FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Haresh

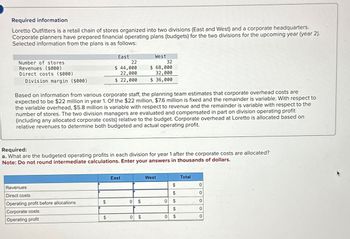

Transcribed Image Text:Required information

Loretto Outfitters is a retail chain of stores organized into two divisions (East and West) and a corporate headquarters.

Corporate planners have prepared financial operating plans (budgets) for the two divisions for the upcoming year (year 2).

Selected information from the plans is as follows:

Revenues ($000)

Number of stores

Direct costs ($000)

Division margin ($000)

East

22

$ 44,000

22,000

$ 22,000

West

32

$ 68,000

32,000

$ 36,000

Based on information from various corporate staff, the planning team estimates that corporate overhead costs are

expected to be $22 million in year 1. Of the $22 million, $7.6 million is fixed and the remainder is variable. With respect to

the variable overhead, $5.8 million is variable with respect to revenue and the remainder is variable with respect to the

number of stores. The two division managers are evaluated and compensated in part on division operating profit

(including any allocated corporate costs) relative to the budget. Corporate overhead at Loretto is allocated based on

relative revenues to determine both budgeted and actual operating profit.

Required:

a. What are the budgeted operating profits in each division for year 1 after the corporate costs are allocated?

Note: Do not round intermediate calculations. Enter your answers in thousands of dollars.

East

West

Total

Revenues

$

0

Direct costs

$

0

Operating profit before allocations

$

0

$

0

$

0

Corporate costs

$

0

Operating profit

$

0

$

0

$

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education