FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardharrow_forwardRequired information [The following information applies to the questions displayed below.] A company makes one product and has provided the following information to help prepare the master budget. The budgeted selling price per unit is $70. Budgeted unit sales for January, February, March and April are 8,200, 13,000, 15,000, and 16,000 units, respectively. All sales are on credit. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. • The ending finished goods inventory equals 20% of the following month's unit sales. 2. Calculate February's expected cash collections. Total cash collectionsarrow_forward

- provide the followinf inforamtion to help prepare the master budget for the next four months of opration Could you solve ( D , E , F and G ) only thanksarrow_forwardKk.186.arrow_forwardBEE Required Informatlon [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 8,300, 14,000, 16.000, and 17,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 25% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two…arrow_forward

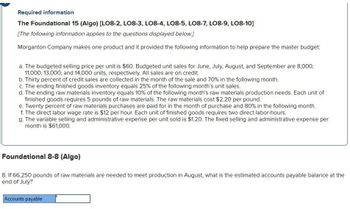

- Domesticarrow_forwardnarubhaiarrow_forwardRequired information The Foundational 15 (Static) [LO8-2, LO8-3, LO8-4, LO8-5, LO8-7, LO8-9, LO8-10] [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget: a. The budgeted selling price per unit is $70. Budgeted unit sales for June, July, August, and September are 8,400, 10,000, 12,000, and 13,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 20% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Thirty percent of raw materials purchases are paid for in the month of purchase and 70% in the following month. f. The…arrow_forward

- Required information Skip to question [The following information applies to the questions displayed below.] Morganton Company makes one product and provided the following information to help prepare its master budget: The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 8,600, 17,000, 19,000, and 20,000 units, respectively. All sales are on credit. Thirty percent of credit sales are collected in the month of the sale and 70% in the following month. The ending finished goods inventory equals 25% of the following month’s unit sales. The ending raw materials inventory equals 10% of the following month’s raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.40 per pound. Thirty five percent of raw materials purchases are paid for in the month of purchase and 65% in the following month. The direct labor wage rate is $14 per hour. Each unit of finished goods requires…arrow_forward近 Requlred Information [The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 8,300, 14,000, 16.000, and 17.000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 25% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $200 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two…arrow_forward国 Requlred Informatlon (The following information applies to the questions displayed below.] Morganton Company makes one product and it provided the following information to help prepare the master budget a. The budgeted selling price per unit is $60. Budgeted unit sales for June, July, August, and September are 8,300. 14,000, 16,000, and 17,000 units, respectively. All sales are on credit. b. Forty percent of credit sales are collected in the month of the sale and 60% in the following month. c. The ending finished goods inventory equals 25% of the following month's unit sales. d. The ending raw materials inventory equals 10% of the following month's raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials. The raw materials cost $2.00 per pound. e. Forty percent of raw materials purchases are paid for in the month of purchase and 60% in the following month. f. The direct labor wage rate is $15 per hour. Each unit of finished goods requires two…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education