FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

![Required information

Use the following information for the Exercises 12-13 below. (Algo)

[The following information applies to the questions displayed below.]

Del Gato Clinic's cash account shows an $16,473 debit balance and its bank statement shows $15,762 on deposit at the

close of business on June 30.

a. Outstanding checks as of June 30 total $2,180.

b. The June 30 bank statement lists a $70 bank service charge.

c. Check No. 919, listed with the canceled checks, was correctly drawn for $489 in payment of a utility bill on June 15. Del

Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $498.

d. The June 30 cash receipts of $2,830 were placed in the bank's night depository after banking hours and were not

recorded on the June 30 bank statement.](https://content.bartleby.com/qna-images/question/9de62490-29a1-4126-ad53-0c4c5fc3af72/deafb923-9738-41fd-8f7c-796d26584cbc/s64f83_thumbnail.png)

Transcribed Image Text:Required information

Use the following information for the Exercises 12-13 below. (Algo)

[The following information applies to the questions displayed below.]

Del Gato Clinic's cash account shows an $16,473 debit balance and its bank statement shows $15,762 on deposit at the

close of business on June 30.

a. Outstanding checks as of June 30 total $2,180.

b. The June 30 bank statement lists a $70 bank service charge.

c. Check No. 919, listed with the canceled checks, was correctly drawn for $489 in payment of a utility bill on June 15. Del

Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $498.

d. The June 30 cash receipts of $2,830 were placed in the bank's night depository after banking hours and were not

recorded on the June 30 bank statement.

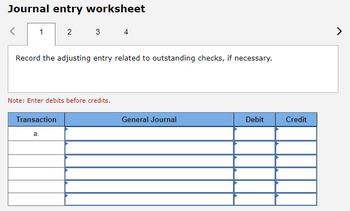

Transcribed Image Text:Journal entry worksheet

1

2

Record the adjusting entry related to outstanding checks, if necessary.

Transaction

3 4

Note: Enter debits before credits.

a.

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please step by step solution.arrow_forwardRequired information [The following information applies to the questions displayed below.] Organic Food Company's Cash account shows a $6,400 debit balance and its bank statement shows $5,790 on deposit at the close of business on August 31. a. August 31 cash receipts of $2,140 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $210 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $2,020. d. In reviewing the bank statement, an $170 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $110 in bank service charges; the company has not yet recorded the cost of these services. Prepare a bank reconciliation using the above information. Bank statement balance Add: Deduct: Adjusted bank balance ORGANIC FOOD COMPANY Bank Reconciliation August 31 Book balance…arrow_forwardOn May 27, you received your bank statement showing a balance of $1,026.34. Your checkbook shows a balance of $1,056.29. Outstanding checks are $245.50 and $377.20. The account earned $62.59. Deposits in transit amount to $705.24, and there is a service charge of $10.00. Calculate the reconciled balance. $29.95 $943.80 O $1,003.70 O $1,108.88arrow_forward

- The following information applies to the questions displayed below.]Del Gato Clinic's cash account shows a $13,712 debit balance and its bank statement shows $14,151 on deposit at the close of business on June 30. Outstanding checks as of June 30 total $2,593. The June 30 bank statement lists a $20 bank service charge. Check No. 919, listed with the canceled checks, was correctly drawn for $789 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $798. The June 30 cash receipts of $2,143 were placed in the bank’s night depository after banking hours and were not recorded on the June 30 bank statement. Prepare its bank reconciliation using the above information.arrow_forwardUse the following information for the Exercises below. [The following information applies to the questions displayed below.] Del Gato Clinic's cash account shows a $15,937 debit balance and its bank statement shows $15,527 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,119. b. The June 30 bank statement lists a $25 bank service charge. c. Check No. 919, listed with the canceled checks, was correctly drawn for $389 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $398. d. The June 30 cash receipts of $2,513 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Exercise 6-13 Adjusting entries from bank reconciliation LO P3 Prepare the adjusting journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation. (If no entry is required for a…arrow_forwardRequired information [The following information applies to the questions displayed below.] Del Gato Clinic's cash account shows a $11,557 debit balance and its bank statement shows $10,864 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $1,522. b. The June 30 bank statement lists a $20 bank service charge. c. Check No. 919, listed with the canceled checks, was correctly drawn for $389 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $398. d. The June 30 cash receipts of $2,204 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Prepare its bank reconciliation using the above information. Bank statement balance Add: Deduct: Adjusted bank balance DEL GATO CLINIC Bank Reconciliation June 30 Book balance Add: Deduct: Adjusted book balancearrow_forward

- Required information Use the following information for the Exercises 12-13 below. (Algo) [The following information applies to the questions displayed below.] Del Gato Clinic's cash account shows an $16,473 debit balance and its bank statement shows $15,762 on deposit at the close of business on June 30. a. Outstanding checks as of June 30 total $2,180. b. The June 30 bank statement lists a $70 bank service charge. c. Check No. 919, listed with the canceled checks, was correctly drawn for $489 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $498. d. The June 30 cash receipts of $2,830 were placed in the bank's night depository after banking hours and were not recorded on the June 30 bank statement. Exercise 6-12 (Algo) Bank reconciliation LO P3 Prepare its bank reconciliation using the above information. Bank statement balance Add: Deduct: Adjusted bank balance DEL GATO CLINIC Bank…arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.]Del Gato Clinic's cash account shows a $14,089 debit balance and its bank statement shows $13,053 on deposit at the close of business on June 30. Outstanding checks as of June 30 total $1,797. The June 30 bank statement lists a $95 bank service charge. Check No. 919, listed with the canceled checks, was correctly drawn for $789 in payment of a utility bill on June 15. Del Gato Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $798. The June 30 cash receipts of $2,747 were placed in the bank’s night depository after banking hours and were not recorded on the June 30 bank statement. Prepare the adjusting journal entries that Del Gato Clinic must record as a result of preparing the bank reconciliation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardPlease see imagearrow_forward

- answer in text form please (without image)arrow_forwardRequired information Use the following information for the Quick Studies 12-13 below. (Algo) [The following information applies to the questions displayed below.] Organic Food Company's Cash account shows a $5,900 debit balance and its bank statement shows $5,440 on deposit at the close of business on August 31. a. August 31 cash receipts of $1,640 were placed in the bank's night depository after banking hours and were not recorded on the August 31 bank statement. b. The bank statement shows a $160 NSF check from a customer; the company has not yet recorded this NSF check. c. Outstanding checks as of August 31 total $1,520. d. In reviewing the bank statement, an $120 check written by Organic Fruits was mistakenly drawn against Organic Food's account. e. The August 31 bank statement lists $60 in bank service charges; the company has not yet recorded the cost of these services.arrow_forwardsaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education