FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

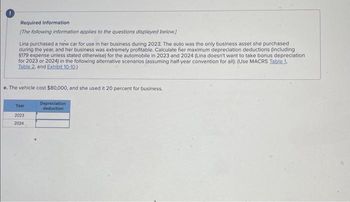

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

Lina purchased a new car for use in her business during 2023. The auto was the only business asset she purchased

during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including

$179 expense unless stated otherwise) for the automobile in 2023 and 2024 (Lina doesn't want to take bonus depreciation

for 2023 or 2024) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1,

Table 2, and Exhibit 10-10.)

e. The vehicle cost $80,000, and she used it 20 percent for business.

Year

2023

2024

Depreciation

deduction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forwardOn July 20, 2022, Mary purchased a passenger automobile that is used 75% for business. The automobile cost $60,000. If she does not elect section 179 and bonus depreciation, what is the depreciation on the automobile for 2022?arrow_forwardAmy purchased a passenger automobile in 2021 for $53,000. She used it 75% for her business and 25% for personal purposes. What is her maximum depreciation deduction for her first year, if she does not claim the special depreciation allowance? (The mid-quarter convention does not apply.) O $7,650 $7.950 $10.200 $10,000 Mark for follow uparrow_forward

- A taxpayer purchased land in 2010 for $92,000 and sold it in 2022 for $84,000 cash. The buyer also assumed the mortgage of $4,000. What is the amount of gain/loss on the sale of the land?arrow_forward0 Required information [The following information applies to the questions displayed below.] Sarah (single) purchased a home on January 1, 2008, for $600,000. She eventually sold the home for $800,000. What amount of the $200,000 gain on the sale does Sarah recognize in each of the following alternative situations? (Assume accumulated depreciation on the home is $0 at the time of the sale.) (Leave no answer blank. Enter zero if applicable.) b. Sarah used the property as a vacation home through December 31, 2016. She then used the home as her principal residence from January 1, 2017, until she sold it on January 1, 2020. (Round intermediate percentage computation to 2 decimal places.) Gain recognizedarrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Lina purchased a new car for use in her business during 2023. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including $179 expense unless stated otherwise) for the automobile in 2023 and 2024 (Lina doesn't want to take bonus depreciation for 2023 or 2024) in the following alternative scenarios ( assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10 - 10.) e. The vehicle cost $83, 800, and she used it 20 percent for business.arrow_forward

- ! Required information Problem 10-67 (LO 10-3) (Algo) [The following information applies to the questions displayed below.] Lina purchased a new car for use in her business during 2023. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including §179 expense unless stated otherwise) for the automobile in 2023 and 2024 (Lina doesn't want to take bonus depreciation for 2023 or 2024) in the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1. Table 2, and Exhibit 10-10.) Problem 10-67 Part c (Algo) c. The vehicle cost $82,400, and she used it 80 percent for business. Year 2023 2024 Depreciation deduction $6,592 $ 13,184arrow_forward! Required information [The following information applies to the questions displayed below.] Sarah (single) purchased a home on January 1, 2008, for $600,000. She eventually sold the home for $800,000. What amount of the $200,000 gain on the sale does Sarah recognize in each of the following alternative situations? (Assume accumulated depreciation on the home is $0 at the time of the sale.) Note: Leave no answer blank. Enter zero if applicable. d. Sarah used the home as a vacation home from January 1, 2008, through December 31, 2017. She used the home as her principal residence from January 1, 2018, until she sold it on January 1, 2024. Note: Round intermediate percentage computation to 2 decimal places. Gain recognized $ 0arrow_forwardDengerarrow_forward

- Required information [The following information applies to the questions displayed below.] Alexa owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Mortgage interest Property taxes $ 3,400 7,500 4,600 830 Repairs & maintenance Utilities Depreciation 4,500 22,200 During the year, Alexa rented out the condo for 115 days. Alexa's AGI from all sources other than the rental property is $200,000. Unless otherwise specified, Alexa has no sources of passive income. Assume that in addition to renting the condo for 115 days, Alexa uses the condo for 8 days of personal use. Also assume that Alexa receives $42,000 of gross rental receipts, her itemized deductions exceed the standard deduction before considering expenses associated with the condo, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to rental use of the home. Answer the following…arrow_forwardDon't provide answer in image formatarrow_forward#2) Mr. Norman Low owns a piece of land. It has a cost of $125,000 and a fair market value of $132,000. In July, 2017, Mr. Low sells the asset to his father for $150,000 and his father sells it a month later for $132,000. REQUIRED: Determine the amount of income to be recorded by Mr. Low as a result of the sale to his father. Determine the amount of income to be recorded by Mr. Low’s father as a result of the sale of the land.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education