Question

Subject - account

Please help me.

Thankyou.

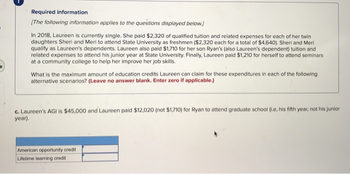

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

In 2018, Laureen is currently single. She paid $2,320 of qualified tuition and related expenses for each of her twin

daughters Sheri and Meri to attend State University as freshmen ($2,320 each for a total of $4,640). Sheri and Meri

qualify as Laureen's dependents. Laureen also paid $1,710 for her son Ryan's (also Laureen's dependent) tuition and

related expenses to attend his junior year at State University. Finally, Laureen paid $1,210 for herself to attend seminars

at a community college to help her improve her job skills.

What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following

alternative scenarios? (Leave no answer blank. Enter zero if applicable.)

c. Laureen's AGI is $45,000 and Laureen paid $12,020 (not $1,710) for Ryan to attend graduate school (i.e, his fifth year, not his junior

year).

American opportunity credit

Lifetime learning credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- Facebook company background, with information on company’s nature of business/ businesses, objective, goal, mission and vision, brand hierarchy and geographical presence.arrow_forwardPls Answers 2nd and 3rd point . Thank youarrow_forwardtrue or false 8. Company's confidential information can be considerably more valuable than information about credit cards.arrow_forward

- Urgent Please : 3. Describe the 4 stages of the expenditure cycle? Answer must be plagirism free. This is complete question. Answer must be not too short or nt too longarrow_forwardQ. What led you to chose a speci- fic business you are working on as part of your business plan? (Your answer should not exceed 15 lines)arrow_forwarddo it fast and do all questions otherwise i will downvote the answerarrow_forward

- Please do not give solution in image format thanku “Honda is finally getting its wings,” writes The Wall Street Journal(May 18, 2015). Some new products, as we discuss in Chapter 5, go from inception to market in months, and some in years. But for Honda, it involved 3 decades of planning and development to deliver one of its most unusual innovations: an ultrafast business jet that carries its engines above its wings. The $4.5 million 7-seat HondaJet is set for delivery to customers mid-2015. For Michimasa Fujino, the 54-year-old CEO of Honda Aircraft, it is the culmination of a decades long fight to make a Honda aircraft in the face of skeptical executives, technical delays and the global recession. His influence touches every aspect of the design, from its curves to the manufacturing process. “This airplane is my art piece,” he states. The jet gives Honda—which also makes robots, boat motors, and lawn mowers—entree into a new market. But no modern car company has successfully made…arrow_forwardPLS HELP ASAParrow_forwardHow to make a portfolioarrow_forward

- business plan presentation slidesarrow_forwardQuestion is : Building and maintaining relationships are key elements of a mortgage broker’s ongoing success. Thinking about the Settlement process a) Outline one example of a “magic moment” you could provide to this new clientarrow_forwardPls. Make an information request letterarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios