchases: General government Public safety Public works Culture and recreation Total purchase orders and invoices At the end of the month, several purchase orders remained outstanding for all functions except Culture and Recreation. Public Works in particular had a large amount of purchase orders outstanding because it had put in an order for delivery of paving materials to be delivered over the months of July and August. For all but Culture and Recreation, consider the amounts for purchase orders received the same as the actual cost of the items. Req a1 Required a. (1) Prepare the general journal entry to record the issuance of the purchase orders. (2) Show entries in subsidiary ledger accounts. b. (1) Prepare the general journal entries to record the receipt of the goods ordered at the actual cost shown and the related payable. (2) Show entries for the subsidiary ledger accounts including the…arrow_forwardThe manager of a bank recorded the amount of time each customer spent waiting in line during peak business hours one Monday. The frequency table below summarizes the results. If we randomly select one of the customers represented in the table, what is the probability that the waiting time is at least 12 minutes or between 8 and 15 minutes? Round to three decimal places as needed. Waiting Time (minutes) Number of Customers 0-3 9 4-7 10 8-11 12 12-15 16-19 20-23 02442 A. 0.727 B. 0.093 C. 0.651 OD. 0.558arrow_forward

- Please help mearrow_forwardCity A has the following financial data. What is the Net Asset Ratio? Cash: $ 4,650; Cash Equivalents: $12,350; Market Securities: $3,462; Receivables: $ 12,409; Current Liabilities: $45,690; Net Assets: $139,450; Total Assets: $2,458,360; Total Revenues: $1,367,809; Total Expenditures: $1,450,098; Population: 1,670.arrow_forwardAccount inquiry (hours) Account billing (lines) Account verification (accounts) Correspondence (letters) The above activities are carried out at two of its regional offices. Activities $78,000 2,000 hours $41,000 20,000 lines $16,000 22,000 accounts $12,000 1,400 letters Account inquiry (hours) Account billing (lines) Account verification (accounts) Correspondence (letters) Northeast Office 180 hours 16,000 lines 1,400 accounts 70 letters Midwest Office What is the cost per letter for the correspondence activity? (Round your answer to the nearest cent.) 300 hours 7,000 lines 600 accounts 130 letters OA. $6.00 B. $29.29 O C. $8.57 OD. $0.73 1arrow_forward

- 3. II 1. Show the impact (with amounts) of each of the following items on the horizontal C. equation. For the asset section, name the specific accounts impacted. i. Record Sales during the year on account of $205,000. ii. Show the impact of $190,000 cash collected during the year. ii. Establish an Allowance for Uncollectible Accounts at year-end. Study guide - Chapter 5 (with solutions).docx iv. In the following year, an account worth $6,000 is determined to be uncollectible, what is the entry? V. A receivable for $3,500 that was previously written off is collected. What is the 2 step entry? Cash + Stockholders' Equity Assets = Liabilities Revenues Expenses Net Income Flow 2. Tearrow_forwardPlease explain also.arrow_forwardQueen Savings is attempting to determine its liquidity requirements for the month of September. September is usually a month of heavy loan demand due to the beginning of the school term and the buildup of business inventories of goods and services for the fall season and winter. This bank has analyzed its deposit accounts thoroughly and classified them as shown in the table below. Hot money funds Vulnerable funds Stable (core) funds Totals Source ($'s in millions) Checking Deposits $10 $65 $85 $160 Savings Deposits $5 $152 $450 $607 Timing Deposits $1,200 $740 $172 $2,112 Totals $1,215 $957 $707 $2,879 Management has elected to hold a 85 percent reserve in liquid assets or borrowing capacity for each dollar of hot money deposits, a 25 percent reserve behind vulnerable deposits, and a 5 percent reserve for its holdings of core funds. Assume time and savings deposit accounts carry a zero percent legal reserve requirement and all checkable deposits carry a 3 percent legal reserve…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education