FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I tried to find a way to get both tables needed for answering the problems.

![**Required Information**

*[The following information applies to the questions displayed below.]*

The following capital expenditure projects have been proposed for management's consideration at Scott Inc. for the upcoming budget year. Use Table 6-4 and Table 6-5. (*Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.*)

**Table: Project Cash Flows and Investment**

| Year(s) | Project A | Project B | Project C | Project D | Project E |

|----------|-------------|-------------|-------------|-------------|-------------|

| Initial investment | $(25,000) | $(25,000) | $(50,000) | $(50,000) | $(100,000) |

| Amount of net cash return | | | | | |

| 1 | 5,000 | 0 | 16,000 | 5,000 | 30,000 |

| 2 | 5,000 | 0 | 16,000 | 10,000 | 30,000 |

| 3 | 5,000 | 10,000 | 16,000 | 15,000 | 15,000 |

| 4 | 5,000 | 10,000 | 16,000 | 25,000 | 15,000 |

| Per year 6-10 | 5,000 | 6,000 | 0 | 0 | 15,000 |

| NPV (14% discount rate) | $1,081 | ? | ? | ? | $2,942 |

| Present value ratio | 1.04 | ? | ? | ? | |

**Required:**

a. Calculate the net present value of projects B, C, and D, using 14% as the cost of capital for Scott Inc. (*Negative amounts should be indicated by a minus sign.*)

| Project | Net Present Value |

|---------|-------------------|

| B | |

| C | |

| D | |](https://content.bartleby.com/qna-images/question/354988b1-49b5-4361-999f-1aaef20d6b01/6477abbe-064d-4426-9dce-210b2d6b1654/l3mbsb_thumbnail.jpeg)

Transcribed Image Text:**Required Information**

*[The following information applies to the questions displayed below.]*

The following capital expenditure projects have been proposed for management's consideration at Scott Inc. for the upcoming budget year. Use Table 6-4 and Table 6-5. (*Use appropriate factor(s) from the tables provided. Round the PV factors to 4 decimals.*)

**Table: Project Cash Flows and Investment**

| Year(s) | Project A | Project B | Project C | Project D | Project E |

|----------|-------------|-------------|-------------|-------------|-------------|

| Initial investment | $(25,000) | $(25,000) | $(50,000) | $(50,000) | $(100,000) |

| Amount of net cash return | | | | | |

| 1 | 5,000 | 0 | 16,000 | 5,000 | 30,000 |

| 2 | 5,000 | 0 | 16,000 | 10,000 | 30,000 |

| 3 | 5,000 | 10,000 | 16,000 | 15,000 | 15,000 |

| 4 | 5,000 | 10,000 | 16,000 | 25,000 | 15,000 |

| Per year 6-10 | 5,000 | 6,000 | 0 | 0 | 15,000 |

| NPV (14% discount rate) | $1,081 | ? | ? | ? | $2,942 |

| Present value ratio | 1.04 | ? | ? | ? | |

**Required:**

a. Calculate the net present value of projects B, C, and D, using 14% as the cost of capital for Scott Inc. (*Negative amounts should be indicated by a minus sign.*)

| Project | Net Present Value |

|---------|-------------------|

| B | |

| C | |

| D | |

Transcribed Image Text:**Present Value and Annuity Factors Tables for Educational Purposes**

### Table 6.4: Factors for Calculating the Present Value of $1

This table shows the present value factors for $1 at various discount rates over different periods.

- **Columns**: The table is organized into columns that represent different discount rates ranging from 2% to 20%.

- **Rows**: The rows signify the number of periods, from 1 to 50.

- **Values**: Each cell within the table provides a factor that can be multiplied by the future value to determine its present value at the respective discount rate and period.

### Table 6.5: Factors for Calculating the Present Value of an Annuity of $1

This table presents the present value annuity factors for $1 received at the end of each period over several periods at various discount rates.

- **Columns**: Similar to Table 6.4, these columns represent different discount rates ranging from 2% to 20%.

- **Rows**: The rows also represent the number of periods, again from 1 to 50.

- **Values**: Each cell gives a factor used to calculate the present value of an annuity of $1. This is used in scenarios where equal cash flows occur at regular intervals, such as loan repayments or lease agreements.

These tables are essential tools in financial analysis, helping students and professionals alike calculate the worth of future cash flows in today's dollars. Understanding how to apply these tables is crucial for decision making in finance, investments, and real estate.

Expert Solution

arrow_forward

Step 1

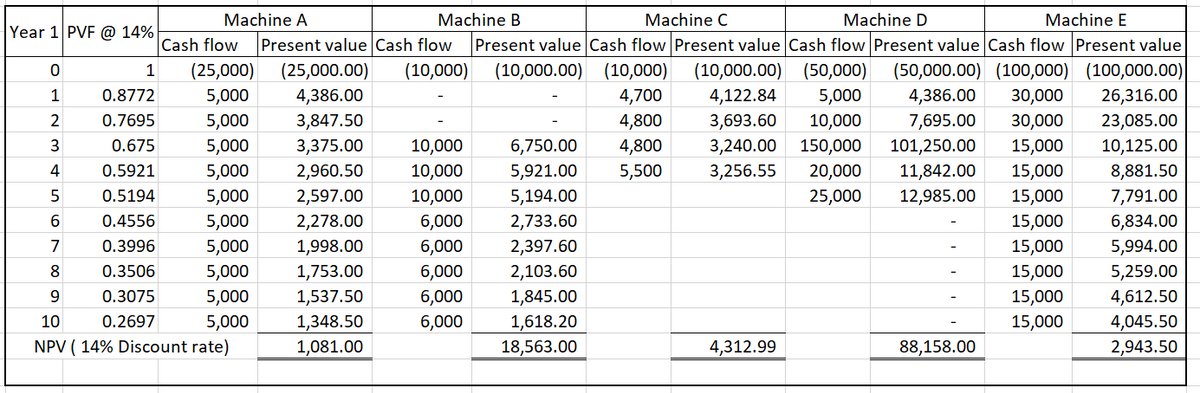

Present value method is used to evaluate the different level of investment projects. With the help of the present value method, we can find out the future value of present cash outflow. It is the most popular method to evaluate any investment plan.

arrow_forward

Step 2

NPV

B = 18,563

C = 4,312.99 or 4,313

D = 88,158

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Is it possible to get a solution with formulas instead of excel?arrow_forwardA system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forwardWhen should you use Power BI Services?arrow_forward

- Can you further explain this to me to better understand the concept on what I'm supposed to do and what formulas I need to apply.arrow_forwardWill you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardHi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education